Royal London Global Equity Select has taken first place in the IA Global sector for the third consecutive year in Trustnet’s annual research looking for funds outperforming their peers on a diverse spread of risk and return measures.

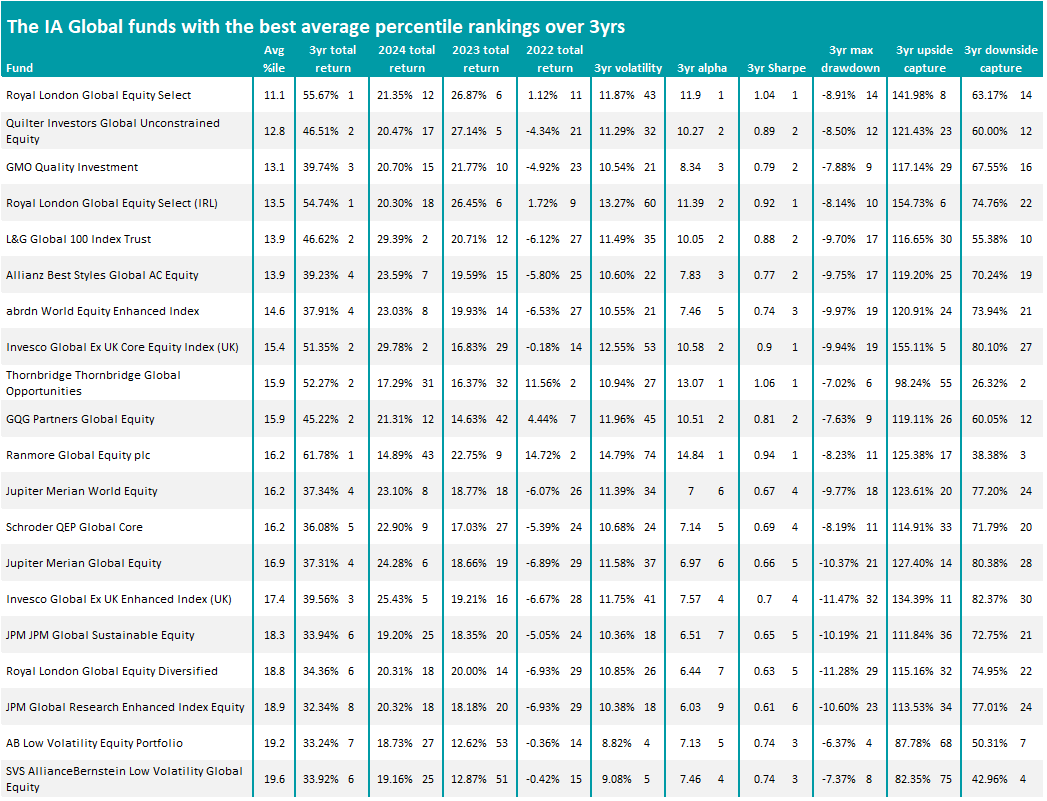

In this series, funds are scored on 10 key metrics: cumulative three-year returns to the end of 2024 as well as the individual returns of 2022, 2023 and 2024 (to ensure performance isn’t down to one standout year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown and upside and downside capture, relative to the sector average.

Each fund’s average percentile ranking for the 10 metrics is then used to discover which were most consistently at the very top for the sector across the board. Essentially, the lower a fund’s average percentile score, the stronger it has been over the past three years.

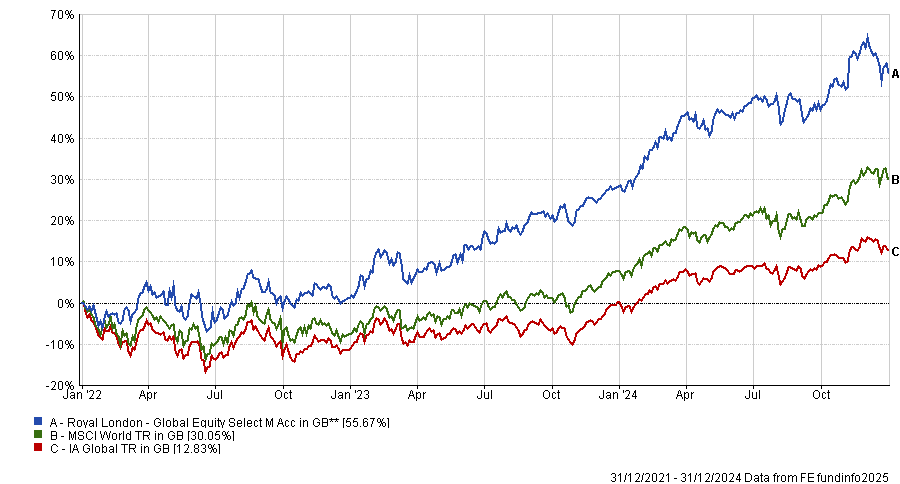

Performance of Royal London Global Equity Select vs sector and index over 3yrs to end of 2024

Source: FE Analytics

As noted above, Royal London Global Equity Select was the top fund in the IA Global sector in this research with an average percentile ranking of 11.1, following its wins in both of the past two years’ research.

