Lindsell Train UK Equity, Liontrust UK Growth and Special Situations and Fidelity UK Select are among the top strategies going through a rough patch at present, according to data from FE Analytics.

In this new series, we are covering the long-term outperformers (measured by being in the top quartile of their sector over 10 years) that have slipped over the past year to the bottom quartile and, vice versa, the decade-long laggards that have turned a corner.

This is not to say some funds have become bad, while others are now good. It is a reminder, however, that not every environment is beneficial to every strategy and that investors should review their portfolios regularly to make sure their funds are still performing as intended.

In the IA UK All Companies sector, there were many more top funds struggling than laggards shooting up the rankings.

The most recognisable name was veteran manager Nick Train’s WS Lindsell Train UK Equity, which went from having £6bn of assets under management (AUM) three years ago to the current £2.6bn.

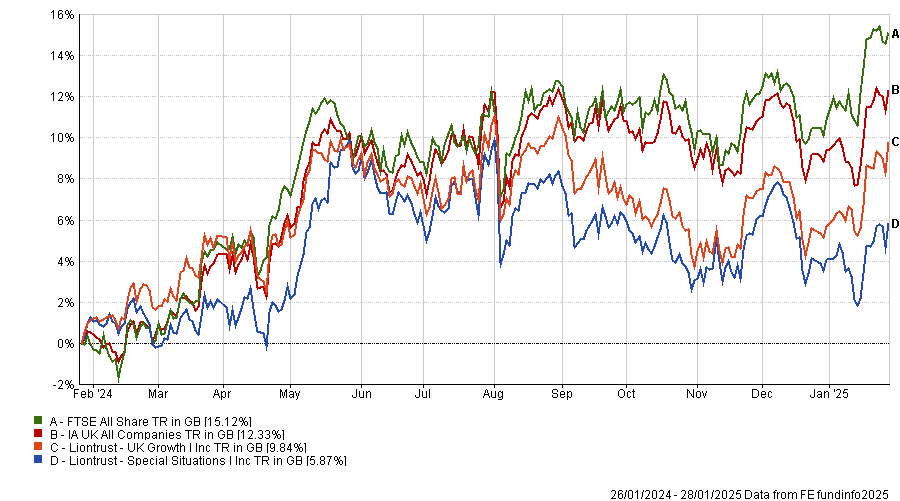

Performance of fund against sector and index over 1yr

Source: FE Analytics

Square Mile analysts David Holder and John Managhan weren’t worried, as the fund “has successfully and consistently met its long-term performance objective” and should be able to continue to outperform the FTSE All Share index by 2% per annum over at least five years.

“Nonetheless, we would stress that this strategy is probably best suited to investors that have little interest in the month-to-month and year-to-year performance of their investments, but instead seek attractive returns over very long time periods,” they said.

Fund pickers continued to back the strategy too, saying in May that Lindsell Train is one to hold or increase exposure to. Instead this was one of the most-sold funds of 2024, as Trustnet recently reported.

Another veteran manager also took a tumbling fall. Mark Slater made the list with Slater Recovery and the smaller Slater Artorius (£19.2m AUM) fund. Both have top-decile returns over 10 years but wobbled over five and precipitated to the bottom decile over one and three years.

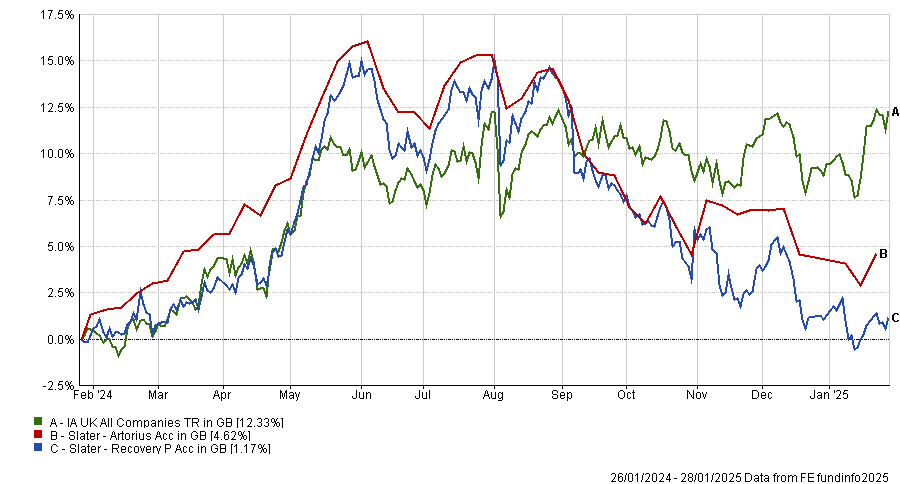

Performance of funds against sector over 1yr

Source: FE Analytics

The assets under management of the recovery portfolio peaked in July 2022 at £530m and are now down to £165.9m.

