New parents face a multitude of competing demands, from immediate expenses like adjusting their home for the new family member, to longer-term investments such as building a portfolio for their child's future.

Accordingly, new parents might need to review their own investment portfolios and adjust them to their new situation.

Rob Morgan, chief analyst at Charles Stanley, urged parents to save and invest in different pots reflecting their different goals, be they short- or long-term in nature.

“Shorter-term needs are generally considered to be less than five years, perhaps putting money aside for family holidays or childcare. Longer-term goals include getting ready for retirement or preparing for school or education fees likely to be incurred in at least five years’ time,” he explained.

“Short-term needs are best addressed through saving cash and long-term ones through investing.”

He proposed a long-term asset allocation of around 85% to 90% in diversified equities, cushioned by and 10% to 15% in bonds and lower volatility investments.

“For the long-term portion of your investments, it’s necessary to harness growth through investing in the stock market, while perhaps having one eye on other costs that might crop up further down the road. It might therefore be appropriate to take sufficient risk to maximise returns whilst remaining diversified to take the edge off inevitable stock market volatility,” Morgan said.

He also called on investors to keep the long-term objective of the portfolio (at least 10 years) in mind and avoid tinkering with it.

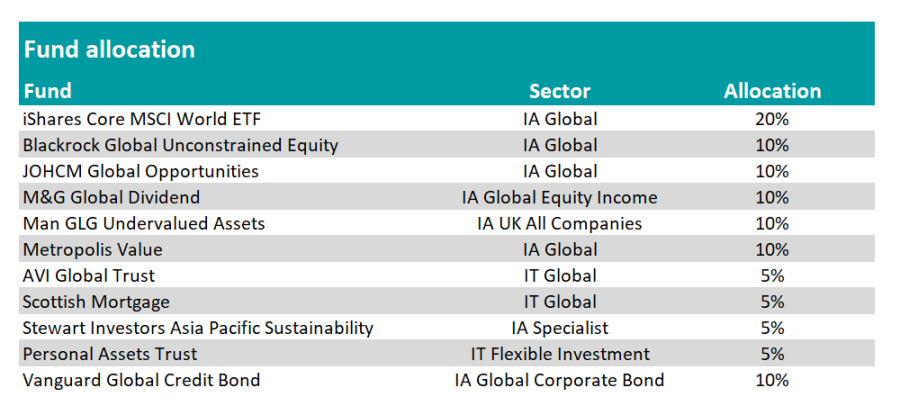

Below, Morgan has built an investment portfolio tailored to the needs of new parents.

Source: FE Analytics

iShares Core MSCI World ETF

His largest allocation is iShares Core MSCI World ETF, which accounts for 20% of the overall portfolio.

The purpose of this fund is to provide low-cost core exposure to global markets, around which more specialist strategies can be added.

It charges investors 0.2% and has exhibited a tracking error of 0.49 relative to the MSCI World index over the past 10 years.

BlackRock Global Unconstrained Equity

The next fund in Morgan’s portfolio is BlackRock Global Unconstrainted Equity, with an allocation of 10%.

The fund, managed by FE fundinfo Alpha Manager Michael Constantis and Alister Hibbert, was launched in January 2020, with the top 10 holdings accounting for 63.7% of the portfolio.

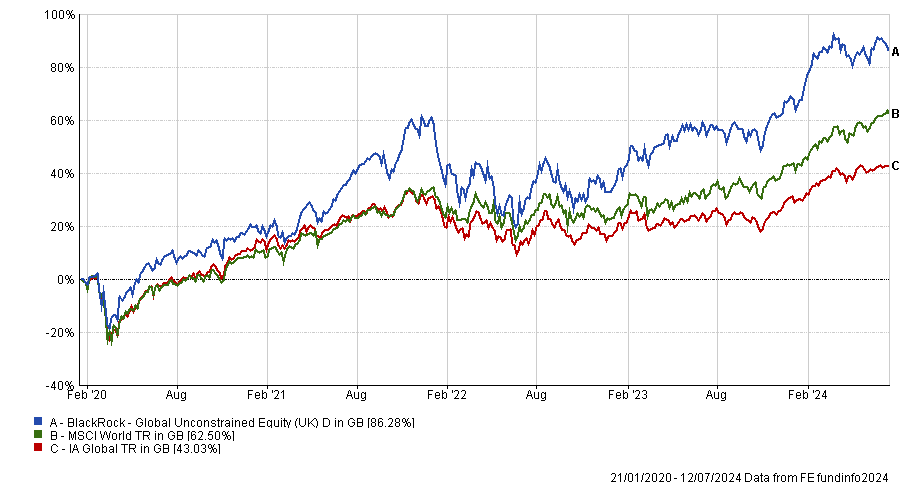

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Morgan said: “A highly focussed global stock-picking fund with an excellent stock picker at the helm. It is growth orientated but has a very selective approach to identifying structural global ‘winners’.”

