Global equity income funds have proven their defensive credentials so far this year and 12 have sheltered investors from all the US equity market’s losses.

Funds in the IA Global Equity Income sector have fallen by an average of 2.6% this year through to 25 April 2025 – less than half the IA Global sector’s 7% losses. The MSCI All Country World Index and the MSCI World have fallen 7.3% and 7.7%, respectively, in sterling terms.

Yet 12 global equity income funds have protected their investors’ capital and delivered positive returns. Some have just scraped into absolute return territory while others, such as Artemis Global Income and Veritas Global Equity Income, have produced strong results. Bearing in mind that the year is only one-third of the way through, their 7.1% and 6.4% respective total returns put investors in good stead.

Fidelity International had the most funds in positive territory; Fidelity Global Dividend, Fidelity Global Enhanced Income and Fidelity Responsible Global Equity Income all protected investors from the stock market’s ravages.

Income funds have held up well for a variety of reasons: many of them are underweight the US, where dividends payouts tend to be lower than the UK and Europe; and companies that can afford to pay dividends often have stronger balance sheets, giving them the firepower to endure economic storms.

Yet even the best global equity income funds were not left unscathed by the stock market’s reaction to Donald Trump’s tariffs and erratic policy-making.

Between the MSCI World’s peak on 23 January and 22 April – ahead of the rally beginning last Wednesday – every single fund in the IA Global Equity Income sector made a loss.

Just three funds lost less than 2% in that period: Fidelity Global Dividend, Veritas Global Equity Income and First Trust Global Equity Income UCITS ETF.

Although losing any money at all is hard for investors to bear, their results were a lot more palatable than the wider sector and the most popular benchmarks. The average peer lost 9.5%, the MSCI ACWI plummeted 15.5% and the MSCI World dropped 16.3% in sterling terms between 23 January and 22 April, according to FE Analytics.

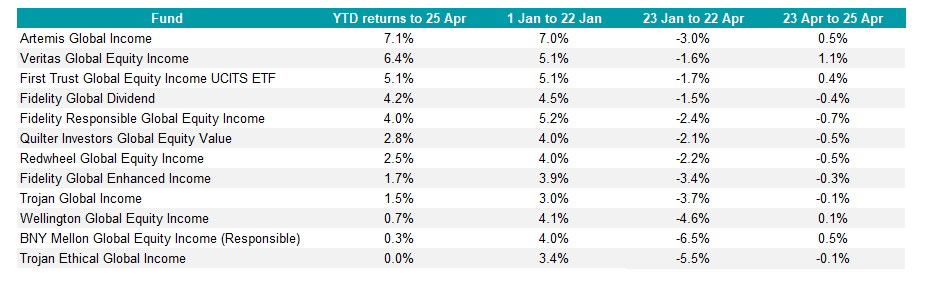

Funds that experienced relatively shallow troughs during this year’s bear market had less ground to make up in the past week or so – and gave back less of their gains from early January’s animal spirits. Overall, that was enough to push 12 funds’ year-to-date total returns into positive territory, as the table below shows.

Global equity income funds with positive YTD returns

Source: FE Analytics, data to 25 April 2025, total returns in sterling terms

Artemis Global Income is at the top of its sector following a strong start to this year. It gained 7% in January prior to the broader market’s dip, then gave less than half of that back when its benchmark plummeted.

The £2bn fund is also the best performer in the IA Global Equity Income sector over one, three and five years to 25 April 2025. It had 33% in Europe ex-UK as of 31 March and just 26% in North America.

Jacob de Tusch-Lec, who has managed the fund since inception in 2010 and was joined by James Davidson in 2020, said: “US equities are expensive by historic standards; the rest of the world is not. We cut back our US exposure long before the Liberation Day nonsense because it was just so expensive. We were further encouraged by the fact that few of the Magnificent Seven are proper dividend payers.

“I’m not tempted to build US exposure back up yet on any dips. It’s not just that US equities still look expensive; it’s also the dollar. Trump has given investors much more incentive to rebalance their portfolios away from the US, away from tech and away from the dollar.”

