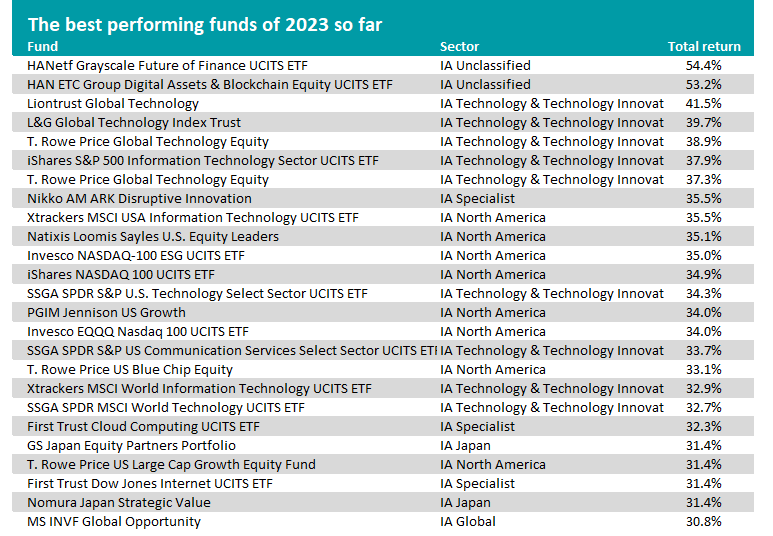

Tech funds such as HANetf Grayscale Future of Finance, HAN ETC Group Digital Assets & Blockchain Equity and Liontrust Global Technology are topping the 2023 performance tables, FE fundinfo data shows, making returns of more than 30% over the year to date.

Following the sell-off of 2022, investors have returned to risk assets this year after inflation showed signs of moderating and central banks started to approach the point where they can ease up on interest rate hikes.

According to FE Analytics, the MSCI AC World index is up 9% since the start of 2023 (in sterling terms) while government bonds – using the Bloomberg Global Treasury index – have fallen 5.5%.

But within equities, some areas have been more in favour than others. The MSCI ACWI Information Technology & Communication Services index has gained 30.4%, putting it far ahead of the other sectors, while MSCI ACWI Utilities brings up the bottom with a loss of 9.4%.

Source: FE Analytics

This dynamic is reflected in the table above, which reveals the 25 highest-returning funds in the Investment Association universe since the start of the year. All are up more than 30%.

Of the 25, 17 funds are specialise in investing in technology companies or related areas while most of the others focus on US large-cap growth stocks, which leads to a high weighting to tech.

Tech stocks were the ones hit hardest in 2022, after rising interest rates put investors off high-growth businesses that were trading on expensive valuations with promises of earnings far off into the future. However, they have rallied strongly this year in part thanks to the boom in artificial intelligence.

The best performer over 2023 so far has been HANetf Grayscale Future of Finance UCITS ETF, which had made a total return of 54.4% by the end of August.

The fund, which is a relative minnow with assets of just £1.8m, invests in “transformative companies” that are building the future of finance and the digital economy, such as payment platforms, blockchain technology businesses and asset managers. Top holdings include Paypal, Plus500, Robinhood Markets and Coinbase Global.

It needs to be pointed out that while HANetf Grayscale Future of Finance has made 2023’s highest return, it has been falling more recently. Its year-to-date total return was close to 120% in mid-July but it tanked for several weeks before rallying somewhat at the end of August.

It’s a similar story with 2023’s second best performer, HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF, which peaked with a return of around 100% in July. It focuses on companies that are in the field of blockchain technologies including cryptocurrency mining, blockchain technology or crypto trading and exchanges.

The first active fund on the list can be found in third place – Liontrust Global Technology, with a total return of 41.5%. While it has also fallen from its highs in July, this was to a lesser extent than the previous funds mentioned.

Managed by Storm Uru and James Dowey, the £121m fund is run using the Liontrust Global Innovation process, which looks for companies with four key attributes: innovation, barriers to competition, good management and cash returns on capital. Top holdings include Tesla, Nvidia and Microsoft.

Aside from tech or US large-cap growth, the only other flavour of fund among the top 25 of 2023 so far is Japanese equities.

GS Japan Equity Partners Portfolio and Nomura Japan Strategic Value both benefited from the strong returns made in Japan this year, thanks to a resilient economy, low interest rates, the weak yen, improving corporate governance and the fact that Warren Buffett has been adding to his Japanese holdings.

