Emerging market equities have underperformed developed markets for most of the past decade – largely due to China’s economic malaise – until the country unveiled a colossal package of stimulus measures last month, lighting the fire under its stock market.

Whether or not investors participated in China’s meteoric rise (the MSCI China index rose 21.4% in sterling terms during September), the question going forward is whether emerging markets as a whole merit a larger place in investors’ portfolios, now that China seems to have put a floor under its bear market and its economy is on a surer footing.

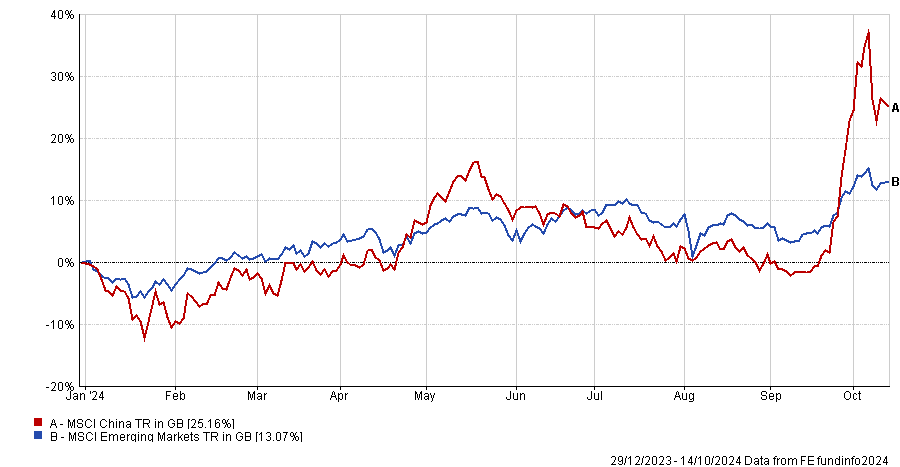

Performance of China and emerging market equities year-to-date

Source: FE Analytics, data to 14 Oct 2024 in sterling terms

Jian Shi Cortesi, investment director for Asian and Chinese equities at GAM Investments, said China’s leadership “sent clear signals to support the economy, the property market and the stock market, with a series of strong and coordinated measures including monetary easing, fiscal stimulus and loans to support corporate share repurchase”.

“The message was clear: the Chinese government is determined to support growth and lift the stock market.”

Below, fund managers articulate their views on China’s stimulus measures and explain whether they have adjusted their emerging markets exposures.

The emerging market bulls

James Klempster, deputy head of Liontrust Asset Management's multi-asset team, said Chinese equities are still cheap even after the recent gains and the country is “geared into a global upswing”. This is why Liontrust has given Asian and emerging markets a high score of four out of five.

Yet he is still on the fence regarding whether the new stimulus measures will bring about lasting change. “While market reactions have been positive to the Chinese stimulus, its success will depend on its ability to deliver a rebound in domestic demand and a turnaround in the struggling property sector,” he explained.

“A re-rating of the stock market could help stoke animal spirits and restore confidence in the economy. However, more fiscal and monetary support will be required for China to overcome its macroeconomic challenges.”

Nandini Ramakrishan, emerging market macro strategist at J.P. Morgan Asset Management, also has a favourable outlook. “Investing in emerging markets depends on several factors: strong domestic growth, a weaker dollar, and a US that is strong but not exceptionally so. Currently all of these factors are in play, with the added benefit of China’s policymakers creating a level of support for its economy,” she said.

China’s stimulus measures signify “a new chapter” for emerging market equities, she continued. “The shift in policymakers’ tone is evident. Fiscal spend, especially programs targeted at boosting household confidence and employment, could boost consumption significantly. Bank recapitalisation could also greatly improve the financial sector.”

Closing out underweights

Aviva Investors’ multi-asset team has also grown more positive on emerging markets, although it is coming from a low base. The team has closed out its tactical underweight to the region now China has taken steps towards overcoming its economic challenges.

Portfolio manager Baylee Wakefield is keeping a watching brief on whether China’s measures address the country’s core issues and what further fiscal stimulus comes through.

“I think to have more material conviction, we would need to see fiscal easing, supply side reform and policies to stabilise property prices,” she explained.

Bank Syz has also moved to neutral from underweight emerging markets. Adrien Pichoud, chief economist and senior portfolio manager, is taking a cautious stance.

“This package of measures has been announced because economic growth and market dynamics were worryingly deteriorating. They are emergency policy adjustments designed to avoid a further deterioration, or even a full-blown economic crisis. They are not intended to engineer a sustainably higher level of economic growth going forward,” he argued.

Emerging markets beyond China

Ramakrishan is also positive on emerging markets outside of China. GDP growth is strong, many economies have controlled post-pandemic inflation, and the US Federal Reserve’s rate cuts should lead to a weaker dollar and stronger emerging market currencies, she said.

Beyond China, corporate earnings are being driven by several growth engines such as “a strong macro upswing in India and the global tech cycle, which directly supports earnings in Korea and Taiwan, as well as long-term consumption and financialization in the Middle East, Latin America and ASEAN regions”, she said.

“It’s also worth noting that the emerging market index is now more diverse with a greater weighting to technology and India, both of which benefit from structural macro tailwinds for long-term investors.”

Pictet Asset Management has just upgraded its emerging markets allocation to overweight from neutral but prefers other countries to China. Chief strategist Luca Paolini said emerging market equities are cheap and have strong earnings momentum, while emerging economies are growing faster than developed markets.

China, however, requires structural change to fix its “deep” problems, “rather than the short-term fixes being offered,” Paolini said. “Going into the home stretch of the US election cycle we are avoiding adding exposure to assets most directly impacted by increased tariffs and trade uncertainty.”