US president Donald Trump has unveiled a raft of new tariffs on countries he believes are taking advantage of America. The scale has been massive, with new tariffs of almost 50% for many Asian countries, 20% for Europe and a milder 10% for the UK, which the president referred to as a baseline charge.

World leaders responded by talking about countermeasures, retaliation and the need to protect national interests, which is “fighting talk” according to Neil Birrell, lead manager of the Premier Miton Diversified Fund range.

“Let’s be clear; the US has started a trade war,” he said.

The immediate reaction of financial markets was a run for safe-haven assets such as gold and government bonds, and a big fall in equity markets and the US dollar.

For Birrell, this shows how problematic these decisions will be for US consumers, with “a fall in the stock market having a real world impact on their wealth, as they are so invested in it”.

But there will be worldwide repercussions too, such as increased costs and inflation, reduced economic activity, reduced company profitability and damages to consumer and business confidence.

“The health of the US domestic economy is very important to the well-being of the world economy. The US has been showing signs of weakness recently and there is nothing in what is going on now that will help it in the short and medium term. As for the long term, correcting trade imbalances should be good for the domestic US economy, but at what short-term cost?” he asked.

“It is hard to know how this will play out. The problem is the unpredictability of the future at present and markets don’t like uncertainty. The sooner there is a clear line of sight, the better.”

On the face of it, the UK has got off lightly, according to Simon Edelsten, chief investment officer at Goshawk Asset Management. But the details are “still vague; the maths behind it unfathomable”.

“Cars made in the UK will probably be sold into Europe rather than the US. The next largest UK export to the US is pharmaceuticals. No one is sure from Trump’s ramble whether the tariffs cover all pharmaceuticals. A US citizen taking a drug made by, say, GSK, is unlikely to switch to a cheaper medication, so will just have to pay the higher price,” he said. “Overall, for businesses, chancellors and US consumers, there is nothing good (or even coherent) about these tariffs.”

Rathbones’ David Coombs said this was “classic Trump shock-and-awe” and merely a negotiating tactic.

“Governments around the world scramble for a response. Australia and the UK call for calm heads, while the EU and Canada are more combative. This is clearly a negotiating tactic,” he said.

“On balance, I think common sense will prevail and some concessions will be made to the US, which will allow Trump to claim victory for the ‘rust belt’. However, the next few weeks will be challenging, with risks and opportunities aplenty.”

Birrell agreed that there is “some room for negotiation”, however, the impact is “immediate and lasting and it’s just a case of how bad the scarring will be”.

The main consequence, he said, is that an element of these tariffs will be permanent, as the US administration needs to raise revenue to fund tax cuts.

Seeing the glass half-full, James Henderson, co-manager of the Lowland Investment Company and Law Debenture, admitted we are heading into “new territory”, but to him the picture is “not all bleak”.

“The reason inflation has been so low since the 70s is because of globalisation, which has brought a lot of prosperity to much of the world. You cannot retreat from globalisation without feeling the negative impacts,” he said.

“But it is easy to overreact. Equity markets are shaken today, but with the threat of inflation rising again, equities have to be part of the investment mix. There will still be sectors for smart stockpickers that will be relatively unaffected. Domestic-focused UK companies are on such low valuations that this will be just noise for many of them.”

James Syme, manager JOHCM Global Emerging Markets Opportunities fund, said that the mindset right now should be to buy on the rumour and sell on the news.

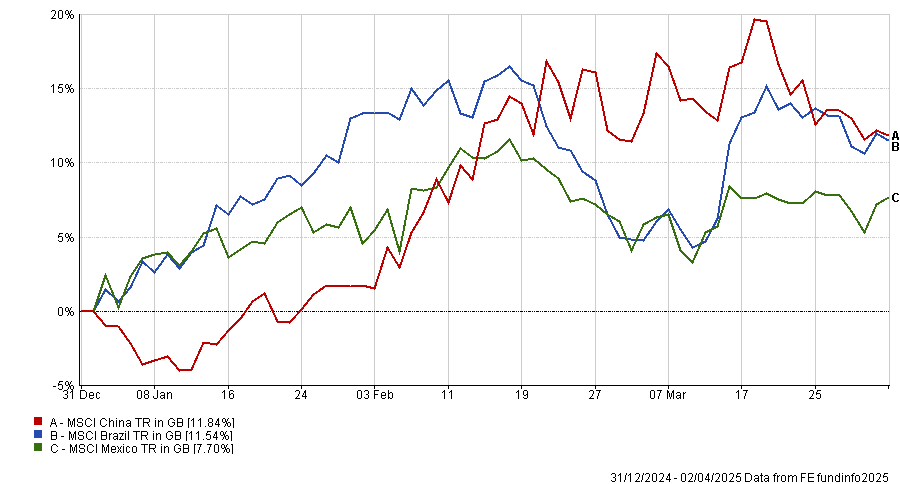

Performance of indices over the year to date

Source: FE Analytics

Mexico and China continue to be the two emerging markets most exposed to the new trade policies but both have outperformed, he noted.

Year-to-date trends show every Latin American market has had a positive return in US dollars, with improved growth prospects even in China, where the historically riskier parts of the asset class are attracting investors as uncertainty grows about where the pain of tariffs will ultimately be felt.

These positive returns stand in contrast to a negative year-to-date return from MSCI US, with MSCI US Growth down 3.9%. On the other hand, former darlings India, Taiwan and Korea have underperformed.

“These are recent trends and, so far, short term,” Syme said. “One swallow doesn’t make a summer but, while the global economic and political environment remains volatile, if we were asked what an emerging market bull market looks like, we would say it looks like this.”