Bonds are once again paying an attractive income, earning their place in investors’ portfolios. Yet there are risks on the horizon, from colossal government deficits to tight spreads on the corporate bond side.

Iain Stealey, international chief investment officer for global fixed income at JPMorgan Asset Management, thinks this is a “very good environment for fixed income” based on the main drivers of bond markets: growth, inflation and monetary policy.

Inflation is coming down towards target across the US, UK and Europe; the US economy is growing slightly above trend, although growth in Europe is weaker; and monetary policy is in restrictive territory, which should allow central banks to “just ease off the break”, he said.

Core fixed income is delivering a positive real return but an even more compelling argument in favour of the asset class is that if things go wrong, for instance if the jobs market deteriorates faster than expected, “there’s a lot of scope for central banks to cut aggressively”, he explained.

Bryn Jones, head of fixed income at Rathbones, said: “We're now back to long duration [government bond] yields of 5% and credit markets in the belly of the curve yielding 6%. You're getting a huge amount of carry protection.”

With yields at these levels, Jones thinks investors should use bonds as a hedge against animal spirits in the equity markets and potential earnings disappointments. “Yielding 5% or 6% in your portfolio as an insurance policy is pretty robust,” he said.

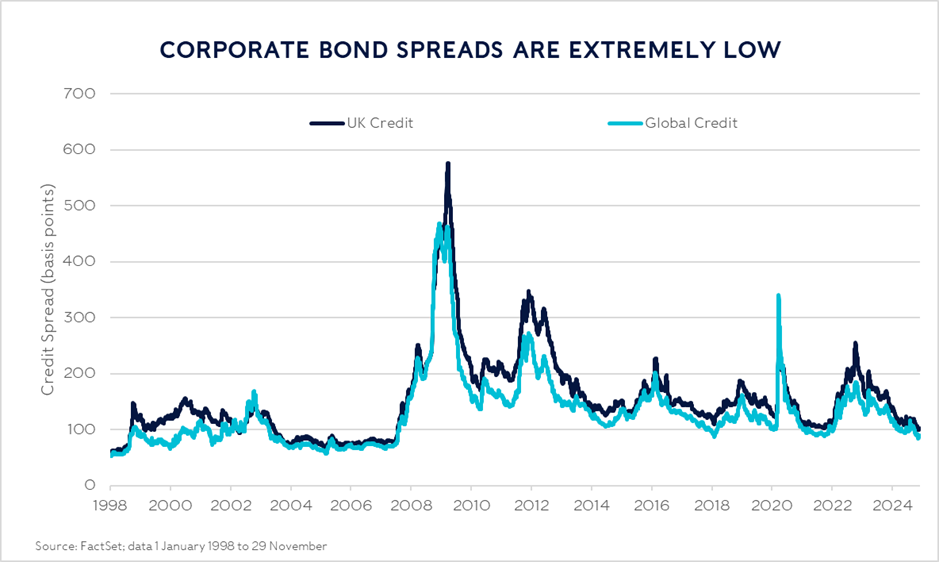

On the corporate bond side, tight spreads are a concern but other factors look compelling, Stealey said.

JPMorgan Asset Management uses the FQT framework, which stands for fundamental, quantitative and technical.

“Corporate fundamentals are great,” he said. Donald Trump intends to embark on pro-growth, pro-business policies and monetary policy is gradually easing. At the same time, corporate balance sheets and profit margins look “absolutely fine”.

“It’s all screaming that corporate health is in a pretty good spot,” he said.

“On the technical side, there’s huge demand for credit” given the high yields on offer “and the supply all gets absorbed well”.

“The challenge is around the valuation or the quantitative aspect because we have got spreads that are at post-financial crisis tights,” Stealey said.

That does not mean that spreads are about to widen dramatically from here. “Something has to go wrong for you to see a big widening,” he explained.

“If you look during the mid-1990s or even in the run up to the financial crisis, you can go for years where spreads just meander along at very tight levels. It could well be that we’re in one of those environments where fundamentals are fine, the technical backdrop is very good and investors just want to own the extra yield you can pick up owning corporate bonds.”

Stuart Chilvers, who manages the Rathbone High Quality Bond fund, believes there are “slightly more challenging times ahead” for credit spreads. “Spreads are at multi-decade lows and I would expect them to widen on any indications of economic weakness,” he said.

Sources: Rathbones, Factset, data from 1 Jan 1998 to 29 Nov 2024

However, a combination of spreads widening and interest rates falling might encourage investors to move from money market funds into fixed income to chase yields. “This phenomenon could help keep spreads tight,” Chilvers noted.

Alexandra Ralph, senior fund manager at Nedgroup Investments, said 2024 has been “an incredibly dull year for credit”.

“It started off pretty expensive and just became more expensive. We've had shallow pullbacks that were so brief and so shallow that you couldn't really reposition the portfolio because of the expense,” she said.

“Spreads, particularly in the US, are the tightest they've been since late 1990s so we don't think there's much opportunity to play any compression, so we're positioning the portfolio for carry, which means we're quite defensively positioned.”

Nedgroup’s credit portfolio has a duration of about four years. “The all-in yield on credit is still attractive. We do think there probably will be a little bit of widening, but in shorted-dated credit, we don't think the widening will be enough to ruin the carry story,” she explained.

Performance in 2024 was sector-driven with real estate debt (where Nedgroup was overweight) outperforming. Ralph expects returns next year to be more stock-specific because bonds are priced for perfection, so if companies miss their results targets, spreads will widen. “Going into next year, we think you will probably get punished if you're in the wrong credits more than you would have done this year,” she said.

Moving over to government bonds, Ralph expects yields to be volatile and to reflect economic data. This was also the case in 2024 and Nedgroup traded duration around the UK Budget, elections in the US and France, and changes in interest rate expectations.

“We were shorter in January, when markets were pricing a lot more interest rate cuts. Then we moved longer in April, back short again in September and then longer again at the beginning of November, just because the market has been getting over excited both ways about the data,” she said.

Next year, Ralph expects the German election and its implications for budgetary expansion to cause additional volatility.

The outlook for US treasuries is a conundrum for two reasons. First, said Jones, many of Trump’s policies are deemed to be inflationary, but “if you actually sat down and asked every US person what they were worried about, inflation would be in there, and yet they've voted in a president that's going to have a big impact on inflation.”

This dilemma might be tempered by political reality. “A lot of those policies still have to go through Congress and Senate. So whilst on the face of it, the policies themselves may be considered to be inflationary, in reality, how many of those policies are actually going to get through and how long will they take to get through?” Jones asked.

Second, as Stealey pointed out, Trump’s policies appear to be “expansionary on a fiscal deficit that’s already reasonably elevated for this stage in the cycle”. However, Treasury secretary nominee Scott Bessent has pledged to bring down the deficit.