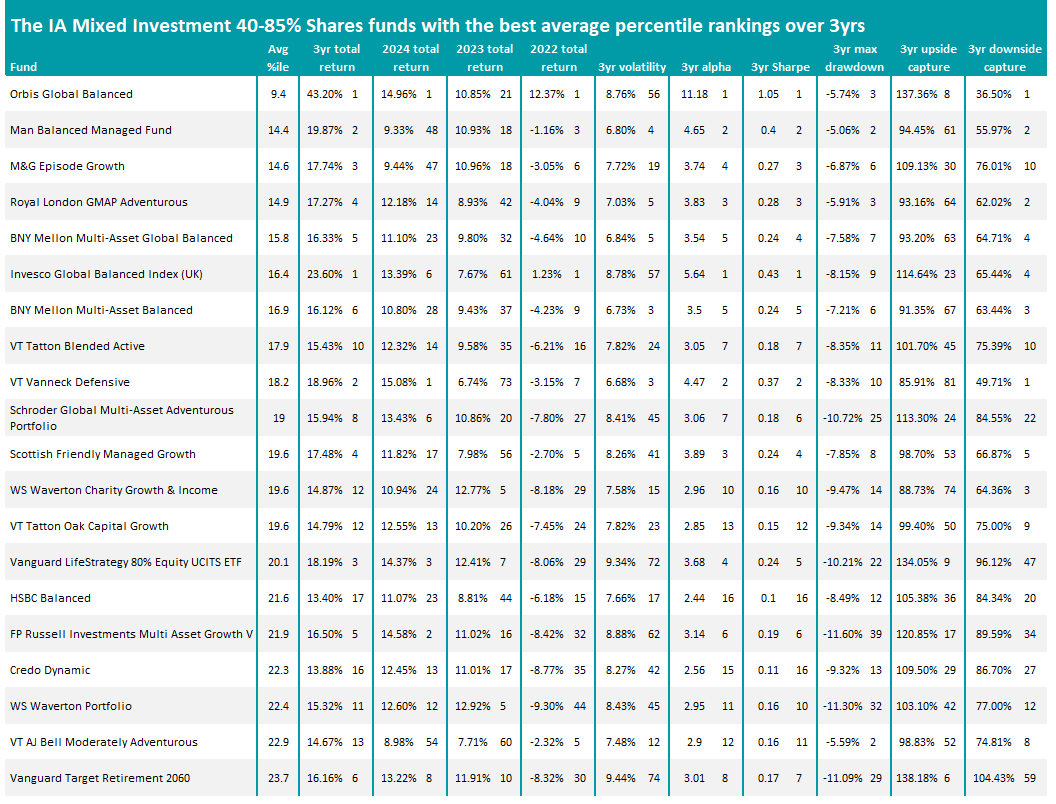

Balanced multi-asset funds run by Orbis, Man Group and M&G are leading the IA Mixed Investment 40-85% Shares sector on a wide range of risk and return metrics, research by Trustnet shows.

This annual research scores funds on 10 key metrics: cumulative three-year returns to the end of 2024 as well as the individual returns of 2022, 2023 and 2024 (to ensure performance isn’t down to one standout year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown and upside and downside capture, relative to the sector average.

We then worked out each fund’s average percentile ranking across the 10 metrics to discover which were consistently at the top for the sector for a host of metrics. Essentially, the lower a fund’s average percentile score, the stronger it has been over the past three years.

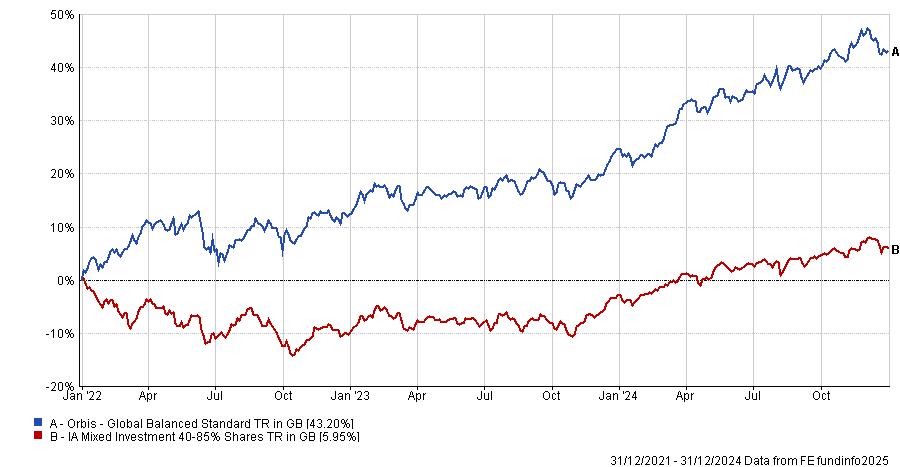

Performance of Orbis Global Balanced vs sector over 3yrs to end of 2024

Source: FE Analytics

This article focuses on the IA Mixed Investment 40-85% Shares sector and the chart above shows the performance of the best fund in this research: Orbis Global Balanced.

Over the three years to the end of 2024, the £537m fund has made a 43.2% total return, putting it in the top percentile of the sector; it’s also in the top percentile for returns in 2022 and 2024, alpha generation, Sharpe ratio and downside capture.