The more popular Slater Growth was spared from this study, but has struggled since February 2022, when it was managing over £1.6bn of investors’ money. Now, that’s just £590m.

Liontrust’s economic advantage team, led by FE fundinfo Alpha Manager Anthony Cross, also appeared in this study with two strategies, Liontrust Special Situations and Liontrust UK Growth.

After a first-decile performance over 10 years, the Special Situations portfolio failed to emerge above the third quartile over the one, three and five years and fell to the fourth quartile over 12 months.

Performance of funds against sector and index over 1yr

Source: FE Analytics

The team looks for companies with a unique competitive edge that they can capitalise on to produce consistently attractive returns.

Square Mile’s Managhan believes the fund has “a number of compelling attributes” and should be able to meet its objective to outperform the FTSE All Share index by 3% per annum over rolling five-year periods.

Again, the analyst focused on the long-term success of the strategy rather than the shortcomings of more recent times. He said: “Pleasingly for longer-term unit holders, the fund’s performance deviation from indices has been positive, with impressive success in meeting its long-term performance objective.”

The fund that fell the furthest is IFSL Evenlode Income. A bottom-quartile one-year return of 3.5% has not diminished its longer track record, however, as its 118.5% gain over the past decade is the top 10-year performance of all the funds in this research.

Square Mile analysts stressed that patience is required with this strategy, and while the underlying holdings should be better insulated from a sharp market downturn, theoretically the fund is “unlikely to outperform in a strongly rising market”, particularly when cyclicals are leading the way.

“Investors should therefore consider this fund, which could be seen as a core holding within a diversified portfolio, with a medium-to-long-term investment horizon,” they said.

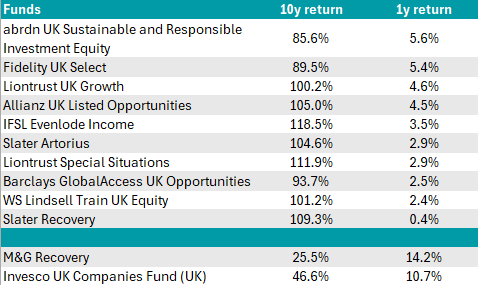

Source: Trustnet

At the other end of the scale, the two strategies that rose to the top over 12 months but remained laggards in the long run were M&G Recovery and Invesco UK Companies.

The former has been managed by Michael Stiasny since 2020, who took charge from veteran stockpicker Tom Dobell. Its recovery hasn’t gone unnoticed and the fund has featured on a Trustnet buy-hold-or-fold feature in October of last year, but it was still early days for many fund selectors, who weren’t yet convinced it could live up to its name.

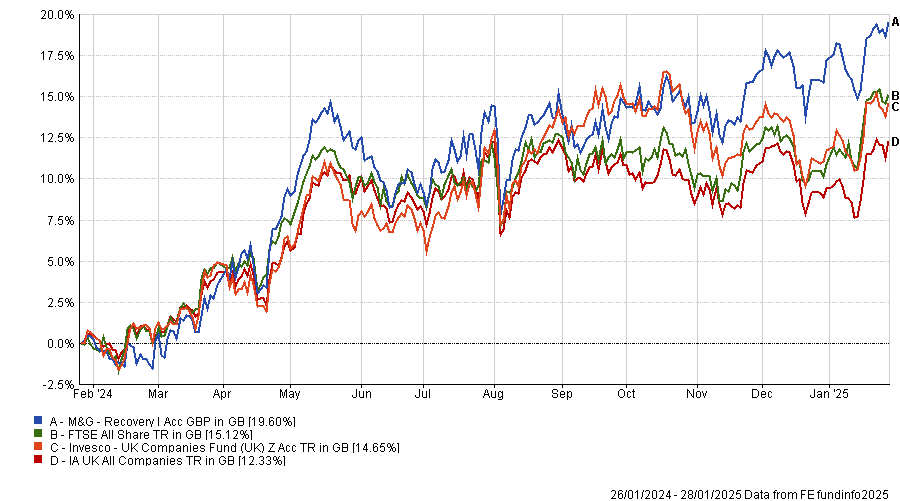

Performance of funds against sector and index over 1yr

Source: FE Analytics

As for the Invesco fund, Martin Walker took up its leadership in October 2024. Prior to that, the fund was known as Invesco Sustainable UK Companies and was managed by Tim Marshall, who has now left the firm.