Chancellor Rachel Reeves has barely been in office a week but has already announced planning reforms to “get Britain building again”.

In her first speech as chancellor, she promised to restore mandatory local housing targets, end the ban on building new onshore wind farms in England and prioritise energy projects within the planning system.

Hassan Raza, investment manager of Capital Gearing Trust, said genuine planning reform could provide “real tailwinds to a range of property, private equity and infrastructure trusts”.

Below, fund selectors highlight which investment trusts stand to benefit from the Labour government’s policies.

Housebuilding, property and construction

Labour promised in its manifesto to build 1.5 million new homes during the next five years and is establishing a housing task force to tackle stalled, large housing schemes. The new government also wants to release ‘grey belt’ areas of ugly but protected land.

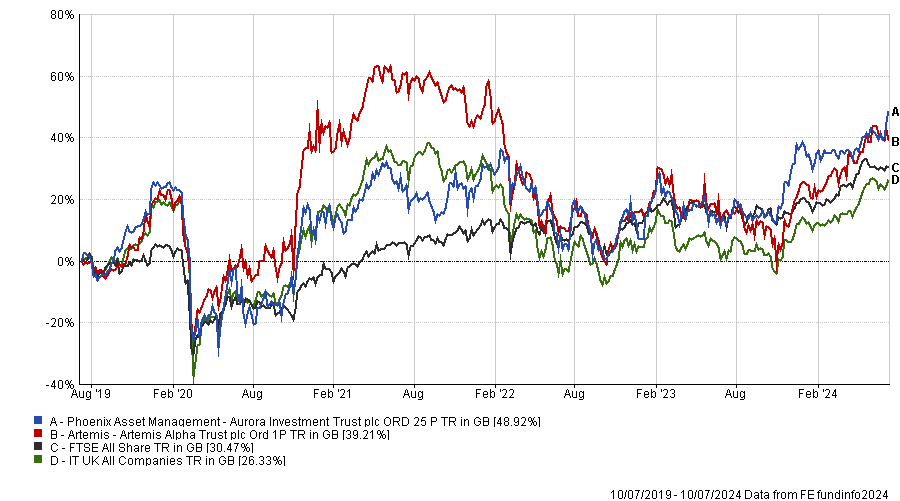

All this bodes well for housebuilders and trusts that own them, such as Aurora Investment Trust, which holds Barratt and Bellway. Managed by Phoenix Asset Management Partners’ chief investment officer, Gary Channon, the trust has a concentrated portfolio of 12 to 20 investments.

Peter Hewitt, who manages the CT Global Managed Portfolio Trust, described Aurora as “a real play on domestic UK”. It has a £189m market capitalisation and an 8.1% discount.

The Artemis Alpha Trust holds several of the same stocks as Aurora and has about 15% in housebuilders, including Redrow and Barratt. Managed by Kartik Kumar and John Dodd, it is trading on a 12.5% discount and has a £123m market cap.

Performance of trusts vs sector and benchmark over 5yrs

Source: FE Analytics

For a purer punt on real estate, Hewitt suggested TR Property. Marcus Phayre-Mudge, a partner at Thames River Capital, has managed the £1.1bn trust since 2011. Most of its assets are in continental Europe, but it still has substantial domestic exposure with 35.7% in listed UK property companies and 6.3% in UK bricks and mortar. Shares sit on an 8.7% discount.

Wind power

Greencoat UK Wind, which owns and operates UK wind farms, is in pole position as Reeves ends the ban on onshore wind farms. Not only will more wind farms be built, but Hewitt expects the value of the trust’s existing assets to rise. He anticipates interest from potential acquirers now that the sector has a “clearer road ahead” and the government is making “positive noises”. The £3.2bn trust is trading on a 13% discount, which has been as wide as 20%.

The lifting of the onshore wind farm ban could prove to be a double-edged sword, warned Juliet Schooling Latter, research director at Chelsea Financial Services.

“Whilst it will likely create more opportunities, increased renewable energy generation means lower long-term power prices that will also be more volatile. We've sometimes seen power prices go negative when it's particularly windy or sunny, which is actually bad for renewables,” she said.