The fund’s top five holdings are Rheinmetall, Mitsubishi Heavy, Hanwha, BAE Systems and General Motors, and its current yield in sterling is 3.5%.

Davidson and de Tusch-Lec invested in European defence stocks ahead of the rally and they are currently overweight financials, anticipating that a high-for-longer interest rate environment will continue to boost profit margins.

“Our fund holds things that are still cheap and ‘under-owned’ – the portfolio is nearly half the market’s price-to-earnings multiple. Hopefully, these stocks will benefit further from a turn in the tide of fund flows and sentiment,” de Tusch-Lec said.

The peer group’s second-best fund for 2025, Veritas Global Equity Income, is betting big on Europe with a 47% allocation to the continent, as well as 18% in the UK, as of 31 March. The £234m fund has a mere 22% in North America.

Its largest sector exposures are industrials (26%) and consumer staples (22%). Top holdings include Unilever, medical technology provider Medtronic and Diageo.

Managed by FE fundinfo Alpha Manager Andrew Headley, Ian Clark and Mike Moore, it is a top-quartile performer over one, three and five years.

First Trust Global Equity Income UCITS ETF is the only passive fund to make our list. It tracks the Nasdaq Global High Equity Income index, which selects companies from the Nasdaq Global index using criteria such as liquidity, dividend yield and the ability to increase dividend payouts. The $32m fund has a 4.06% yield, distributed quarterly.

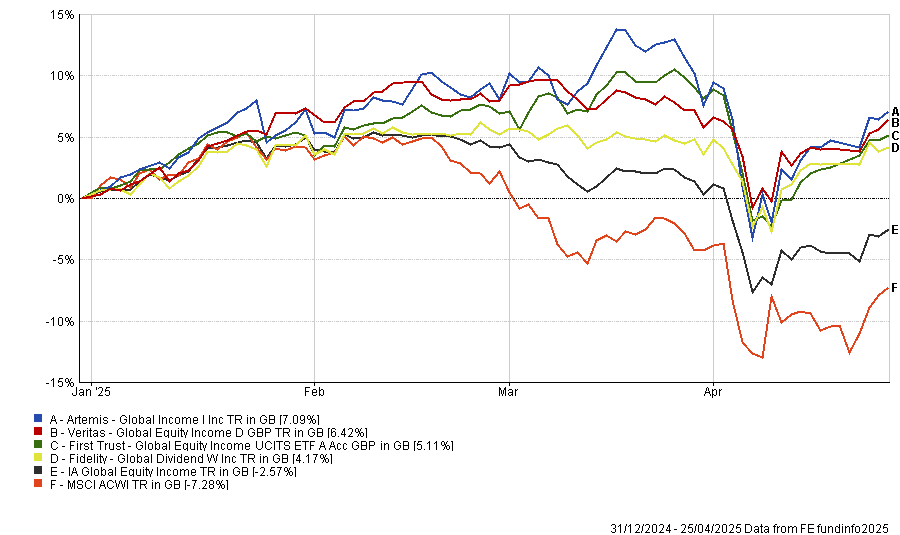

Performance of funds vs sector and MSCI AWI ytd

Source: FE Analytics, data to 25 April 2025

Of the 12 funds in positive territory, Fidelity Global Dividend lost the least between 23 January and 22 April, giving up a mere 1.5%. Managed by Daniel Roberts, it is the second-best fund in its sector over one year, judging by total returns in sterling, and the seventh-best over three years.

The fund has 37% in the euro zone, 16% in the UK and 27% in the US. It has a 2.38% historic yield, distributed annually, with the next payment due on 30 April.

The £3.4bn fund features on Hargreaves Lansdown’s Wealth Shortlist, as do Artemis Global Income and Trojan Global Income.

Analysts at the investment platform said: “Roberts has one of the strongest stock-picking records in the global equity income sector. We like his sensible investment approach and that he doesn’t overlook unfashionable areas. He won't compromise on quality and is mindful of valuation.

“He's a reasonably conservative investor and places more importance on sheltering investors' capital than growing it. While he's usually not quite kept up when markets have risen, he's held up much better when they've fallen.”