Oil prices slumped last week as investors worried about US tariffs, a large build-up in US crude stock and an increased oil output announced by OPEC+ countries. Brent crude futures fell to $69.30 a barrel – their lowest price since December 2021 – to then recover somewhat towards the end of the week.

Some experts say a gradual falling back in price is natural, as major oil companies and governments row back on clean and green energy and focus more on new supply. However, for Nick Kirrage, manager of the Schroder Income fund, oil has reached its “long-term neutral, normalised price” at $80 per barrel. He argued it will not strain too far from this figure despite some volatility along the way.

The price of $80 is “neither expensive nor cheap” and is supported by the necessity of oil products even within the energy transition and within an environment, sustainability and governance (ESG) framework. Oil was demonised at the peak of the ESG conversation but investors were extrapolating this to mean its demise – which is something Kirrage tries to exploit in his fund, as he recently told Trustnet.

“As a value investor, the transition argument is inescapable and over the medium to long term the shift is going to happen. But, humans being humans, they extrapolate. So we went from a period of extraordinarily benign thinking about climate change to one in which it became white heat and oil and gas businesses fell off a cliff,” he said.

“During Covid prices were negative and recovered massively since. The easier money has now been made from energy investments and the argument is much more balanced. We know we will need oil and gas businesses to transition, although there is a question as to whether or not they are needed in 50 years.”

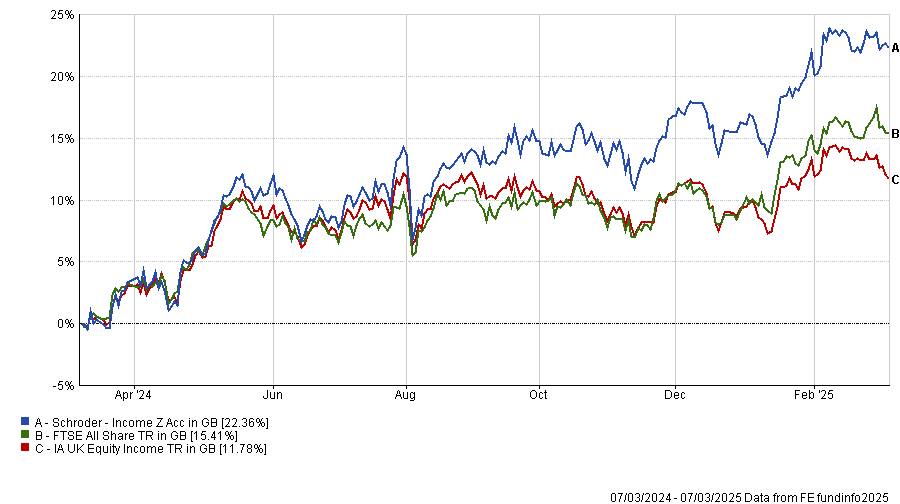

Performance of fund against index and sector over 1yr

Source: FE Analytics

The price of $80 is also reasonable for Jonathan Waghorn, manager of the Guinness Global Energy fund and the Guinness Sustainable Energy fund.

“OPEC+ countries have committed multiple times to deliver a reasonable oil price to satisfy their economies but also to incentivise investment in long-term projects. Their actions have been designed to achieve an oil price that, to some extent, closes their fiscal deficit while not spiking the oil price too high and over-stimulating supply,” he said.

“As ever, spot oil prices over the next 12 months will be volatile and with a good amount of third-party supply next year it is plausible that the price per barrel remains below $80 for a period. However, we maintain our long-term oil price average of $80, being a price that incentivises sufficient oil supply and demand over the next few years, whilst being good enough for OPEC+ balance sheets.”

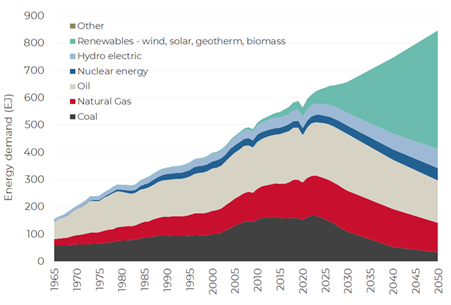

As for the shelf life of oil companies, Waghorn expects demand to peak around 2030 and fall gently thereafter, maintaining over 90 million barrels per day by 2040.

Natural gas demand will likely extend beyond oil, peaking around 2040, while coal will fall over 75% by 2050, as illustrated in the chart below. This means “oil and natural gas businesses will be a part of the energy transition and have long futures ahead of them”.

The two strategies run by the manager are a pureplay oil and gas portfolio and a pureplay sustainable energy strategy and are essentially fully invested in both all of the time.

Globally primary energy demand between 1965 and 2050

Source: Guinness, BP Statistical Review of World Energy

Kirrage invests in Shell (3%), Eni (2.4%) and BP (2.1%), but has been “gently selling down over time”, as these businesses have been “an important part of the UK for a very long period of time”.

He has remained invested in Eni in spite of a disappointing performance over the past year – it was the bottom-third contributor after Rolls Royce and Intel, losing the portfolio 0.65 percentage points in the 12 months to 31 December 2024.

“We like these businesses, particularly for their fundamental income and because they are pretty conservatively financed. But at the moment, it's a high single-digit percentage of our fund, rather than anything more,” the manager said.

Douglas Scott, co-manager of the top FE fundinfo Crown-rated Aegon Global Equity Income, is underweight the oil sector because of secular trends favouring other areas, such as technology.

As technology companies are maturing, many pay an income and the Aegon fund invests in Microsoft (6.9% of the portfolio), Alphabet (2.8%) – which paid its first dividend in April last year – and Meta (1.9%). The exposure in the energy sector is limited to TotalEnergies (2.1%), as it has a better yield than the US oil majors and therefore still plays an important role in the income requirements of the fund.

“We maintain an overweight to the areas where we have a fundamental belief in their growth, where we can add value through our stock analysis and portfolio construction,” the manager said.

“That means that we have to be underweight somewhere and the oil sector is one of those where we are less certain about the future, although I’m not sure that trying to pinpoint ‘peak oil’ is somewhere we add our best value”.