Headlines about ISA millionaires usually conjure up images of affluent middle-aged people, perhaps on the cusp of retiring after saving diligently throughout their careers. Junior ISAs, however, have made it possible for much younger people to amass significant wealth and to do so with a far smaller annual outlay.

Lucy Coutts, investment director at JM Finn, said: “The most important word in investment is time. A Junior ISA is the perfect vehicle to benefit from the effect of compounding which, in simple terms, is interest on interest over time. And the longer the time horizon, the greater the impact of compounding.”

If parents and grandparents club together to put the maximum of £9,000 into a child’s JISA every year until he or she turns 18, and the JISA is invested in a multi-asset portfolio with an average annual growth rate of 7.1%, it could be worth more than £300,000 by the time its recipient reaches adulthood, Coutts calculated.

While this may sound like a high amount, some 70,550 JISA accounts were topped up by the maximum in the tax year 2022-2023, according to HMRC data obtained by RBC Brewin Dolphin, a 45% increase on the previous year.

If the young adult chooses to keep their JISA invested and continues to contribute £9,000 a year (rather than the £20,000 maximum for an ISA), their savings would be worth just over £900,000 on their 30th birthday. They would arrive at the magical £1m figure by the tender age of 31.

In practice, a JISA’s performance would vary according to how financial markets perform and how it is invested. The 7.1% figure is the average annual return between 1995 and 2024 for a portfolio with 60% in the iShares Core MSCI World UCITS ETF (in dollars) and 40% in Xtrackers Global Sovereign UCITS ETF (with the currency hedged back to euros).

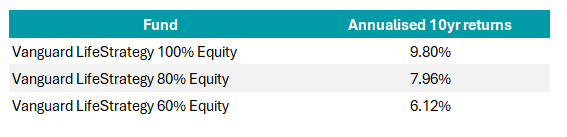

Savers could boost their returns by increasing their exposure to equities, as the table below reveals, using Vanguard’s sterling-denominated LifeStrategy funds with different equity allocations as examples.

Annualised returns for Vanguard LifeStrategy funds

Source: FE Analytics

However, the strong performance of global stock markets during the past few decades does not necessarily mean equities will repeat those results going forward. Capital Group expects global equity markets to return an annual average of 6.3% over the next 20 years. The firm lowered its forecasts recently due to high valuations, increasing market concentration and the bull market of the past two years, during which price appreciation has outstripped earnings growth.

Nonetheless, JM Finn advocates a high equity allocation for JISAs. The default option for its clients’ JISAs is the YFS JM Finn Adventurous Portfolio, which has 90% in equities.

The balance of 10% or less outside of equities is split between fixed interest and diversifiers, such as property and gold.