Source: FE Analytics

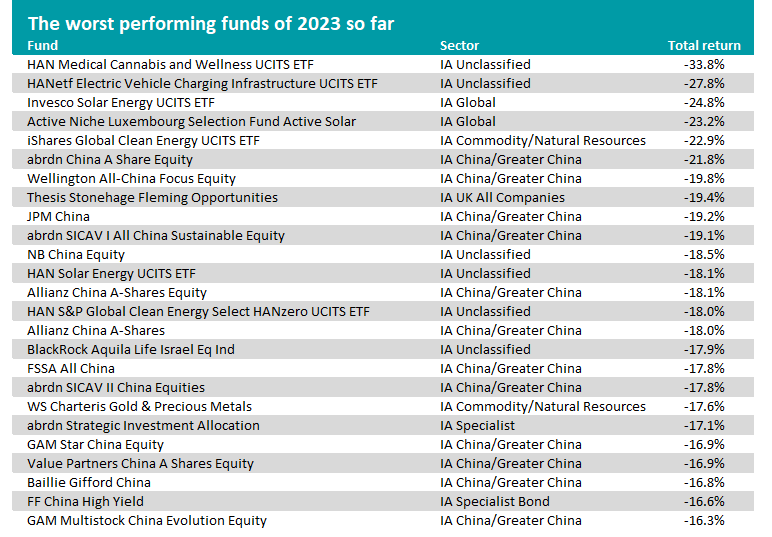

Flipping things around, the worst return of the year to date has come from HAN Medical Cannabis and Wellness UCITS ETF. After some initial hype, cannabis stocks have been on a downward trend since 2021 and this has continued into 2023.

Most of the funds in this table fit into two themes, the first being clean energy stocks. This is because many of these businesses fund their projects with borrowing, which left them looking vulnerable when interest rates rise.

The other theme is Chinese equities. China has struggled this year on the back of worrying economic data and continued problems in its property sector.

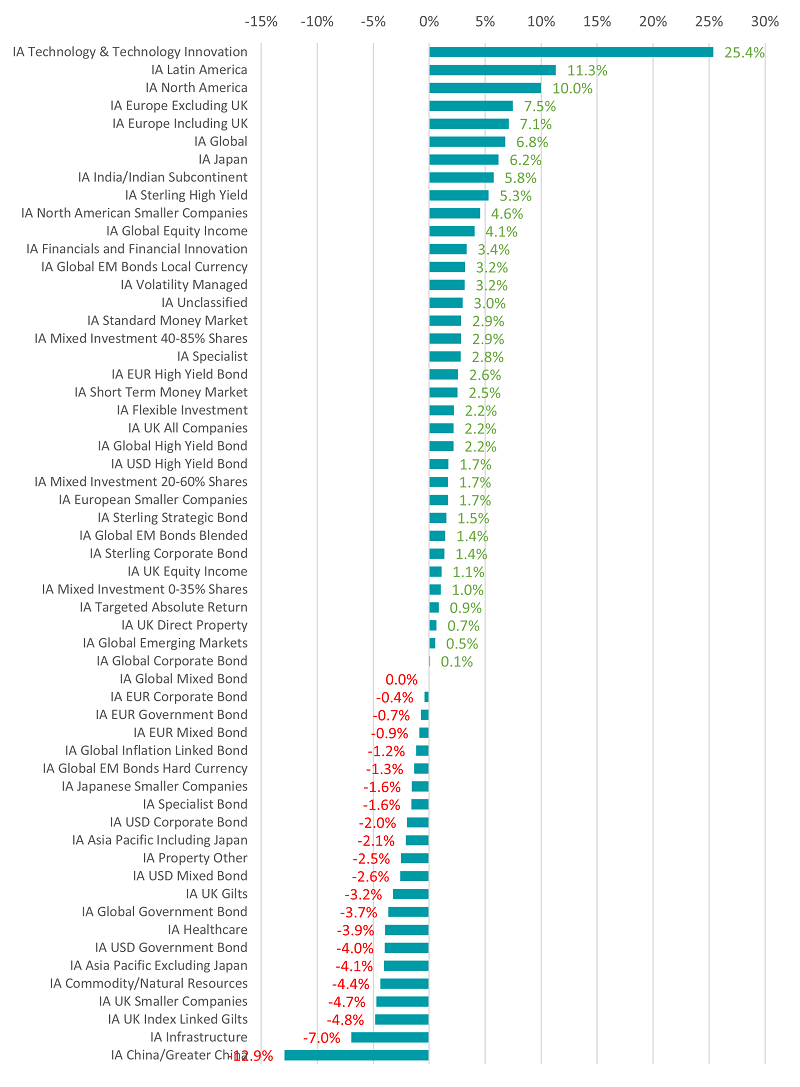

As can be seen in the chart below, the IA China/Greater China sector is the weakest performer over 2023 so far, while IA Infrastructure, IA UK Index Linked Gilts and IA UK Smaller Companies funds are also struggling.

IA Technology & Technology Innovation has been the strongest performer, as would be expected, followed by IA Latin America, IA North America and IA Europe Excluding UK.

Performance of Investment Association sectors in 2023

Source: FE Analytics