With just two months to go until the end of 2024, this year looks set to be another disappointing one for anyone invested in UK equities.

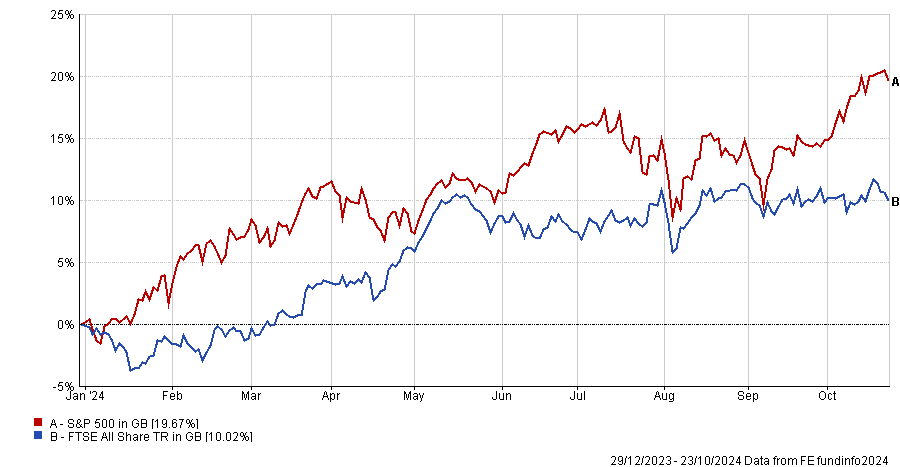

Despite optimism that domestic stocks could finally be in line for a rebound, this has failed to materialise. Although the FTSE All Share index is up 10% year to date, this is a below-par return compared with markets such as the US, where the S&P 500 is up 20.6%.

When pitted against European, emerging market, Japanese, US and global indices, the FTSE All Share is the second worst over 12 months and third worst year-to-date.

But this is not just a new phenomenon. Over 10 years, the UK’s main index is the second worst among this list with a gain of 89%, beating on the MSCI Emerging Markets index and almost four times less than S&P 500.

For this reason, Anna Farmbrough, co-manager of the Ninety One UK Equity Income and UK Alpha funds, said “we can understand why clients have given up” on investing in domestic stocks.

Performance of indices year-to-date

Source: FE Analytics

However, there are always opportunities to be found, according to co-manager Ben Needham, who said the depth and scale of the UK’s underperformance for much of the past decade has left myriad underappreciated stocks waiting for someone to take a chance on them. Below the managers outline their three favourites.

JD Wetherspoons

Firstly, the managers identified JD Wetherspoons as one of their favourite stocks, despite a decline in share price of 14% YTD. It is one of the managers’ core holdings, occupying the 10th position in the portfolio.

Needham said one of the reasons it is attractive is because of its price advantage compared to other hospitality businesses. Rather than competing with other hospitality venues, Wetherspoons now sees supermarkets as its main competitor in terms of price. Consequently, Wetherspoons has developed a significant price advantage over other pubs on the market.

Farmbrough added: "We think this is very realistic because people have gone from drinking outdoors to drinking at home, so their direct competition has changed". This makes it a very “safe” bet in difficult economic circumstances.

Share price of Wetherspoons YTD

Source: Google Finance

Moreover, Farmbrough credited the company for its longer-term emphasis on reinvestment, primarily through how it treats employees. For example, the firm pays its employees better than almost all of its competitors, leading to much higher tenures. Indeed, an internal report from the firm last year stated that it had paid out £520m in free shares and bonuses between 2006 and 2023.

Farmbrough noted, if it stopped paying its employees bonuses and paid them in line with other pubs, “profits would increase by 50% overnight” indicating how much the firm puts into its workforce.

AJ Bell

Another favourite for the Ninety One team is the leading savings and investment platform AJ Bell. While they noted that the platform is hardly underappreciated, with shares up 56% YTD, Needham and Farmbrough felt its true long-term potential has yet to be fully recognised.

Share price of AJ Bell YTD

Source: Google Finance

The biggest advantage of the firm is its value proposition and ability to cater to both traditional consumers and financial advisors, giving it a broad customer base. “It looks after the customer as an asset manager, which no one ever talks about,” Needham said.

Moreover, the team described it as a great example of a capital-light UK stock – or one that was poised for sustained long-term growth with very limited investment needed. This allows it to provide consistent income while also allowing capital to appreciate over time.

With earnings per share growing at more than 20% per annum but still trading at a price-to-earnings ratio of 23.7x, Farmbrough and Needham described it as one of the “bedrocks of our portfolio”.

Wise

Finally, the team identified cross-border payment company Wise as another underappreciated industry leader. It has had a challenging year, with share price down 11% in 2024 so far, with particularly large slides downwards in April and June. Despite these outflows, Farmbrough and Needham felt the stock had significant potential to disrupt the cross-border payment market.

Share price of Wise PLC YTD

Source: Google Finance

Traditionally, cross-border payments are made through a ‘correspondent banking model' in which to transfer money internationally it passes through multiple different banks, each of which takes a “cut of the pot”.

By contrast, Wise allow investors to transfer money more cheaply and quickly than many competitors because it has direct links with local banks.

Moreover, the firm has been expanding its services with new products such as the Wise platform API, which lets customers do cross-border transfers as if they were traditional banking customers.

Needham said: “So that disrupts by saying ‘we are going to have a cheaper fee than you because we are not using this correspondent banking model’. But don't worry, you can plug yourself into its infrastructure, and it will solve this problem for you at the same time, which we think is genius. The value proposition is phenomenal for the customer and we wish more customers had heard about it."