There is a growing expectation that the Bank of England will soon cut interest rates, potentially as early as its next meeting in August.

Falling interest rates would stimulate economic activity, benefitting the more cyclical areas of the stock market, such as household goods and construction companies, utilities and retailers.

As Rebecca Maclean, investment director, UK Equities at abrdn, said: “Lower interest rates can reduce mortgage rates and debt servicing costs, thereby increasing discretionary income and bolstering consumer confidence.”

Below, managers of UK equity funds explain which sectors and stocks they expect to benefit from rate cuts.

Housebuilding and construction

Falling interest rates reduce the cost of mortgages, making home purchases more affordable, which should enable housebuilders to thrive.

The sector is also poised to benefit from the new Labour government’s commitment to build 1.5 million new homes over the next five years.

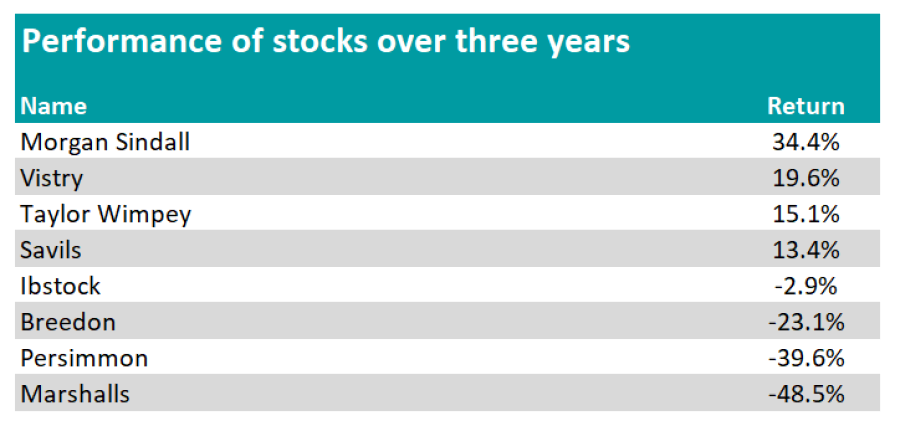

Hence Ambrose Faulks, co-manager of Artemis UK Select, believes housebuilding will be at the “epicentre” of a stock market revival and holds Vistry and Morgan Sindall within his fund.

Job Curtis, manager of The City of London Investment Trust, is also bullish on housebuilders, holding positions in Taylor Wimpey and Persimmon. Additionally, he invests in brick-maker Ibstock and Marshalls, which produces paving stones and roofing products.

“They should benefit medium-term as improved demand leads to more homes being built,” Curtis said.

Simon Murphy, manager of VT Tyndall Unconstrained UK Income, also focuses on businesses that serve the housing industry. For example, he invests in the aggregates business Breedon Group, buy-to-let mortgage provider OSB Group and property manager Savills.

Performance of stocks over 3yrs

Source: FE Analytics

Real estate

Some managers prefer the real estate sector and anticipate an upswing if rates are cut, due to reduced borrowing costs, increased property values and higher demand.

