Despite the caution that investors started 2024 with, the year ended up being another strong one with the global stock market gaining close to 20% - although gains were concentrated into relatively few areas.

Last year had plenty of issues for investors to navigate, such as ongoing conflicts in Europe and the Middle East, central banks bringing down interest rates and around half of the world’s population going to the ballot box – including the UK and the US.

Below, Trustnet looks at the market from a range of viewpoints to show which areas made the most and the least for investors across the whole of 2024.

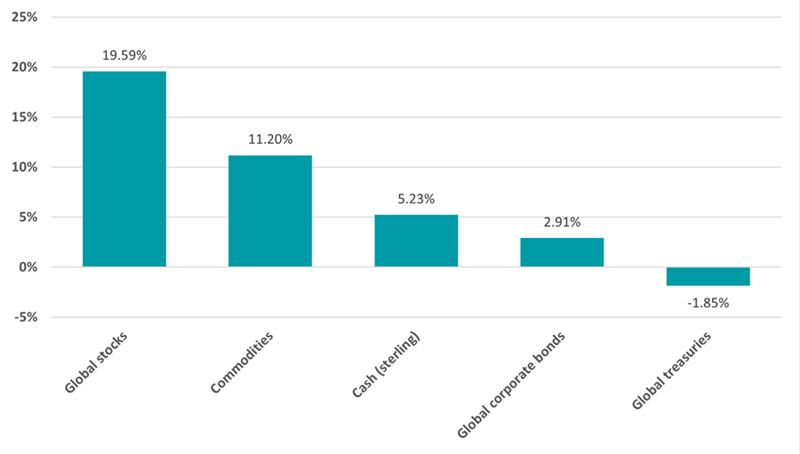

Performance of asset classes in 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Dec 2024

Stocks were the clear winners last year, with the MSCI AC World index making a 19.6% total return. As we will see, most major stock markets delivered a positive return but the US exceptionalism narrative and continued enthusiasm for artificial intelligence (AI) meant the US was top of the pack.

However, fixed income had a more challenging year. Analysts at FE Investments said: “Inflation fell steadily over most of this year and this allowed central banks to cut rates, however, progress has not been steady as economic growth stalled in the UK and Europe and inflation ticked up. Investors had to continually adjust their forecasts for the speed of interest rate cuts and this caused significant volatility.”

Cash performed better and generated a real return for investors, as inflation declined far more and faster than short-term interest rates.

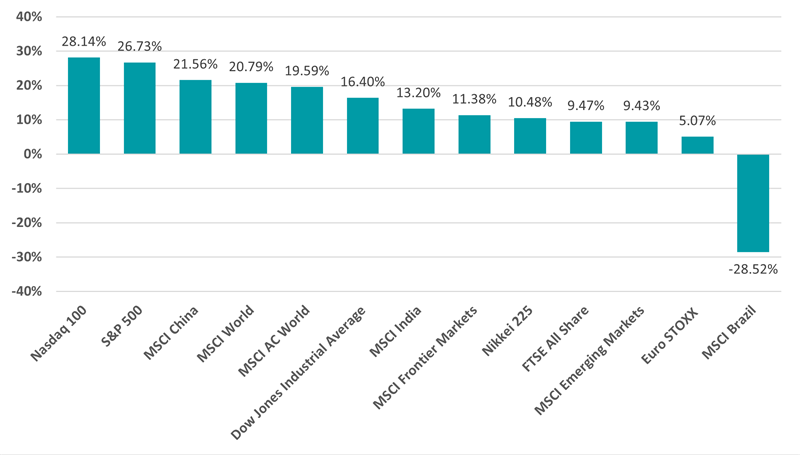

Performance of regional stocks in 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Dec 2024

As noted above, US equities were the year’s best performers: the tech-heavy Nasdaq was up more than 28% with the broader S&P 500 not too far behind.

FE Investments said: “US equities continue to defy bearish calls and have broken record after record in 2024. Techno-optimism – belief that new AI breakthroughs will unlock ever higher profit margins and productivity – coupled with strong corporate earnings growth have led US stocks to add over 25% this year. Massive US government spending has also played a part.”

Chinese stocks also had a strong 2024, after a few tough years. Performance was poor initially but investor sentiment jumped towards the end of 2024 when the Chinese government promised a massive stimulus package to boost the world’s second largest economy.

Domestic investors fared worse but the FTSE All Share still posted a 9.5% total return. The UK market has been unloved for some time, although 2024 demonstrated that attractive valuations and greater political stability could tempt investors back.

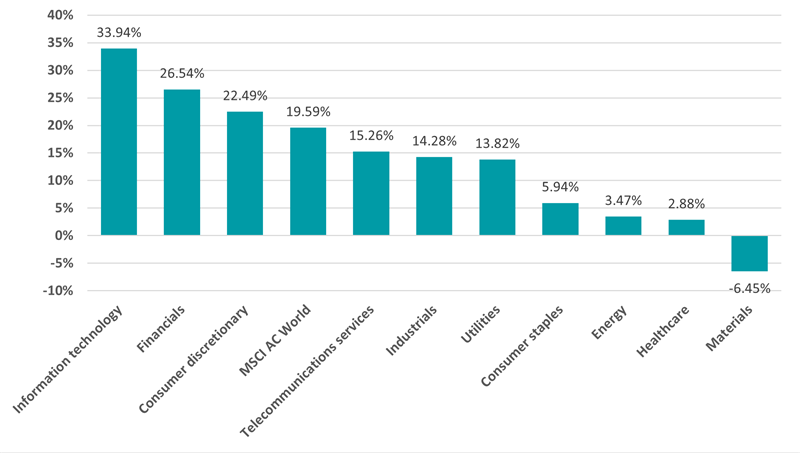

Performance of stock sectors in 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Dec 2024

After seeing the strong performance of the Nasdaq last year, it should not be a surprise that the information technology industry was the best part of the global stock market.