The £573m fund’s three-year total return of 55.7% is significantly higher than its average peer and its MSCI World benchmark, putting it in the first percentile of the sector. It’s also scored particularly highly for alpha and Sharpe ratio.

Royal London Global Equity Select has undergone some big management changes since this research was last run at the start of 2024, however. Former managers Peter Rutter, James Clarke and Will Kenney departed in April last year to launch Life Cycle Investment Partners.

Lead manager Paul Schofield, as well as deputies Finn Provan and Matt Kirby, only took over the fund in November 2024, having joined Royal London Asset Management from Aviva Investors, so their contribution to the fund’s strong performance record has been limited. Trustnet asked the experts what investors in the fund should do when the new managers took the reins.

Its Dublin-domiciled mirror fund (Royal London Global Equity Select (IRL)) came in fourth place in this study with an average percentile ranking of 13.5 while stablemate Royal London Global Equity Diversified is in 17th place, as shown in the table below.

Source: FE Analytics

In second place with an average percentile of 12.8 is Quilter Investors Global Unconstrained Equity, which is managed by Royal London Asset Management (which took over from Ninety One UK in August 2022). Francois de Bruin is lead manager with Paul Schofield as deputy, and many of its largest holdings and sector weightings are similar to those of Royal London Global Equity Select.

GMO Quality Investment took third place with an average percentile of 13.1, thanks to strong results for three-year returns, alpha generation, Sharpe ratio and maximum drawdown. The $4.9bn fund is managed by Tom Hancock, Ty Cobb and Anthony Hene.

Analysts with FE Investments said: “The fund tends to be fairly benchmark agnostic as a result of the fund’s focus on quality. We should expect the fund to have consistent overweights in IT and healthcare, as well as in the US as a result of its search for the highest quality companies. The fund does not invest in Japan and it can have minor exposure to emerging markets.

“In terms of performance, the fund is expected to have a fair amount of defensiveness when the market sells off whilst deriving most of its performance from good stock selection.”

What about Fundsmith Equity, one of the best-known funds in the sector? Its average percentile ranking of 62.3 over the past three years puts it in 347th place out of 489 funds.

The £23.1bn fund has made just a total return of just 5.5% over the three years to the end of 2024 and is in the 72nd percentile for Sharpe ratio. In his annual letter to investors, manager Terry Smith recently asked investors to look past the fund’s short-term underperformance.

“Outperforming the market or even making a positive return is not something you should expect from our fund in every year or reporting period, and outperforming the market was more than usually challenging once again in 2024,” he said.

“Our fund owns some but not all of these [mega-cap] stocks, and it was difficult to perform even in line with the index unless you owned them at least in line with their index weighting.”

Lindsell Train Global Equity, another well-known global fund often compared with Fundsmith Equity, fared better with an average percentile ranking 41.5 – ranking it in 186th place. The fund’s score was buoyed by relatively low volatility, maximum drawdown and downside capture.

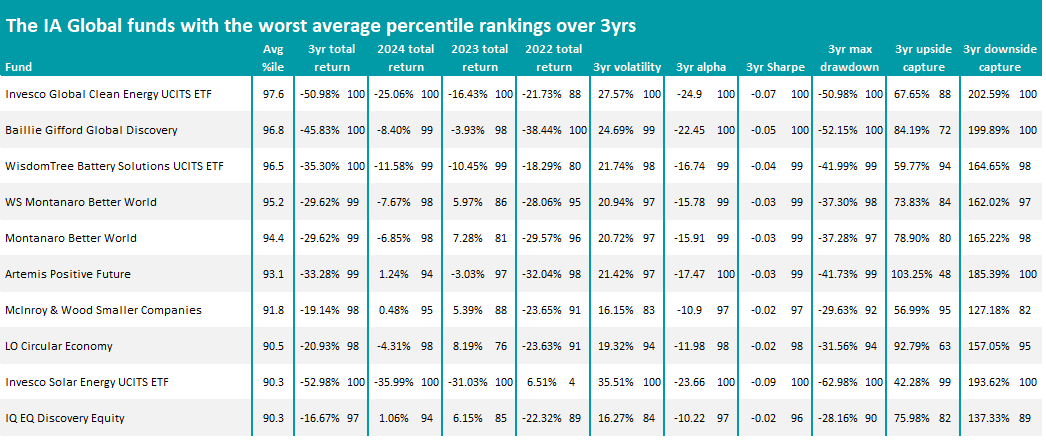

Source: FE Analytics

Turning to the funds with the highest average percentiles – i.e. the ones that have been at the bottom of the sector across the metrics we examined – it’s Invesco Global Clean Energy UCITS ETF with the worst result at 97.6.

The fund has been in the 100th percentile for multiple metrics over the past three years, including for three-year returns (it’s down 51%), volatility, Sharpe ratio, maximum drawdown and downside capture.

Indeed, clean energy and sustainability strategies account for most of the funds coming bottom in this research, as factors such as high inflation and interest rates have hampered their performance in recent years.