Law Debenture may be one of the Association of Investment Companies’ Dividend Heroes but income is not the managers’ top priority. Instead, FE fundinfo Alpha Manager James Henderson and Laura Foll focus on growing the overall pot, first and foremost.

They have the luxury of investing for capital growth because alongside its equity portfolio, Law Debenture houses a professional services firm. Worth 20% of the trust’s assets, it contributes more than one-third of the income, providing a cushion.

Henderson said: “My view is that income funds should always focus on growing the capital first. If you grow the capital and have a bigger pot of money, it's much easier to produce sustainable income growth. If you try too hard on the income and you bleed the capital to produce the income, you [hit] a brick wall.”

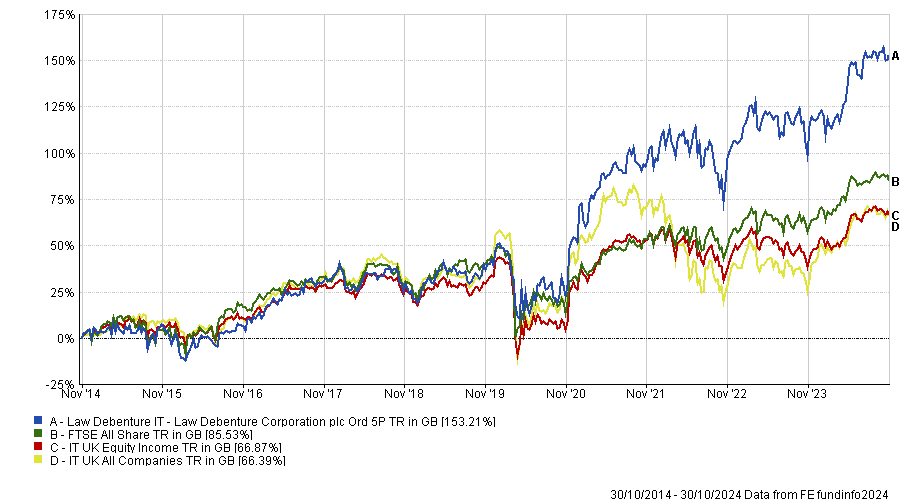

This approach has paid off. Law Debenture is the best performing investment trust in the IT UK Equity Income sector over both five and 10 years. Not only that, but it has pulled ahead of every single trust in the IT UK All Companies sector and beaten the FTSE 100 and FTSE All Share indices over five and 10 years as well.

Performance of trust over 10yrs vs UK sector averages and FTSE All Share

Source: FE Analytics

It has also increased its dividend for 14 consecutive years, with a five-year annualised dividend growth rate of 11.1% as of 12 March 2024. The trust’s dividend yield was 3.7% as of 30 September 2024.

Below, Henderson told Trustnet why he is increasing his exposure to AIM-listed shares and which stocks have been his best performers.

Please describe your investment process

We use a contrarian approach to investing by focusing on value, but always with the belief that things are not just cheap, they are going to grow. Growth is what helps you avoid value traps.

How does having a professional services firm within the trust impact your investment approach?

Law Debenture’s professional services firm amounts to 20% of the trust’s assets but contributes 35% of the income. This allows us to have a lower-yielding portfolio than most income funds and a bigger universe of stocks we can look at.

In 2020, when a lot of companies were cutting or stopping their dividend because of the pandemic, half the income from the quoted sector disappeared. The professional services business contributed 65% of the trust’s overall income that year.

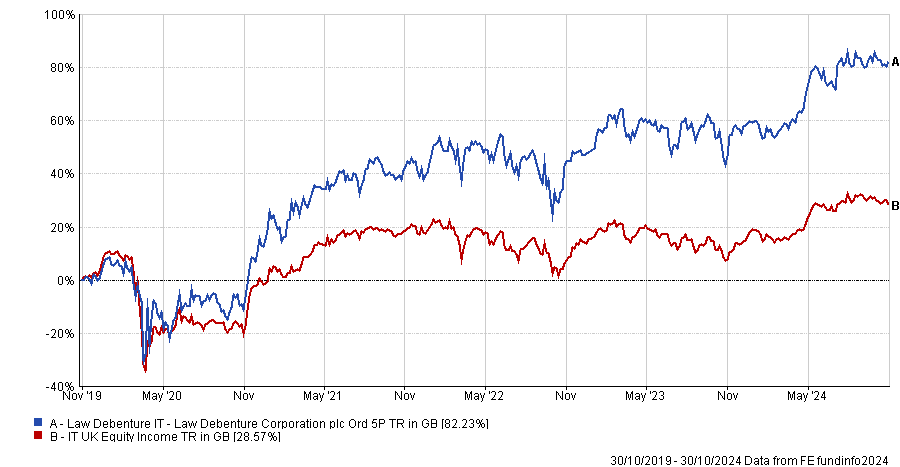

The board made a bold decision that year to put £70m into the UK equity market. I had the freedom to buy zero-yielding shares that had sold off without worrying about the income, which was the main reason for the trust’s strong five-year track record. We were able to hold companies such as Ceres Power Holdings and Rolls-Royce, which have been our biggest contributors over five years.

