Investors need to be careful when holding more than one IA UK Equity Income fund or they risk owning many of the same stocks, according to data from FE Analytics.

A contracting UK market – with a record number of FTSE 350 companies currently under offer and many larger companies getting taken out in a frenetic wave of M&A activity – may be forcing fund managers into the same shrinking pool of companies.

Additionally, although the dividend picture in the UK is improving, it was hit last quarter as mining stocks slashed their payouts, limiting the number of options further for those with an income mandate.

As such, Trustnet investigated the most common stocks among funds in the IA UK Equity Income universe, where there is an alarming level of crossover.

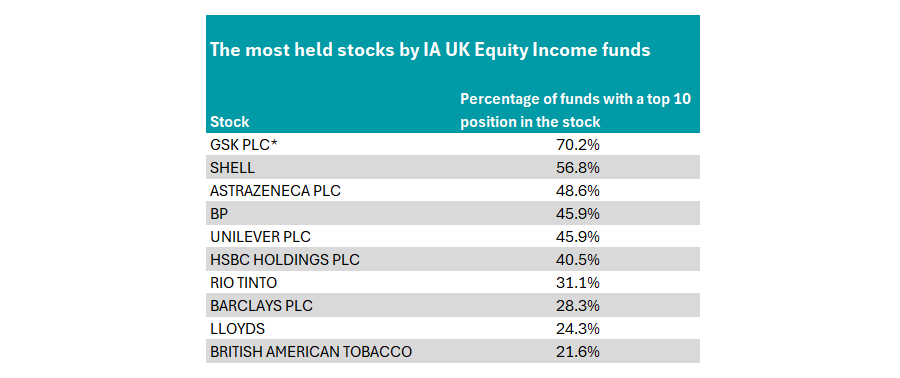

The table below shows the percentage of the 74 funds in the sector that own the 10 most popular stocks in their top 10 holdings. The figures below – big as they may be – are likely to be even higher if full portfolio data were available.

Source: FE Analytics

In the top spot, some seven in 10 funds in the IA UK Equity Income sector own pharmaceutical giant GSK among their top 10 positions. We have included an asterisk here as we have scanned for fund factsheets that refer to GSK and/or GlaxoSmithKline.

Among the funds with a large weighting to the stock, Man GLG Income tops the list with a 6.5% position. Managed by FE fundinfo Alpha Manager Henry Dixon, GSK is the biggest holding in the £1.9bn fund, which also includes six other names on the top 10 list above: BP; Rio Tinto; HSBC; Barclays; Lloyds; and Shell.

Other funds with notable weightings of more than 5% to GSK include Jupiter UK Income (6.2%), CT UK Equity Alpha Income (5.9%), BNY Mellon UK Income (5.8%) and CT UK Equity Income (5.6%).

However, these figures were lower than others on the list, suggesting that, although most managers own the stock, they tend not to be as concentrated.

Managers appear to have more conviction in the second most popular stock among UK equity income funds: Shell. More than half of the sector own the oil behemoth in their top 10 holdings – 56.8% to be precise.

WS Canlife UK Equity Income and BNY Mellon UK Income have the largest positions here, with more than 9% allocated to the stock in both funds – around 3 percentage points higher than the top backers of GSK.

Schroder UK-Listed Equity Income Maximiser (8.5%), HSBC Income (8.3%) and JPM UK Equity Income (8.3%) also have significant weightings.

However, it is worth noting that Shell is a larger part of the FTSE All Share index, and therefore to go overweight the stock managers will need to take a chunkier position size.

In all except Schroder UK-Listed Equity Income Maximiser, Shell is the largest position in the fund. Instead, the Schroders fund lists AstraZeneca as its biggest holding, worth 9.5% of the portfolio.

AstraZeneca is third on the list of most-owned UK companies among IA UK Equity Income funds, with just under half (48.6%) of the sector including it in their top 10.

UBS UK Equity Income, CT Select UK Equity Income, WS Canlife UK Equity Income and CT Responsible UK Income are the others with the pharmaceutical giant featuring among their top five holdings, with position sizes ranging from 9.2% to 7.8%.

Following the same pattern, BP is in joint fourth place, with 45.9% of the sector owning the stock in their top 10 holdings. It means the top four are split between oil titans in second and fourth place, spliced with pharma companies in first and third.

Although a popular choice, funds that own BP in their top 10 are less concentrated in the stock, much in the same way as GSK. The portfolio with the biggest allocation to BP (UBS UK Equity Income) only has 6.3% in the company.

M&G Dividend and M&G Charifund have 5.7% and 5.5% respectively in BP, while JOHCM UK Equity Income and L&G UK Equity Income have put around 5.2% in the stock.

Rounding out the top five is consumer staple Unilever, which appears in an identical number of top 10 lists as BP.

Familiar names have significant exposure to Unilever, including Fidelity Moneybuilder Dividend (7.7%), CT UK Equity Alpha Income (6.9%) and CT UK Equity Income (6.2%), the latter of which have made an appearance in this article already.

Lazard Multicap UK Income and Schroder UK-Listed Equity Income Maximiser round out the top five backers of Unilever.

Lower down the table above, banking groups HSBC, Barclays and Lloyds are all well backed by IA UK Equity Income funds. The former is the most popular, with 40.5% of the sector taking a top-10 position in the group, while the figures drop to 28.3% and 24.3% for Barclays and Lloyds respectively.

Rio Tinto splits up the bank run, sitting in the seventh spot, with 31.1% of funds in the sector backing the world's second-largest mining company, while cigarette and vape company British American Tobacco rounds out the top 10, just pipping its rival Imperial Brands.