Growth has been the dominant investment style in the past decade, helped by the low interest rates environment that followed the global financial crisis of 2008.

Yet, many investors were caught off guard last year when value investing made a comeback as interest rates started rising.

Although growth has resumed its position at the top of the charts this year, it has mostly been driven by a handful of US tech mega-caps. While commentators have been debating on the sustainability of such a narrow group of market leaders, interest rates have continued their ascent.

Jonathan Griffiths, investment product manager at ebi, said: “We’ve seen the performance of the US and global stock markets driven by the growth orientated ‘Magnificent Seven’ tech stocks, following investor excitement around the potential for artificial intelligence.

“However, following the market factoring in that the Federal Reserve and other central banks may keep interest rates higher for longer, the performance of these stocks has fallen back over the past quarter.

“We believe that the short-term market set-up that provided a tailwind for the growth factor may well continue to weaken, with it potentially turning out that investors became a bit over-excited in the short term.”

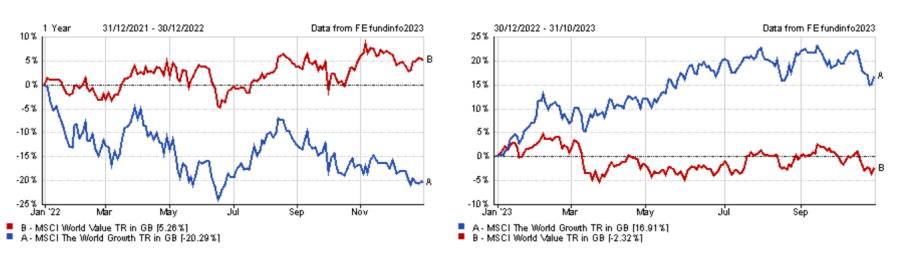

Performance of indices in 2022 and YTD

Source: FE Analytics

As a result, growth investors may ask themselves what the future has in store for them. The good news is that there is still a place for growth in investment portfolios but investors will now need to separate the wheat from the chaff, according to wealth managers.

For Rob Burgeman, investment manager at RBC Brewin Dolphin, growth companies can be divided into three categories.

The first one is made of rapidly growing but profitable companies, the second are firms growing at a slower pace but that are cash flow generative . The last one is about businesses that are years away from being either profitable or cash flow positive. The latter category has suffered the fiercest derating as interest rates started soaring. As a result, it is the category Burgeman is the least confident about.

He explained: “The problems that these type of growth companies face in the current environment are two-fold. Firstly, using higher interest rates and, therefore, a higher risk-free return, the net present value of future profits is a lot lower.

“This means that, for those companies who are not generating cash and need constant refinancing, raising funds via equity markets becomes much more dilutive and, if they do it, much more dilutive to existing shareholders.

“Secondly, if they choose to raise funds via debt markets or bank loans, the rate of interest they have to pay is also much higher and more revenue than needs to be syphoned off to meet debt repayments.”

Therefore, RBC Brewin Dolphin favours quality-growth, large- and mega-caps, which is also Canaccord Genuity Wealth Management’s preference.

Its head of equity fund research Kamal Warraich said that higher quality-growth companies with strong levels of profitability and reduced dependency on debt have historically provided protection for equity investors during difficult cycles and should “in theory” help investors through the “turbulent twenties”.

Alex Harvey, senior portfolio manager & investment strategist at Momentum Global Investment Management, added that it will also be important to check the pedigree of the manager when picking a growth fund.

He said: “You want a manager who has been here before and invested through several cycles; ideally someone with war stories from the tech bubble, which is probably the closest comparison to the (US) growth sector today, albeit today’s market is built on real revenue and real earnings.”

For small-cap growth strategies, Harvey stressed that it is important the manager is capacity aware and committed not to just grow their assets under management at the cost of performance.

In spite of those challenges, Harvey believes that this difficult period could prove beneficial for growth investors as weaker companies might be wiped out.

He said: “Higher rates may help flush out the weaker businesses that would otherwise persist in the low or zero rate world, awash with liquidity, when cheap financing could be found or extended.

“Call it ‘creative destruction’ if you like, but the rapid rate normalisation serves to catalyse this sequence of events.”

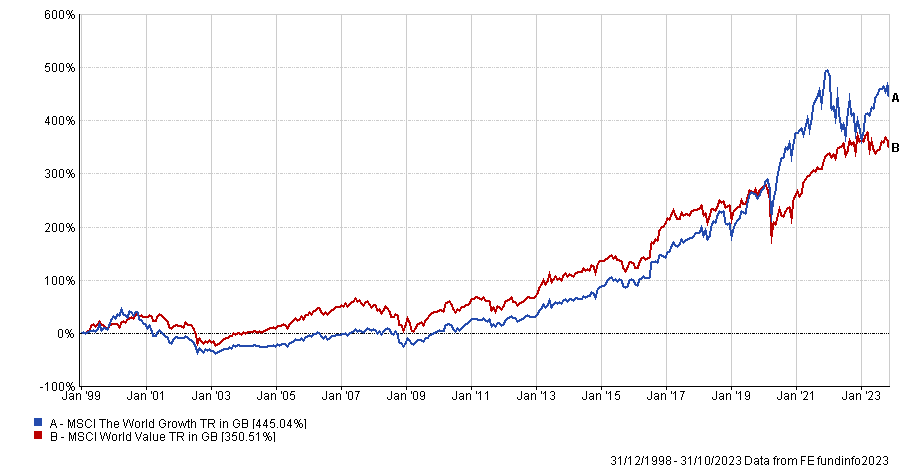

Griffiths, however, favours the value factor, which he argued has outperformed growth over long enough timeframes. For instance, data from FE Analytics suggests that value outperformed growth from the second half of 2000 until early 2020 when using the MSCI The World Growth and the MSCI World Value indices as proxies for each factor.

He said: “The fundamentals behind the value factor remain robust, including a general undervaluation and underappreciation of value stocks leading to an excess risk-adjusted return potential over the longer-term.

“Rather than seeking to tactically trade the value and growth factors, we believe the best approach is to strategically position a portfolio across value and the other range of factors supported by academic research (namely minimum volatility, momentum, quality and size), harvesting available factor premiums over the long term.”

Performance of indices since January 1999

Source: FE Analytics

Canaccord’s Warraich agreed and added that undervalued good quality companies did well during periods of higher interest rates such as in the 1970s.

Yet, Harvey recommended investors not to bet on any singular equity investment style in any meaningful way. He concluded: “Investment styles are very hard to time, and when they move, they move quickly. For that reason, we advocate a blended style approach, but will pivot to a degree to where we see the better valuation opportunity, which today remains in value.”