Manager Alec Cutler and his team follow the wider process used across Orbis: a contrarian and long-term approach, seeking out intrinsic value in the market. This results in a very active portfolio, with the team willing to take big bets against the market.

Among its top holdings at present are the iShares Physical Gold ETC, US inflation-linked government bonds and equities such as US energy infrastructure company Kinder Morgan, German energy corporation Siemens Energy, Taiwan Semiconductor Manufacturing and computer game giant Nintendo.

Analysts at FundCalibre said: “Cutler and team have shown they have the ability to build a bottom-up portfolio of holdings that can perform across a variety of market conditions, adding value through equities and fixed income and asset allocation.

“The fund also has a contrarian approach, which has been demonstrated on numerous occasions in the past, often to the benefit of investors.”

FundCalibre’s analysts also like Orbis’ fee structure, which does not levy an annual management fee. Instead, investors pay a performance fee when Orbis Global Balanced outperforms but are refunded if it underperforms.

Source: FE Analytics

In second place is Adam Singleton and Henry Neville’s £284m Man Balanced Managed fund, with an average percentile ranking of 14.4. Its three-year return of 19.9% is far below Orbis Global Balanced’s but still high enough to put it in the sector’s second percentile; the fund also performed strongly for volatility, alpha, Sharpe ratio, maximum drawdown and downside capture.

The portfolio is largely built from other funds run by Man Group, with Singleton and Neville blending their top-down market perspectives with the security selection skills of the underlying managers.

Top holdings include Henry Dixon’s Man Income, Man Dynamic Allocation (run by Singleton and Neville), Dixon’s Man Undervalued Assets, Michael Scott’s Man High Yield Opportunities and team-managed Man Japan Core Alpha funds.

Craig Moran, Craig Simpson, Tony Finding and Alex Houlding’s £889m M&G Episode Growth fund came in third place with an average percentile ranking of 14.9 thanks to strong three-year returns, alpha, Sharpe ratio and maximum drawdown.

The process behind the fund looks for opportunities where asset prices have moved away from ‘fair’ value because of an emotional overreaction by investors. The fund then invests where prices are expected to move back towards their normal longer-term valuations.

You have to look further down to find the biggest members of the IA Mixed Investment 40-85% Shares sector, however.

The £13.5bn Vanguard LifeStrategy 80% Equity fund is ranked 35th out of 196 funds, with an average percentile ranking of 27.4. The fund’s 15.4% three-year return is enough to be in the sector’s first decile, but it was pulled down the rankings by its higher-than-average volatility and downside capture.

The 47.4 average percentile ranking of the Vanguard LifeStrategy 60% Equity stablemate puts the fund in 92nd place. The £16.3bn fund – the largest member of the sector – was held back by its returns in 2022, volatility, maximum drawdown and downside capture.

The £5bn Baillie Gifford Managed fund is ranked 177th out of 196 funds in the sector, owing to an average percentile of 78.1. The 8.8% loss over three years is the second worst in the IA Mixed Investment 40-85% Shares sector while it is in the 100th percentile for volatility, alpha, Sharpe ratio, maximum drawdown and downside capture; it is, however, in the first percentile for upside capture.

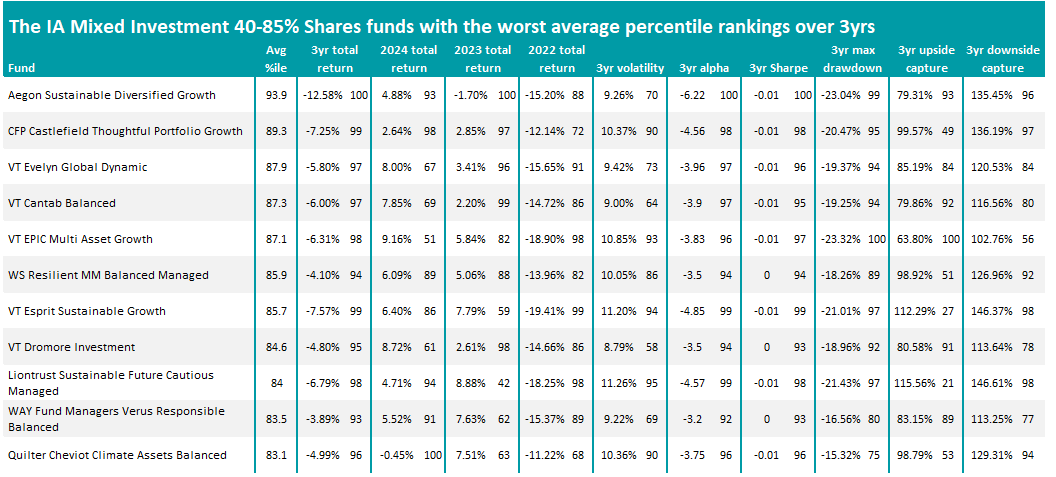

Source: FE Analytics

The worst result in this research came from Aegon Sustainable Diversified Growth, where a 12.6% loss over the three years to the end of 2024 is the lowest return of the peer group.

It isn’t the only balanced fund with a sustainable tilt to find itself at the bottom of the rankings in this research, after rising interest rates hit their underlying assets hard.

CFP Castlefield Thoughtful Portfolio Growth, VT Esprit Sustainable Growth, Liontrust Sustainable Future Cautious Managed, Verus Responsible Balanced and Quilter Cheviot Climate Assets Balanced are the bottom 10, with others sitting just outside it.