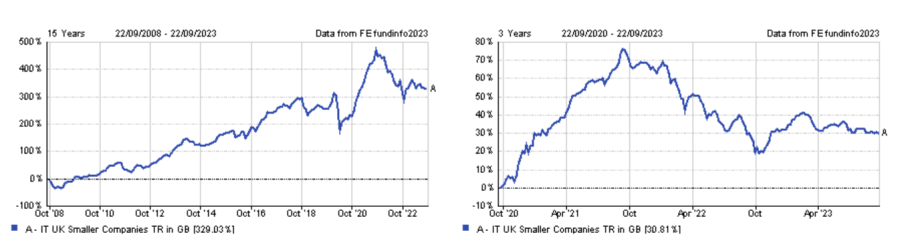

UK small-caps have a track record of delivering strong performance after economic and market downturns.

According to the Association of Investment Companies, investing in the average investment trust in the IT UK Smaller Companies sector at the end of September 2008 following the collapse of Lehman Brothers would have returned 39% three years later. If held for 15 years, this initial investment would have grown 316%.

As a result, now could be a good entry point into UK small-caps for investors prepared to ignore the noise resulting from the current uncertainties

Trustnet has asked three investment trust managers in the IT UK Smaller Companies sector to highlight the holding they feel the most confident about.

Performance of sector over 15yrs and 3yrs

Source: FE Analytics

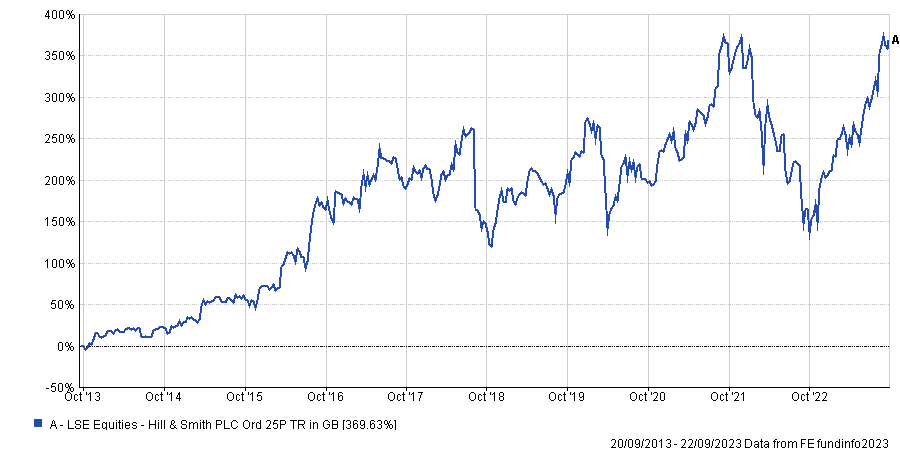

Amanda Yeaman, co-manager of abrdn UK Smaller Companies Growth, chose Hill & Smith, which is involved in the infrastructure industry.

The company is benefiting from government spendings on infrastructure as a tailwind, particularly in the US, which accounts for about 80% of the firm’s profits.

Yeaman said: “The management team is riding that wave particularly well. It has done some great divestments and some good acquisitions. It is pushing organic growth by broadening the geographic reach, diversifying the product range and it has a great pipeline of mergers and acquisitions (M&A).

“The last time we heard from Hill & Smith, the company had delivered record results and increased its dividend by 15%. If that isn't a signal of the confidence for the outlook of that company, then I don't know what it is.”

Performance of stock over 10yr

Source: FE Analytics

Ken Wotton, portfolio manager of Strategic Equity Capital, chose XPS Pensions Group, a pensions actuarial business also offering investment consultancy and administration services to trustees and sponsors of pension schemes.

Wotton said: “This business is a challenger trying to take on large multinational competitors. It is growing the top line by double digits and has significant multi-year contracts underpinned to its revenue. Most of those contracts are index-linked, so it's a beneficiary of inflation from a revenue point of view. It now has very limited leverage, is generating a lot of cash and paying attractive dividends.”

He added that XPS Pensions Group, like many UK smaller businesses, is undervalued. Therefore, Wotton expects the characteristics exhibited by the company to lead to a re-rating over the next few years.

Should that not be the case, Wotton believes the firm will become a target for a potential takeover. He said: “It’s not that we want it to happen, but it is an alternative way of realising value if the stock market persists in not valuing it properly.”

Performance of stock since listing

Source: FE Analytics

George Ensor, portfolio manager of River and Mercantile UK Micro Cap, named ActiveOps, a management process automation software company.

Ensor said: “It provides productivity software to large global organisations with distributed back offices. The software drives a 15% improvement in productivity of back office staff.

“In an environment where wages are going up and where people are working both from home and offices, this is a pretty good opportunity for this business.”

Ensor added that successful software businesses in the UK often trade on a 3.5x to 5x enterprise value to sales (EV/sales), while ActiveOps currently trades on a 1x EV/sales.

The EV/sales ratio measures a company’s value relative to its sales revenue, with a lower figure indicating that a company may be undervalued.

Performance of stock since listing

Source: FE Analytics

Ensor said: “The business had its IPO in 2021 on 5x sales. It's delivered and upgraded since then and yet the share price has more than halved because the market sees it as a loss-making, high-risk, early-stage growth tech business and the marginal seller has pushed the price down to very low levels.

“It's got 25% of its market cap in cash. There isn't a funding issue, it has actually been free cash flow positive for the past five or six years. This is not a loss-making type business but a profitable one that I think will compound good growth from here.”