Investment trusts have an enviable track record with some dating back more than 100 years, but it is a relatively young one has caught experts’ eyes due to its stellar performance since its launch in May 2018.

The trust in question, Odyssean Investment Trust, has returned 52.7% since its entry to the London stock exchange and is as such the third best performer in the IT UK Smaller Companies sector over five years, just behind Harwood Capital’s Rockwood Strategic and Oryx International Growth.

As a result, the trust is now in the recommended lists of broker firms Winterflood and Numis and some financial advisers believe young investors should consider buying some shares in the trust. This is also one of the portfolios that Hawksmoor Investment Management has selected to hopefully benefit from the cheapness of the UK market across its multi-asset fund range.

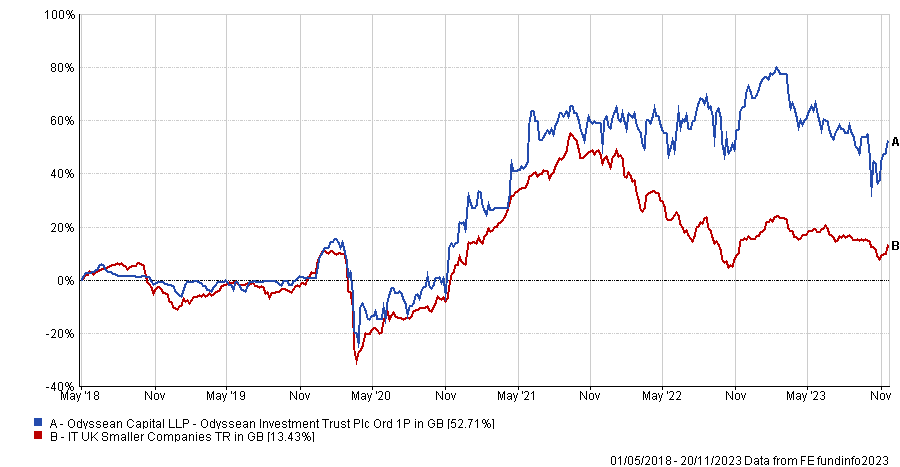

Performance of trust since launch vs sector

Source: FE Analytics

Odyssean stands out because of its concentrated portfolio, with the top 10 holdings making up 83.3% of the total assets and also due to the fact it is one of the very few investment trusts to currently command a premium to net asset value (NAV).

Ben Mackie, co-manager of the Hawksmoor Global Opportunities, Hawksmoor Vanbrugh and Hawksmoor Distribution funds, explained that this concentrated portfolio combined with a private equity approach to public markets make Odyssean an attractive proposition.

He said: “The managers actively engage with their underlying companies. They seek to drive changes and improvement. A concentrated portfolio enables them to do that. That differentiates them to a lot of other small-cap managers.”

To do so, managers Stuart Widdowson and Edward Wielechowski ensure investee companies have self-help programmes in places. That includes management and strategy changes or improving communication with the markets.

One of the strong driver of performance for Odyssean has been M&A, as 10 of its holdings have been acquired since launch. The trust is likely to continue to benefit from those activities as private equity firms and others are taking advantage of the cheapness of the UK market to acquire firms.

Elliott Hardy, investment trust research analyst at Winterflood, said: “In a recent call, Odyssean’s management noted how the UK small- and mid-cap markets are currently trading at 28% discounts to their respective third party fair value estimates.

“In the current environment of depressed UK equity valuations, we would therefore not be surprised to see Odyssean benefit from significant M&A activity over the near-to-medium term.”

Yet analysts at Numis stressed the portfolio also benefits from stock-specific characteristics and self-help opportunities. For instance, it avoids crowded, momentum-driven trades and has, therefore, avoided the sell-off when growth companies trading on high valuations started derating amid rising interest rates.

Another strength of the trust is that its investee companies, albeit small, generate most of their revenues overseas. Winterflood analysts noted that it has benefited Odyssean since inception, as the trust has been able to pick up businesses with a global nature in the “unloved” UK market.

They also highlighted two shareholder-friendly policies as further reasons to hold the trust. One is a realisation opportunity, which gives investors the possibility to realise all of their investments at NAV less costs every seven years post IPO, with the first one being scheduled in May 2024.

The second policy is about the trust’s ability to deploy 50% of profits made from takeovers to buy back shares in the event the average discount would exceed 5% for 60 days prior to exit.

Hardy said: “Both of these policies are attractive and should provide some share price support should the UK sector continue to face macro headwinds.”

Gavin Trodd, associate, investment companies research at Numis, warned, however, that the trust is likely to lag in an environment where investors are willing to take more risks to pursue higher returns.

Investors also need to be comfortable with the possibility that performance is likely to differ from small-cap indices over short periods due to the concentrated nature of the portfolio.

Odyssean’s strategy is not completely unique and bears many similarities with Strategic Equity Capital, managed by FE fundinfo Alpha Manager Ken Wotton.

Just like Odyssean, Strategic Equity Capital is characterised by a concentrated portfolio and applies a private equity approach to public markets as well. In spite of those resemblances, there is, however, no common holding across the two portfolios.

As such, Strategic Equity Capital could be an alternative option to Odyssean and investors may look to its ongoing charge figure of 1.07%, which is cheaper than Odyssean’s 1.4%.

Moreover, Strategic Equity Capital boasts a longer track record, although Stuart Widdowson was once the manager of the trust prior to the launch of Odyssean.

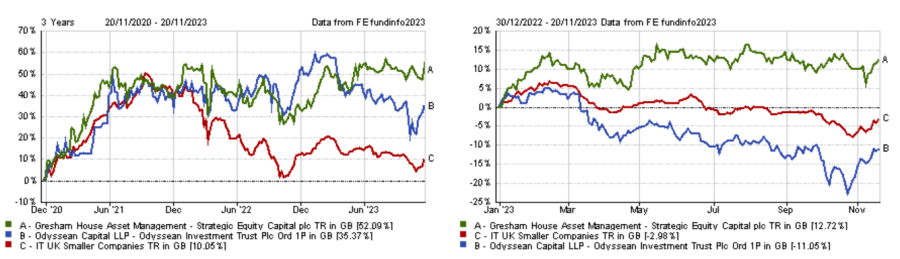

Strategic Equity Capital has also had the upper hand in terms of performance in more recent periods, as the below chart shows.

Performance of trusts over 3yrs and YTD vs sector

Source: FE Analytics

Strategic Equity Capital also trades on a discount (8.7%), which may mean it is better value to investors. In spite of this, Winterflood still prefers Odyssean.

Hardy explained: “We note that the shareholder register of Strategic Equity Capital is concentrated with more discount sensitive investors, which may limit the potential for a rerating.

“Moreover, Odyssean’s premium means it is one of the few trusts that have been able to issue shares recently, which is a positive and should provide sufficient liquidity and allow management to execute on any investment opportunities that may arise due to current valuations.”

Hawksmoor’s Mackie sees value in both investment trusts and holds the two of them across his three multi-asset funds. He highlighted Strategic Equity Capital is addressing its discount with a buyback policy and also offers a 100% realisation opportunity in 2025. Therefore, the discount could be narrowed over a short period of time and the trust’s liquidity improved.

Also, the trusts are not perfectly correlated despite tapping into the same part of the market. According to FE Analytics, the correlation between the two trusts stand at 0.71 over five years, 0.63 over 3 years and 0.39 over one year.