Post ‘Liberation Day’ the outlook for bonds has become more uncertain. Despite high yields, concerns have grown as the market attempts to navigate the impact of tariffs, which could cause a surge in inflation and require higher interest rates from central banks.

Although Jason Borbora-Sheen, manager of Ninety One Diversified Income fund, recently told Trustnet that bonds can outperform equities over the long term, he acknowledged that it is not a bulletproof asset class and warned that, at times, it can be “more of a threat than an opportunity”.

He attributed this to inflation's stickiness. Demographics, deglobalisation, and, most recently, politics, have created a volatile inflationary backdrop that could persist for much longer than investors think, causing bonds and equities to become much more correlated, he argued.

While he believes in this scenario bonds can still outperform equities, it also means investors cannot assume bonds will have a static role in a portfolio. Sometimes, they will be a threat, and other times they will be an opportunity.

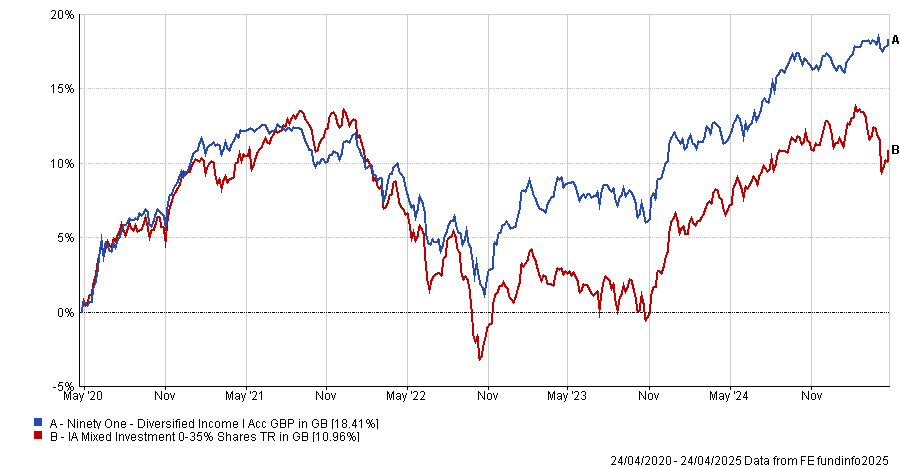

Performance of fund vs sector over the past 5yrs

Source: FE Analytics

Below, he explains why he does not want the fund to be viewed as a multi-asset strategy, why being cautious was both the best and worst call he made in the past five years and why investors have the wrong attitude towards income.

What is your investment process?

The fund is trying to play the role of what fixed income historically did or what people look for from a low-risk alternative. Essentially, we do not want to be seen as a multi-asset fund, instead we see ourselves as a fixed-income replacement.

It is built from the bottom up based on “bond-like” securities and then it’s put together based on how those things correlate to one another. We aim to manage the risk of capital loss through derivatives such as options and futures.

What differentiates your fund?

Our objectives are quite different. As mentioned, we are not a multi-asset strategy in the traditional sense, and we want to sit within the alternatives bucket rather than performing the asset allocation role of an overarching multi-asset portfolio. We are most successful when investors understand that we are a complimentary exposure.

Other strategies that try to fill this role are very top-down focussed and try to play their books towards specific outcomes. Instead, we want to select securities that match the goal of the fund and then use top-down controls to ensure we can navigate various macro-environments.

We think we are very different to what clients do themselves. Most clients focus on capital appreciation and equities and think about income incorrectly. We also hold very different securities, such as New Zealand or Australian bonds and use derivatives like options and futures that clients may be unaware of.

Could you explain how investors think about income incorrectly?

Many investors view income as a side project. There is a philosophy that you should think about income at retirement age and during your working era, the focus should be on capital appreciation.

Because of this people will look at an asset and ask, ‘Can I buy it for £10 now and sell it for £20 later'? But if you can buy an asset for £10 now and get a pound of income per year, you will get to the same point with a more certain pathway. This is because, when it comes to income, the worst-case scenario is that you have a default or missed payment, whereas capital appreciation is subject to natural market fluctuations.

If you want to achieve a total return, you should be ambivalent about where it comes from and I think investors have got that wrong and left a lot of money on the table.

Why do investors need a fixed-income replacement?

The move up in gilt yields feels monumental right now but historically it is not an enormous change. It does not take a genius to realise that a 4% yield on a 10-year bond now is better than 2% years ago, but what matters most to clients is their shorter-term experience, the one- or three-year return. That could all still be negative.

Because of our different approach to security selection, such as holding infrastructure, our yields have gone from 4% to 5.5%, as the rate environment has helped fixed income. So, we participate in the upsides, but because we are a replacement strategy, we can mitigate the current downsides much better.

In that sense, I think a fixed income replacement remains a relevant and compelling proposition.

What have been your best and worst calls in recent years?

We have been cautious about our duration since 2022, which worked out. By managing the downside risk with futures and options we did well during the 2022 bear market and were one of the best-performing funds in the sector but also caught some of the upside in 2023.

Right now, the duration is about three years, which is just above average.

In 2021, being too cautious on riskier assets was probably our worst call. We had started to hedge our credit exposure because we thought the move in inflation would be negative, but we were too early and got that wrong.

What do you do outside of fund management?

I do a lot of swimming, and I like whisky. I take a lot of trips to local distilleries, which are always amazing.