BlackRock Global Unconstrained Equity has been one of the best performing funds in the IA Global sector over three years, sitting in the first quartile and ranking 33rd out of 485.

JOHCM Global Opportunities

To diversify beyond the Magnificent Seven and broad market indices, Morgan added JOHCM Global Opportunities, attributing it a 10% weight.

He highlighted the tactical use of cash and the portfolio’s focus on “underappreciated quality”.

The fund, led by FE fundinfo Alpha Managers Ben Leyland and Robert Lancastle, has scant exposure to technology, with healthcare, consumer products and financial services being the most represented sectors through holdings such as UnitedHealth, Philip Morris International and Deutsche Boerse.

Performance of fund over the past 10yrs vs sector and benchmark

Source: FE Analytics

The fund has lagged the MSCI All Country World index over the past decade, but has made positive returns over every standard period.

M&G Global Dividend

Also accounting for 10% of the portfolio, M&G Global Dividend’s role is to harness growing dividends to provide an engine of performance when markets aren’t making progress in terms of capital growth.

“The focus on income provides good diversification from a tracker and growth strategies,” Morgan said.

The fund yields 2.5% and invests predominantly in the basic materials and consumer products sectors, with companies such as Methanex Corporation and Imperial Brands.

Performance of fund over the past 10yrs vs sector and benchmark

Source: FE Analytics

M&G Global Dividend sits in the second quartile of the IA Global Equity Income sector over 10 and five years.

Metropolis Value and Man GLG Undervalued Assets

For exposure to the value factor, Morgan included both Metropolis Value and Man GLG Undervalued Assets, with a 10% allocation for each of them.

The first fund, managed by FE fundinfo Alpha Managers Jonathan Mills and Simon Denison-Smith, blends both value and growth elements in its approach and has £434m under management.

“In a world of mega-funds and trillion-dollar asset managers, the value of a nimble strategy and efficiency of research and decision making should not be underestimated,” Morgan said.

Performance of funds over the past 10yrs vs sectors

Source: FE Analytics

Man GLG Undervalued Assets focuses on UK equities and is a contrarian call, as investors have been turning their backs on the domestic market.

Morgan praised the fund’s “consistent process”, “disciplined approach” and “emphasis on balance sheets” as tools to take advantage of a potential future re-rating in the UK.

The £1.6bn fund has delivered top-quartile performance over one, three and five years and is run by Henry Dixon and Jack Barratt. They recently won the FE fundinfo Alpha Manager of the Year award for UK equities for the second year running.

Scottish Mortgage and AVI Global

Morgan also recommended making a 5% allocation to two investment trusts – Scottish Mortgage and AVI Global – which both boast distinctive strategies.

The former offers exposure to some of the world’s “most exciting” growth companies, including privately-owned ones, which can’t be easily accessed.

However, Morgan warned that this trust can by highly volatile and sensitive to investor sentiment, hence the small position size.

