UK inflation remained at 6.7% in September – the same level of the previous month, raising questions around the next meeting of the Bank of England’s Monetary Policy Committee (MPC) in November.

This morning’s consumer price index (CPI) reading released by the Office for National Statistics (ONS) has surprised on the upside, ruining the narrative of a subsiding pressure on monetary policymakers to up interest rates, said AJ Bell head of financial analysis Danni Hewson.

“September’s stickiness rather ruins the narrative. UK inflation is not making a slow but sustained backtrack, it’s got trapped between the push and pull of prices at the pump and those on supermarket shelves,” he said.

“Price volatility happens all the time but at the moment it’s raising big questions about whether the government will meet its target of halving inflation by the end of the year and, more importantly, how it might impact Bank of England policymakers ahead of their next interest rate decision.”

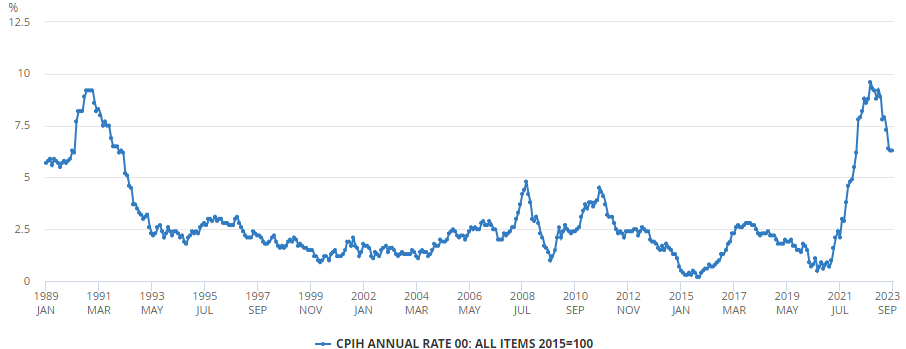

CPI annual rate

Source: Office for National Statistics

Increasing oil prices are responsible for this morning’s news, according to Charles Hepworth, investment director at GAM Investments.

“Despite a fall in food and drink prices over the month, UK inflation was ahead of market forecasts and all down to rising petrol costs,” he said.

But core inflation (which excludes the inherent volatility in fuel prices) also came in at 6.1% ahead of an expectation of a 6% rise (but down from the 6.2% level seen the previous month), which rekindles worries around monetary decisions.

“While the Bank of England prefers to use core inflation measures when assessing the need for further rate hikes, the core measure also marginally surprised,” Hepworth continued.

“This inflation print however is probably not enough for the Bank to go more restrictive in a little over two weeks’ time.”

However, Hewson isn’t as certain as to the future direction of the Bank of England and markets aren’t either.

“There is a lag when it comes to the impact of interest rate hikes, which would have been at the forefront of the minds of MPC members last time out and is likely to continue to influence their decision-making next month,” he said.

“To that end, markets are still pretty wedded to the notion that rates won’t change next month, but there is a degree of uncertainty that wasn’t present yesterday and that’s reflected in share prices this morning.”

Taken at face value, these numbers keep the pressure on the Bank of England to continue raising interest rates a while longer, according to Daniele Antonucci, chief investment officer at Quintet Private Bank.

“But that said, it’s also becoming more evident that the economy is slowing, with a mild recession expected over the coming months,” he said.

“These two dynamics suggest that we’re close to the peak in interest rates, although central banks will keep them elevated for some time to ensure there’s no inflation resurgence.”

As for the impact on investments, Antonucci has recently added longer-dated UK bonds to some portfolios to capture the higher yields while also adding a cushion should the economic outlook deteriorate.

“As rates reach a plateau, high-quality bonds become more attractive. Historically, their yields tend to trend in line with central bank rates,” he concluded.