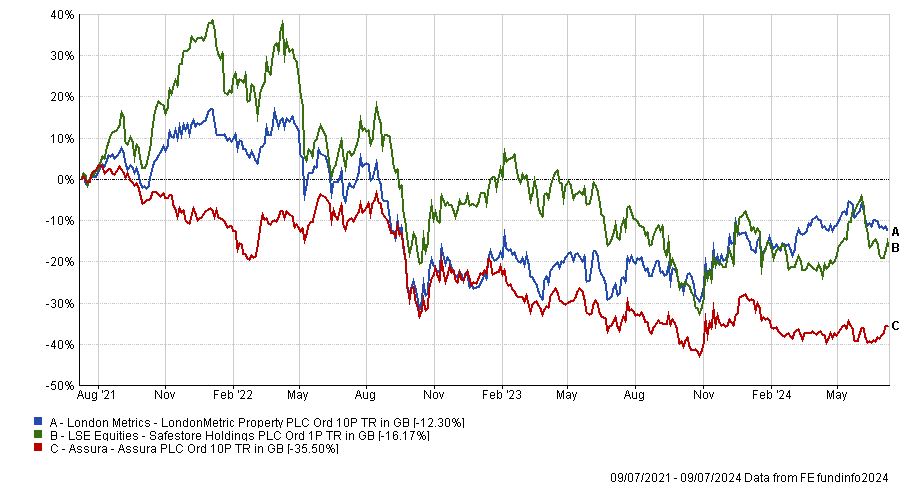

Therefore, Simon Moon, co-manager of Unicorn UK Smaller Companies, favours LondonMetric Property, a REIT focused on logistics and retail properties.

Meanwhile, Callum Wells, co-manager of the Castlefield Sustainable Portfolio funds, prefers Assura, which focuses on general practitioner and primary care buildings.

Charles Luke, manager of Murray Income Trust, believes that Safestore, the UK’s largest provider of self-storage, will thrive.

He said: “Firstly, the interest charged on its debt would decline. Secondly, the discount rate on which its assets would be valued would fall resulting in a higher asset value. Finally, for its customers, a lower interest rate would likely lead to an increase in disposable income and greater housing activity, both of which would be likely to benefit demand for Safestore’s product.”

Performance of stocks over 3yrs

Source: FE Analytics

Consumer discretionary

For Andy Gray, co-manager of Artemis Special Situations, one of the “mysteries” of the past six months has been the lack of upturn in consumer spending.

“Covid savings are intact, unemployment is low, wage growth is strong, inflation has eased. Indeed, consumer confidence is back to pre-Covid levels. Yet consumer-facing companies are yet to see it,” he observed.

“Larger ticket consumer purchases in particular look overdue a recovery with volumes well below 2019 levels.”

Interest rate cuts might act as a catalyst to encourage UK consumers to increase their spending, particularly on larger items.

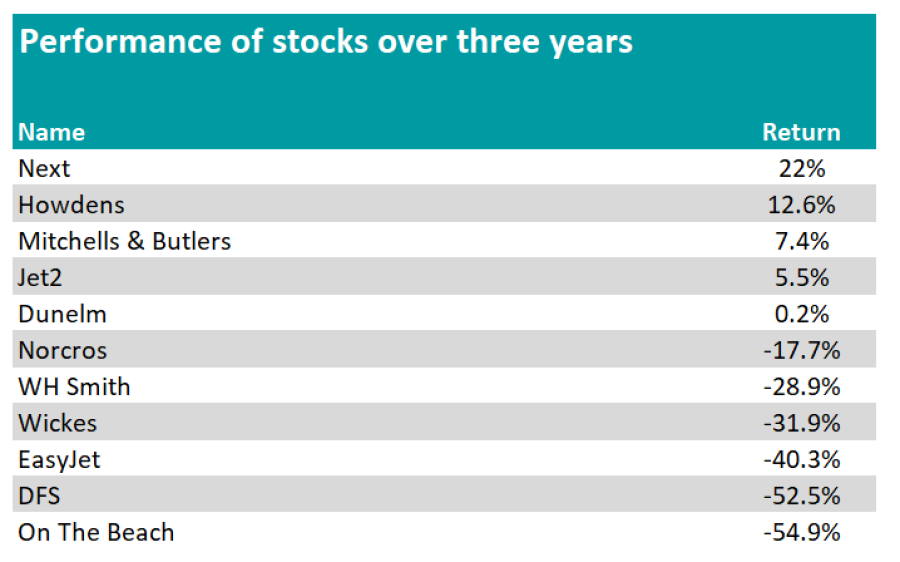

Therefore, Gray holds furniture retailer DFS and kitchen manufacturer Howden, noting that these companies have gained market share during the downturn and enhanced their product offerings.

Murphy, who also holds DFS and Howden in VT Tyndall Unconstrained UK Income, pointed to DIY retailer Wickes and home furnishing retailer Dunelm.

Will Tamworth, co-manager of Artemis UK Smaller Companies, is overweight in the UK consumer discretionary sector, anticipating that rate cuts will serve as a catalyst to encourage consumers to make major purchases.