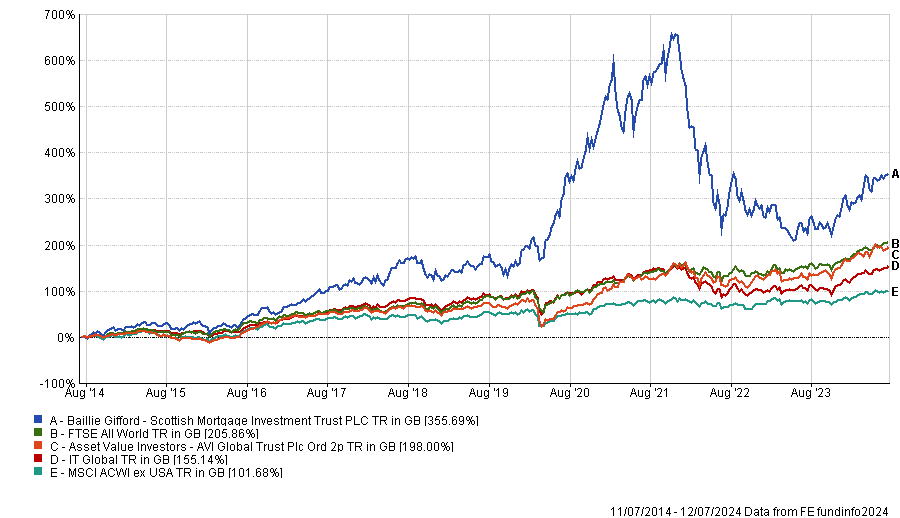

Performance of investment trusts over the past 10yrs vs sector and benchmarks

Source: FE Analytics

AVI Global takes a completely different route to generate returns, taking an activist approach in family-controlled holding companies, selected closed-ended vehicles and Japanese special situations.

Morgan said: “It is unlike anything else in the peer group or any index. This makes it an important diversifier with very different return drivers from other portfolio constituents.”

Stewart Investors Asia Pacific Sustainability

For exposure to the dynamic Asia Pacific region, Morgan selected Stewart Investors Asia Pacific Sustainability, attributing it a 5% weight.

He chose this fund for its large allocation to India and its exposure to parts of Southeast Asia where economic growth is rapid.

“Although companies [in those regions] are expensively rated, the fund’s emphasis on quality and good management should help it maximise the opportunities,” he noted.

The fund is managed by FE fundinfo Alpha Manager David Gait, who is underweight to China.

Performance of fund over the past 10yrs vs sector and benchmark

Source: FE Analytics

Personal Assets Trust

Morgan also included Personal Assets Trust, which blends blue-chip shares, government bonds and gold.

As this investment trust focuses on capital preservation, its role in the portfolio is to protect against downside risk while also delivering long-term growth.

Due to the nature of its strategy and purpose, Personal Assets is the least volatile strategy in the portfolio.

Performance of fund over the past 10yrs vs sector and benchmark

Source: FE Analytics

Vanguard Global Credit Bond

Finally, Morgan picked Vanguard Global Credit Bond to complete the portfolio with an allocation to fixed income.

This fund gives a broad exposure to global markets in a single, actively managed solution.

Morgan said: “It’s a one stop shop for bonds, simple and effective. Its focus is predominantly on developed market investment-grade securities, but with some scope to buy high yield bonds, investment-grade emerging market debt and other asset classes. The vast majority of the portfolio will be currency hedged to remove additional foreign exchange volatility.”

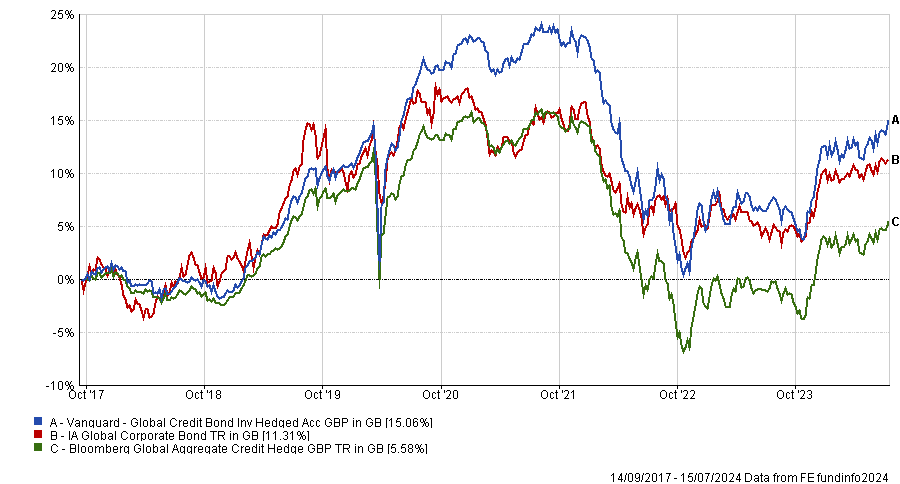

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Vanguard Global Credit Bond was launched in 2017 and is the best performing fund in the IA Global Corporate Bond sector over five years.