The US is the best place for investors to put their cash for the second half of the year, according to a survey of market strategists, portfolio managers, research analysts and economists at Natixis Investment Managers.

While many had forecasted a recession, the US has defied expectations in the first half of the year, with the re-emergence of the tech sector thanks to the boom in interest for artificial intelligence (AI). This has led to a market rally, with the Nasdaq delivering returns of 30% and the S&P 500 gaining 15.9%.

Around a third of those surveyed suggested this could continue for the next six months, suggesting the region will be the strongest equity market globally.

Yet, none of the experts believe that the tech rally will intensify. Less than a third said it would continue steadily, while 6% of strategists think the “bubble will burst”.

However, half of the experts expect equities to cool off in the second half of the year and that prices will dip to reflect the fundamentals.

Mabrouk Chetouane, head of global market strategy and solutions at Natixis IM, said: “Big tech helped equities come roaring back in the first half of the year, but while few predict a major downturn, most are concerned about corporate earnings across the second half and expect the rally to fade away by the end of the year.

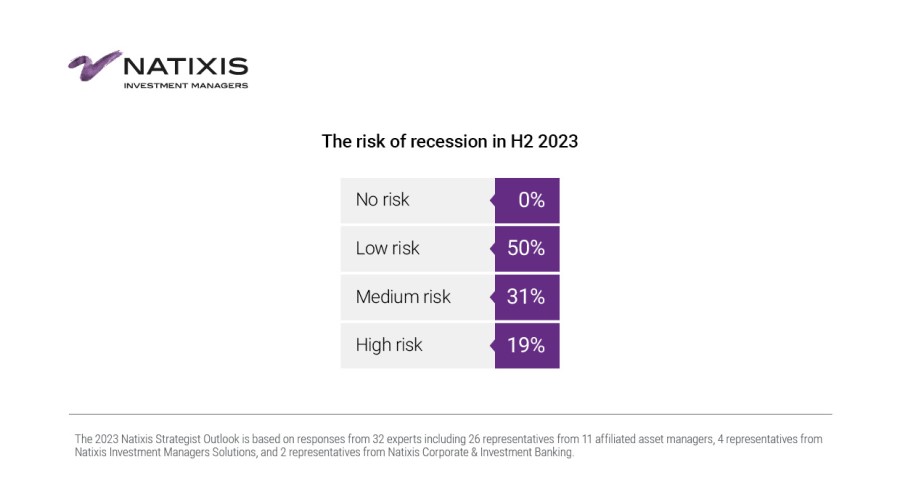

“Recession is still a real possibility, but most expect a softer landing. The successes of the first half may dissipate, but our strategists and economists still believe there are good opportunities if you look carefully.”

Source: Natixis Investment Managers

While 34% of the surveyed experts bet on the US, 22% said the leading market would either be Japan or the emerging markets (excluding China).

Corporate reforms and a focus on sustainable growth in Japan have helped propel the Nikkei to return 27.9% by 30 June, its biggest gain in 33 years. As for Europe, 16% of the experts said it would be the leading market in the rest of the year.

Europe outperformed the US at the beginning of the year until the tech rally kicked off, but Carmignac experts expect earnings growth in the region to be in slightly negative territory by the end of the year, with a recovery in 2024.

Axelle Pinon, a member of the investment committee at Carmignac, said: “The luxury sector will matter, as it has been one of the main contributors to the performance of European indexes this year, supported by a more benign rate environment and China’s reopening.

“Therefore, this earnings season should be an indicator of its ability to pursue outperformance for the coming months. The sector has had positive revisions from the consensus over the past weeks, setting the bar higher, with the risk of China not making up for weakness in the US market, as seen with Richemont.”

Moving on to China, it sparked a lot of expectations at the beginning of the year with the country’s reopening. Yet, as it has failed to materialise, only 6% of experts at Natixis IM believe that China will be the winner in the second half of the year.

Danni Hewson, head of financial analysis at AJ Bell, said that that China’s reopening is proving to be less robust than hoped at the start of the year and that investors are “growing tired” of waiting for the Chinese government to announce new stimulus measures.

He added: “There are concerns that the Chinese housing market will remain sluggish and that has weighed on sentiment towards all things related to real estate and construction, including miners over fears that commodities demand could weaken.”

As for the UK, none of the strategists at Natixis IM saw it as a potential winner.

There was also a strong consensus that large-caps would outperform small-caps. This is partly due to tighter credit standards following the banking crisis in the first quarter of 2023. In terms of style, strategists were evenly split on whether growth or value would outperform to year end.

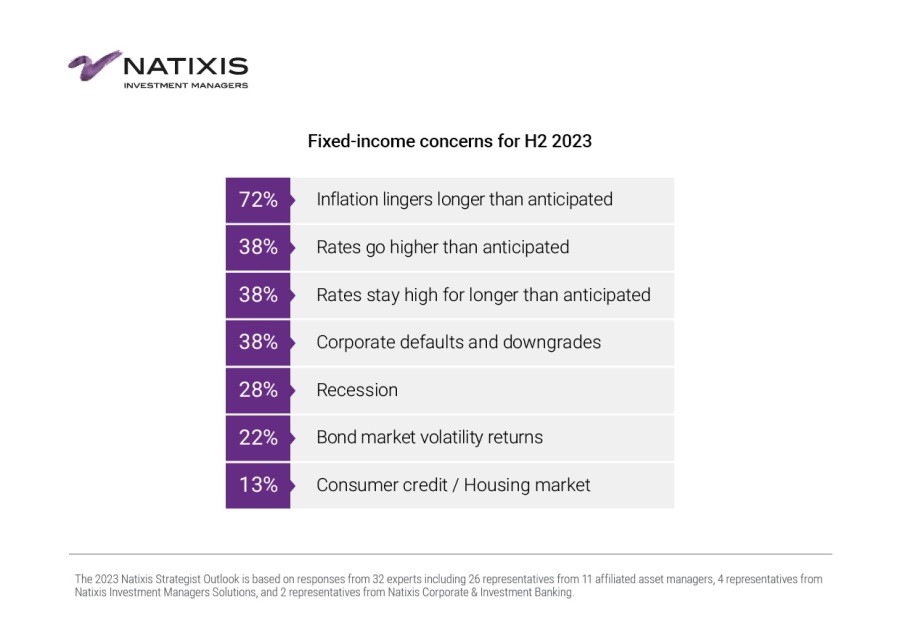

For the fixed income market, most of the experts said that long-duration would outperform short-duration bonds by the end of 2023. Bonds have made a comeback this year, as central banks hiked rates to the highest levels since the global financial crisis.

Source: Natixis Investment Managers

While markets have proven to be more resilient than expected in the first half of the year, Natixis IM called investors not to fall into complacency as headwinds remain. Geopolitics, central bank policy and corporate earnings were assessed as the main potential hurdles.

Chetouane said: “Inflation is cooling off, but we aren’t through the woods yet. Strong consumer spending, inflated cost of services, and geopolitical tensions may keep inflation lingering for longer, which will result in higher rates for some time yet. Strategists generally think it will take until 2025 until targets are met.”