Global stock markets have almost been reduced to a one-trick pony over the past year. Nvidia has shot the lights out, rising 203% in a single year, single-handedly dominating the returns of the major benchmarks.

The relative performance of active fund managers therefore hinged upon whether they owned Nvidia (which most top-quartile performers in the IA Global sector did) and whether they were overweight versus its substantial position in their benchmarks.

As a case in point, Axiom Concentrated Global Growth Equity led the IA Global sector, returning 39% for the year to 30 June 2024. Hot on its heels with returns in the thirties were GAM Disruptive Growth, Blue Whale Growth, GQG Partners Global Equity and Polar Capital Artificial Intelligence. All five counted Nvidia in their top 10 holdings.

However, 17 funds in the IA Global sector managed to achieve top-quartile performance over the past year without Nvidia featuring in their top 10 holdings.

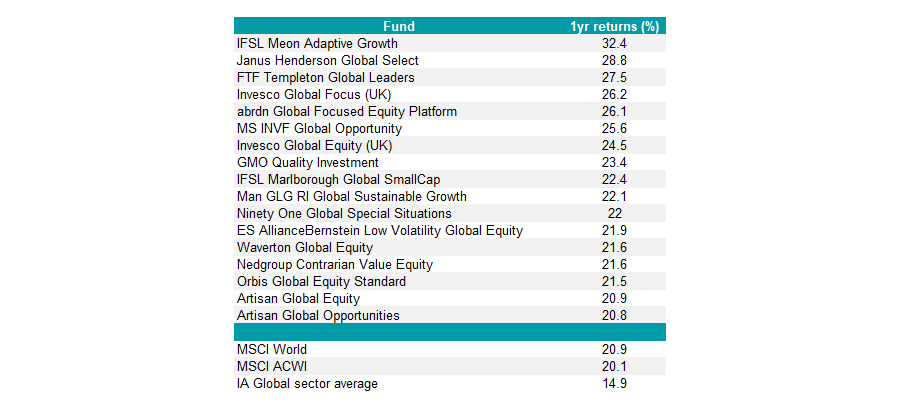

Top-quartile funds that don’t currently have Nvidia in their top 10 positions

Source: FE Analytics, funds’ factsheets. These funds delivered top-quartile returns within the IA Global sector for the year ended 30 June 2024 in sterling terms and do not hold Nvidia within their top 10, according to their most recent factsheets.

At the top of the list, the IFSL Meon Adaptive Growth fund was a poster child for finding opportunities outside of the tech sector. Its top three contributors drew from other areas that have surged recently: the diabetes and weight loss drug producers Novo Nordisk and Eli Lilly; and aeroplane manufacturer Leonardo, which profited from the rally in defence stocks.

Its largest holdings as of 1 July 2024 were insurer Talanx, Hyatt Hotels, analytics and data specialist RELX, biotechnology pioneer Amgen, diabetes care specialist Ypsomed, information and software specialist Wolters Kluwer, CBOE Global Markets, engineering and cybersecurity provider Parsons Corp., Vertex Pharma and construction company ACS Actividades.

The £33.5m fund held Nvidia briefly – an underweight position worth 1.3% of the portfolio. It bought Nvidia shares on 2 October 2023 at $448 and sold the stock on 25 January 2024 at $626.

Investment manager Robert Hale said the fund invests in a diversified portfolio of quality global equities, selected using a quantitative investment process, looking at momentum, volatility, Sortino ratios, risk and price trends.

The second-best performing fund in the list above was the £708m Janus Henderson Global Select fund, an all-cap portfolio of 40 to 70 stocks managed by Julian McManus and Chris O’Malley. They focus on companies where they believe the market underestimates free-cash-flow growth and their largest holdings are Microsoft, Taiwan Semiconductor Manufacturing Co. (TSMC) and Vistra Energy.

Vistra has been a primary contributor to performance over the past year. It is one of the largest independent power producers in the US and it recently became a major supplier of nuclear power through its acquisition of Energy Harbor.

Vistra has "an attractive generation mix of nuclear and gas, which match America’s growing power needs, partly driven by data centres", the managers said. "The market misunderstood the improvements made to the company’s business model, and the stock at one point traded at a 30% free-cash-flow yield."

