The past few years have been tough for many fund managers. Rising interest rates were a headwind in 2022 for growth companies especially, then in 2023 and 2024, mega-cap technology companies left most other stocks in the dust, making the increasingly-concentrated indices hard to beat.

Another problem – according to Ross Mathison, co-manager of the £1.2bn Baillie Gifford Responsible Global Equity Income fund – is the reluctance of some fund managers to face up to poor performance.

The biggest temptation for managers is to put their heads in the sand and blindly hope their performance improves, he said, whereas what they really should be doing is reflecting on their mistakes and finding ways to improve their investment process.

“Your philosophy should be set in stone, but your process should be forever iterating,” he said.

One way Baillie Gifford does this is its ‘dividend hall of shame’, where Mathison and his colleagues examine companies they owned that have cut their dividends to see if those cuts were in any way predictable.

Below, he outlines the importance of learning from your mistakes, argues that banks are a poor fit for equity income strategies and reveals why the Baillie Gifford team wants to marry its favourite companies.

Could you explain your investment philosophy?

We believe that when you identify companies that durably compound their earnings, decade after decade, there is a systematic mispricing in those companies.

Our research is set up to identify examples of those mispriced companies by looking at businesses long-term earnings and the dividends that they will deliver.

We are looking for those compounding machines that grow year after year, decade after decade, that can be resilient in tougher economic times.

What differentiates you from other equity income funds?

When you invest very long term, the emphasis of the process becomes different. We always say that we are not looking to hold these companies for a few days, we want to get married to them and continue to own them 10 years from now.

What matters to us over the long term is that we get the earnings direction right, that we get the magnitudes correct, and that this will be far more influential for long-term returns than the earnings multiple.

What do you mean when you say you invest in responsibly growing businesses?

We want to invest in businesses that, in aggregate, are not causing harm. This was born because clients in our sister strategy had certain ‘red lines’ on sectors and companies they did not want to profit from, and it is a core part of our philosophy.

That is not to say we will not invest in companies with material impacts, for example we invest in Albemarle, a lithium mining company. But the other side to this is without lithium, we have no batteries, and without batteries, we don't make the transition to electric vehicles and cleaner forms of energy storage.

What was your best-performing stock over the past year?

CAR Group, which is an Australian car listing business that is used by dealers to move inventory around.

It’s a business that has done exceptionally well recently, with the stock up by 35% this year. CAR has developed a strategy to go beyond Australia and has now rerated materially.

It could grow at a faster rate if it wanted to, but it is more focused on how it can hand down growth to the next generation rather than optimising earnings.

And your worst?

Edenred, which is a French-owned business that produces meal, food and clothes vouchers in Europe and Latin America.

The company has had a tough time recently, with the stock down by 41% in the past 12 months. It initially did very well for us and was a big beneficiary of inflation but it has now derated massively.

But the point to make about that is, so what? All managers make mistakes; what matters is what you do with those mistakes and how you can learn from them. So, we have an exercise called the dividend hall of shame, where we look back at companies that have cut dividends to figure out if those cuts were predictable and see how we can improve our process.

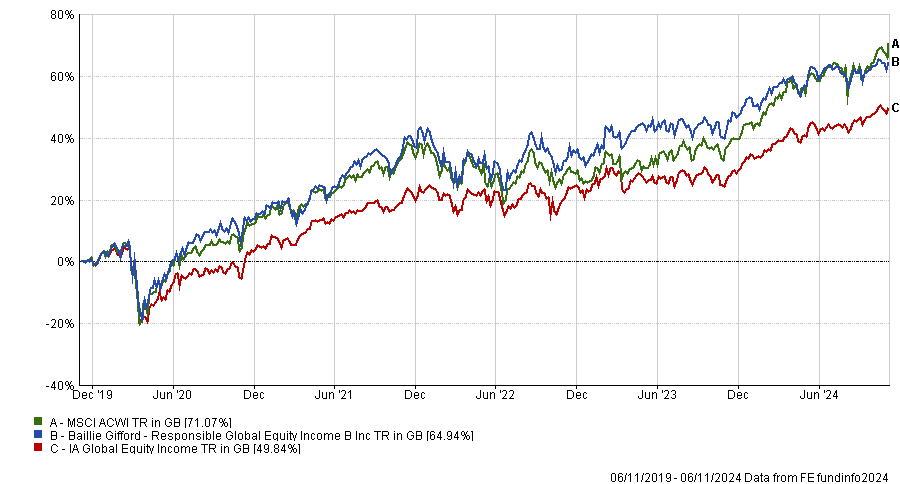

The fund was a top-quartile performer over five years but has fallen to the third quartile over three years. Can you explain this dip in relative performance?

Most of that comes from underperformance over the past year, when several deep cyclicals that we do not hold, such as European banks, have done very well.

There are certainly lots of great banks, but in general, we do not think they are a good long-term fit for our fund. Banks require a lot of capital and balance sheets are so complicated that even when you think a bank is relatively vanilla and clean, there are always risks. When confidence in banks goes, things can unravel very quickly.

We want to provide resilience by avoiding companies that are cyclical and driven by interest rates. Instead, we prefer to focus on how management can pivot a business towards growth.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

What do you do outside of fund management?

I'm a dad to two girls who take up most of my time and I'm a big sports fan.

My side hustle is that I dislike the current gender and cognitive imbalance in our industry, so I am working to see what small part I can do to change that.