The ‘Magnificent Seven’ – Amazon, Apple, Google, Microsoft, Meta, Nvidia and Tesla – have led the market for several years as investors are excited about their roles in the AI revolution.

Financials also had a good year, supported by the election of Donald Trump as US president in November. Trump’s deregulation agenda is seen as beneficial to banks and other financials companies, as well as tech, leading to a strong post-election rally.

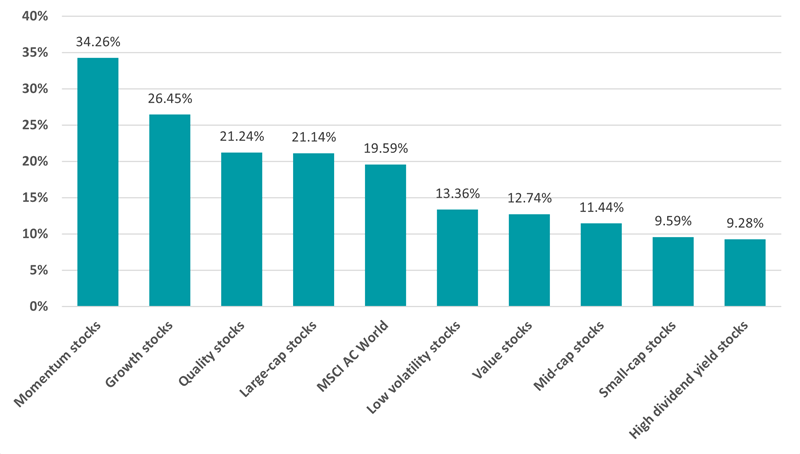

Performance of investment factors in 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Dec 2024

Given that US tech mega-caps had another strong year, largely down to the continued outperformance of Nvidia (up 171% in 2024) and other Magnificent Seven stocks, the momentum factor was the best performer. Momentum investing involves buying assets that have shown strong recent performance and selling those with weak performance, in the belief that trends will continue in the same direction.

This meant that factors such as small-cap and value investing, which tend to be more tied to the health of the economy and have been overlooked as investors focused on growth stocks, continued to struggle. However, the valuation gap between these areas and the likes of mega-cap tech has become so large that some investors are tipping them for a rebound if the economy strengthens from here.

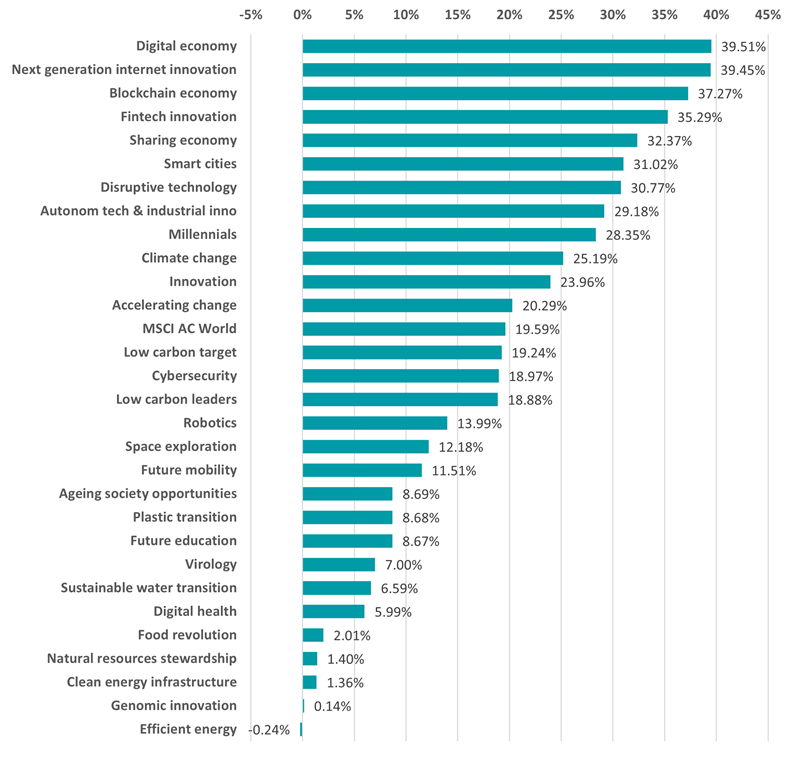

Performance of thematics in 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Dec 2024

When it comes to thematic investing, there’s a clear split between those expected to benefit from Trump in the White House and those forecast to suffer. Trump’s deregulation plans and enthusiasm for cryptocurrencies means that themes such as the digital economy, next generation internet, blockchain and fintech rallied hard last year.

On the other hand, themes like efficient energy, clean energy infrastructure and natural resources stewardship are unlikely to be the priorities of the incoming Trump administration and have posted much weaker returns.