McManus and O’Malley did invest in Nvidia in January 2024, but it isn't a top 10 position and the fund is underweight (with 1.8% in Nvidia) versus its benchmark (4.2%). The fund also owns TSMC and ASML.

TSMC is a leader in foundry chip manufacturing and is benefitting from strong growth in high performance compute, including AI applications. "The company’s dominant position is allowing it to raise prices, resulting in margin expansion, and it trades at a fraction of the valuation of stocks such as Nvidia," the managers said.

European semiconductor capital equipment maker ASML has been a major contributor to the fund's performance and has developed the EUV technology required to manufacture cutting-edge chips, including those made by Nvidia.

Janus Henderson Global Select’s other top 10 holdings are drawn from a variety of sectors and include BAE Systems, Marathon Petroleum, Liberty Media, Teck Resources, Dai-ichi Life, Canadian Natural Resources and Ferguson.

Third in line was Franklin Templeton Global Leaders, up 27.5% in the year to 30 June. Its largest positions include Amazon, Microsoft, Alphabet, Micron Technology, TSMC and T-Mobile. Beyond tech and telecoms, Rolls-Royce is the fund’s third-largest holding and other top-10 names include Icon, UnitedHealth Group and Freeport-McMoran.

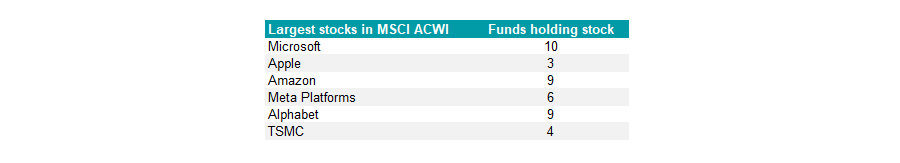

Although the funds in this study sidestepped Nvidia, they have built up substantial exposure to technology through the other ‘Magnificent Seven’ giants (six of which feature in the MSCI ACWI’s top 10, the exception being Tesla) and TSMC.

Of the 17 funds listed above, 10 own Microsoft, while Alphabet and Amazon each feature amongst nine funds' top 10 positions, as the table below shows.

Popular stocks within the top 10 holdings of funds that don’t own Nvidia

Source: funds’ factsheets

Outside of the ‘Magnificent Seven’, top-performing tech companies in the past year included Arm Holdings, which returned 184.9% for the year to 8 July 2024, Uber Technologies (66.1%), Netflix (56.4%), ASML (55.1%), SAP (54.9%) and Advanced Micro Devices (51.4%).

Beyond the technology sector, some of the best performing stocks held by the funds in this study were Rolls Royce (up 213.9% or the year to 8 July 2024, according to Google finance), aerospace company Leonardo (up 108%), Eli Lilly (101.8%), Vistry (101.7%), General Electric (81.7%), Novo Nordisk (81.3%), Japanese insurer Dai-ichi Life (61.9%), private equity trust 3i Group (61.3%), Netflix (56.4%), UBS (54.8%), MercadoLibre (52.6%) and aircraft equipment manufacturer Safran (50.5%.)

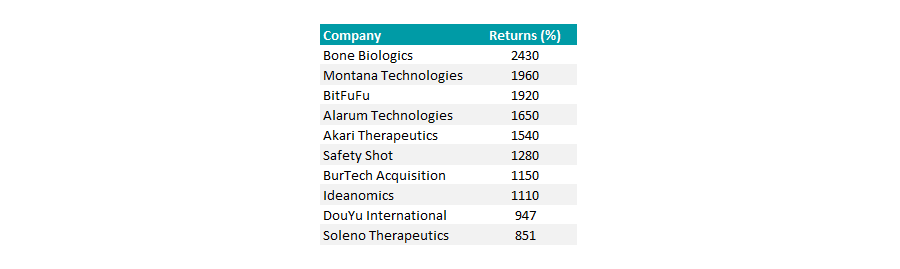

Even larger returns were on offer amongst lesser-known stocks. Eight US-listed companies all rose by more than 1,000% in the year to 30 June 2024, according to AJ Bell. The best-performing UK-listed company was Upland Resources, up 511%.

Best performing US-listed stocks over 1yr to 30 June 2024

Source: AJ Bell, data to 30 Jun 2024