In addition to investing in home-oriented businesses such as DFS and bathroom equipment retailer Norcros, Tamworth also favours travel-related businesses like low-cost airline Jet2 and online travel agent On The Beach.

Murphy also believes that travel and leisure are themes to play ahead of interest rate cuts. These sectors have been recovering since the Covid lockdowns but he expects increased disposable income after rates fall to provide a further boost.

His key holdings in this area are WHSmith and low-cost airline EasyJet.

Meanwhile, Artemis UK Select invests in clothing retailer Next and the pubs and restaurants group, Mitchell & Butlers.

Performance of stocks over 3yrs

Source: FE Analytics

Financials

UK banks have proven to be a terrific investment since central banks began their hiking cycle and Faulks expects them to continue performing well, even as macroeconomic concerns recede.

He said: “Due to their use of the five-year swap rate to hedge themselves, they are still meaningfully under-earning their full capacity, so we would expect their earnings to grow during the first falls in interest rates. Not least, this will ease deposit pressures.”

Yet, lower rates are likely to benefit the wider financial sector, driven by increased activity and investors seeking alternative income sources.

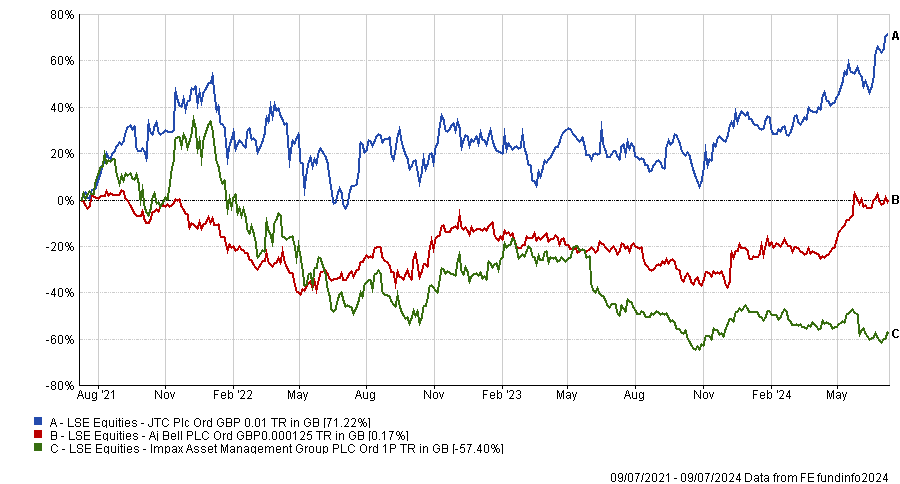

For example, Moon highlighted global professional services provider JTC, which could experience heightened demand for its fund administration and corporate services.

Similarly, investment platform AJ Bell could see gains from higher trading volumes and increased assets under management as investors become more active in a lower-rate environment.

Wells also sees potential in asset managers such as Impax, which are expected to benefit from increased assets under management due to rises in the value of their underlying investments.

Performance of stocks over 3yrs

Source: FE Analytics

Growth companies and small-caps

Finally, fund managers highlighted growth companies and small-caps, both of which suffered as interest rates were on the way up.

Maclean said: “The valuation of equities is sensitive to long-term discount rates. The compression of valuations for growth-oriented companies during the interest rate hikes of 2021 and 2022 exemplifies how heightened discount rates can dampen the present value of future cash flows, with the reverse true when rates fall.”

Moon has invested in recently-listed Raspberry Pi, known for its single-board computer, anticipating increased adoption across various industries.

He also believes that Microlise, a provider of telematics and fleet management solutions, will benefit from increased business investment in efficiency-boosting technologies.

Small-caps have suffered in recent years because they are often more closely connected to the health of the domestic economy, compared to their larger peers.

However, they are also among the first to benefit from interest rate cuts.

Wells concluded: “There is certainly value in small-caps, as evidenced by recent takeover activity, often by savvy private equity investors who have acted quickly to snap up bargains before interest rates reduce and valuations surge again.”