Performance of trust vs sector over 5yrs

Source: FE Analytics

Clean energy

Labour wants to make Britain a clean energy superpower and its ambitions stretch far beyond wind power. Raza expects GB Energy and the National Wealth Fund to “play a critical role in mobilising existing technologies (solar, wind and biomass) and commercialising new ones (hydrogen and carbon capture).”

This should improve conditions for the disposal and development pipelines of trusts such as the NextEnergy Solar Fund and JLEN Environmental Assets, he said.

Labour's renewable push will also require more battery infrastructure to stabilise the grid, which could help some of the battery trusts which have been “massively out of favour”, Schooling Latter said.

Peter Walls, manager of the Unicorn Mastertrust fund, agreed. “More intrepid investors may want to look at the battery storage trusts, although prices here are expected to remain volatile, with greater sensitivity to energy prices and uncertainty about the National Grid.”

Meanwhile, Raza believes that investment in the national grid and broader infrastructure to support electrification should provide a boost for trusts such as International Public Partnerships.

Infrastructure

Many infrastructure investment trusts are trading on wide discounts due to higher interest rates and borrowing costs but some of this pressure will ease as and when the Bank of England cuts rates.

Labour’s reforms are a further tailwind, including the creation of a £7.3bn National Wealth Fund to invest in ports, gigafactories and steel.

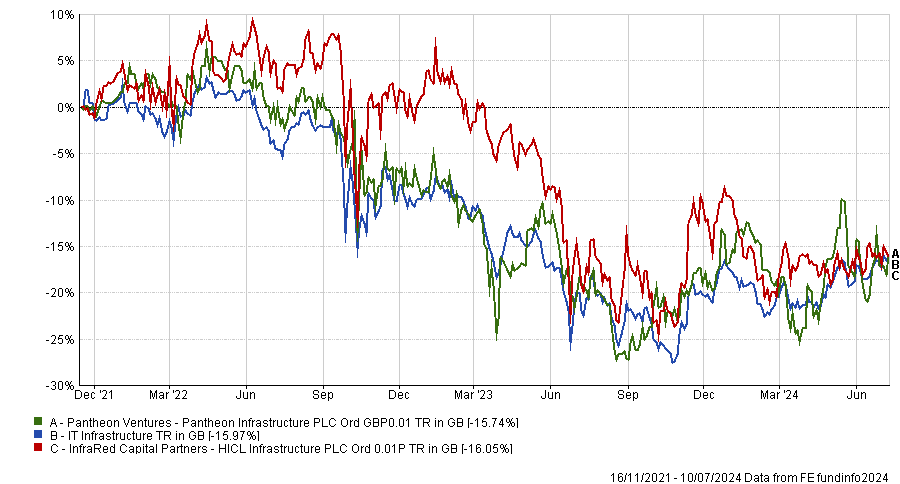

Walls said: “While UK interest rates may well stay higher for longer, the direction of travel is downwards and this combined with the Labour party’s stated policies, increases the attractions of trusts such as HICL Infrastructure and Pantheon Infrastructure, which trade at wide discount to net asset value.”

Performance of trusts since Pantheon’s inception

Source: FE Analytics

James Carthew, head of investment companies at QuotedData, highlighted Downing Renewables & Infrastructure Trust (on a 34% discount) and Pantheon Infrastructure (on a 28% discount).

UK equities

Prime minister Keir Starmer has declared it his mission to “kickstart UK growth” and comes to power at a time when UK equity valuations are compelling, despite strong performance in recent months.

Small-caps are the cheapest part of the market, after a rough few years, said Walls, highlighting Aberforth Smaller Companies and Henderson Smaller Companies as good options.

Carthew also pointed to “big bargains” and wide discounts in the UK Smaller Companies sector, naming Montanaro UK Smaller Companies (on a 14% discount), Rights & Issues (13%) and BlackRock Throgmorton (10%).

Moving from listed small-caps to private equity, Hewitt tipped Literacy Capital, which is managed by the father and son team, Paul and Richard Pindar. They invest in small, privately-owned UK companies such as housebuilder Antler Homes and recruiter Kernal, often enabling the founders to partially cash out, and they professionalise how these businesses are run.

Performance of trust vs sector since inception

Source: FE Analytics

The £304m trust has already performed well and will prosper if the UK economy picks up, Hewitt said. It donates 0.9% of its net asset value every year to help disadvantaged children learn to read.