Performance of trust vs sector over 5yrs

Source: FE Analytics

What changes have you made recently?

We are increasing our AIM weighting, which is at 7% and I wouldn't go beyond 10%. We own small- and mid-cap stocks too but the real valuation anomaly is on AIM, because people have been so nervous about tax changes.

Before the Budget, people were saying that scrapping inheritance tax (IHT) relief on AIM stocks would see them fall as much as 30%. The market went up straight after the Budget, which tells you the doom had been priced in.

Some investors have concerns about the liquidity of AIM stocks but we can buy less liquid things and that's a real privilege we need to use. It's what you do differently that makes you perform differently.

We’ve been buying some alternative energy stocks. You wouldn't normally see them in an income fund because they're not going to pay dividends for another 10 years, but they should help grow the trust’s overall pot, which produces the income.

I’ve also been buying investment trusts that have fallen to very large discounts including Grit, which invests in African properties, and VH Global Sustainable Energy Opportunities.

What have been your best and worst performers recently?

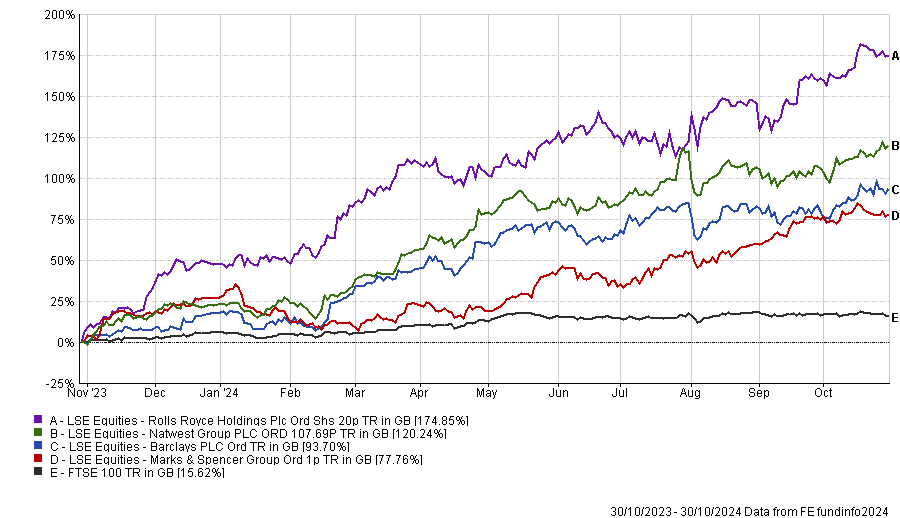

In the past year, the biggest contributor by quite a considerable amount is Rolls-Royce and, after that, Marks & Spencer. NatWest and Barclays are up there.

Performance of shares vs FTSE 100 over 1yr

Source: FE Analytics

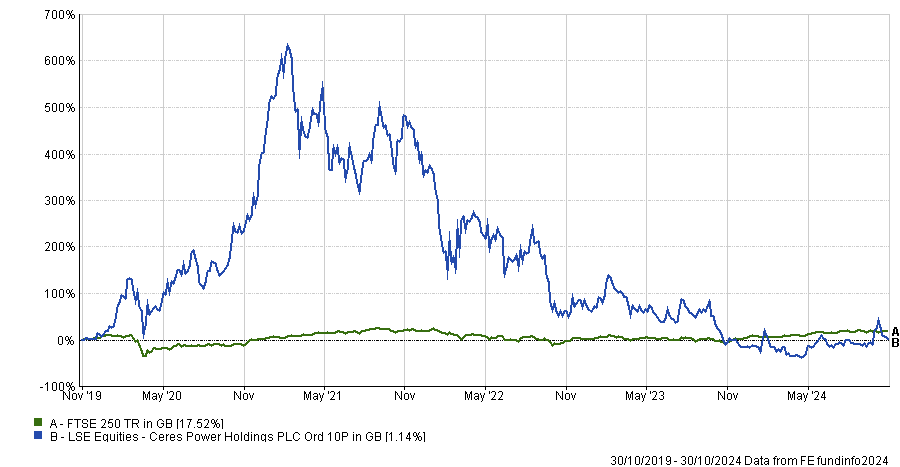

Ceres has been dreadful this year, but on a five-year view it has been a top contributor. I sold quite a lot of the holding in 2022 and 2023 and I've been buying it back recently.

Ceres Power vs FTSE 250 over 5yrs

Source: FE Analytics

With Ceres, the market got over-excited about how quickly hydrogen would replace more traditional fuels in fuel cells and people thought hydrogen might even go straight into cars. When things didn't happen as quickly as people had hoped, disappointment set in.

Something out of left field that hurt us was Morgan Advanced Materials, which had a cyber-attack. Everyone came to work one morning to see a pirate flag on their screens and, shortly after that, they couldn’t see where any of their stock was or what they'd sold. That caused a lot of disruption, which led to share price weakness.

What do you enjoy doing outside of investing?

I train racehorses. I used to ride in jump races, but I now just ride my horses at home.