The UK has a reputation of being a value market stuffed full of banks and energy companies and an equity income stalwart to boot. But that characterisation is unfair, according to Iain McCombie, manager of the Baillie Gifford UK Growth trust.

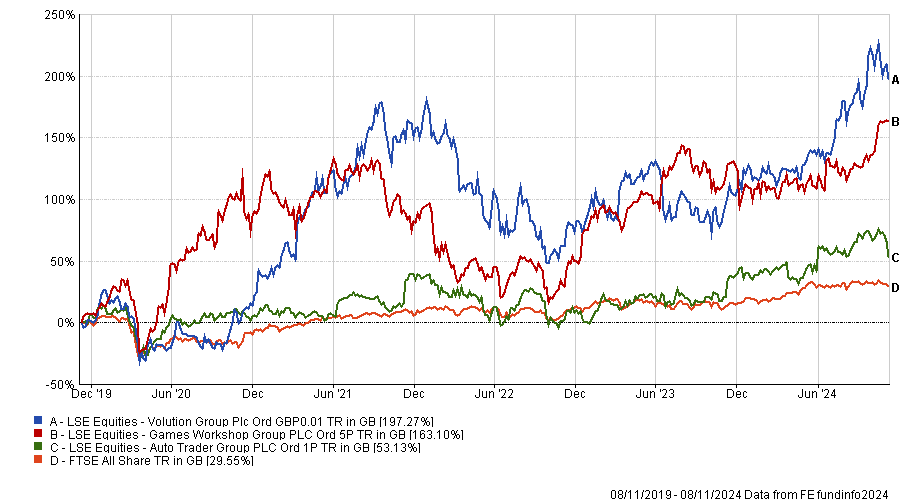

McCombie, who is head of UK equity at Baillie Gifford, has found plenty of British companies with cutting edge technology, world-leading innovations, dominant market shares and exceptional management teams. He singled out Games Workshop, Volution and Auto Trader as three of the most attractive growth companies in the UK.

Auto Trader’s market share is over 10 times bigger than the second-largest player in its market and 19 times bigger than the next competitor. “That is the kind of market share dominance I love,” he said. The management team is not complacent and is exploring avenues for growth, such as providing car finance and taking a small commission.

Games Workshop has intellectual property that it would be impossible to replicate and enjoys 30% profit margins. Warhammer, where people collect, build and paint figurines, has a cult following and new iterations generate a lot of buzz.

The company’s exceptional management team thinks long term about being responsible custodians of the franchise, McCombie said. For instance, Games Workshop is talking to Amazon about a TV series but the management team is adamant about staying true to Warhammer’s characters – otherwise there would be uproar from the Warhammer community.

Volution Group, which makes fans and cooling systems, is the trust’s biggest holding. It has benefitted from green regulation covering ventilation and healthy indoor air in the UK, Europe and Australia. Its Vent-Axia bathroom fan has a strong market share and the company’s profit margins exceed 20%.

Volution has grown to become 6.1% of Baillie Gifford UK Growth’s portfolio through strong performance. McCombie tends to initiate positions at a fairly equal weight but then lets his winners run.

Performance of stocks vs FTSE All Share over 5yrs

Source: FE Analytics

Howdens, the leading trade kitchen supplier, is another company with a long-term mindset and a relentless drive to keep making its proposition better, he said.

Howden’s profits fell last year, although they are still way above pre-Covid levels. McCombie said this did not concern him because it is a sign the business continues to invest in providing the best product range and the best customer service so it can “keep bashing the competitors over the head”.

The only unquoted company the trust owns is Wayve – the automated driving technology specialist – even though it is permitted to invest up to 10% in unlisted businesses. Wayve is collecting data from Ocado vans about how drivers react and using it to train its neural network, so instead of having a rules-based AI system, it learns from human behaviour in real life situations.

It's early days for Wayve which is still pre-revenue. In May it raised over $1bn in a series C funding round led by Softbank with commitments from Microsoft and Nvidia.

The trust also owns several financial services companies including AJ Bell and St James’s Place. It also held Hargreaves Lansdown before it was taken out by private equity buyers.

UK financial services companies’ number one concern is regulation, McCombie said. He believes regulation should strike the right balance between protecting consumers but also preserving the UK’s competitive advantages. “It’d be odd if we not quite kill the golden goose but certainly strangle it in red tape,” he said.

AJ Bell has a great management team, strong inflows and a good proposition for its customers as one of the cheaper investment platforms.

Competitor Hargreaves Lansdown is larger and has more resources and the current management team is doing a good job, but it has not always been well managed and the firm is having to spend a lot of money on technology, McCombie said. He would have been willing to back management if they had rejected the private equity bid.

St James’s Place’s new chief executive officer, Mark Fitzpatrick, is impressive and the firm is getting its hands around its fees, he continued. The wealth manager decided last year to lower fees across the board and scrap its high exit fees.

St James’s Place announced in February 2024 that it had received complaints from clients about inadequate customer service and it had set aside £426m to refund clients where ongoing service has not been evidenced.

McCombie said he was disappointed by the lack of evidencing but pointed out that inflows have been impressive for the past two quarters despite bad publicity.

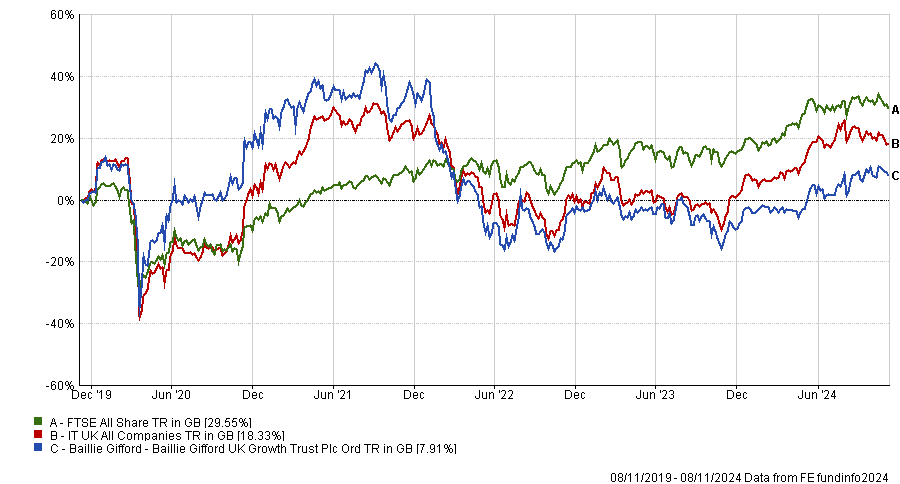

The Baillie Gifford UK Growth Trust has 45% of its portfolio in FTSE 250 companies and has selected stocks where McCombie thinks he can at least double his initial investment.

The mid-cap bias has been a headwind to performance in recent years. There has been a flight to safety and a preference for large-caps, which have outperformed and that has been “painful for us”, he said.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

But despite poor performance, turnover in his portfolio has been low, which he said proves his conviction in his companies and his team’s patient, long-term approach. “Everyone says they’re long term until reality happens and you get punched in the face,” he rued. Sometimes the hardest thing in investing is to do nothing and stick to your stocks, he added.

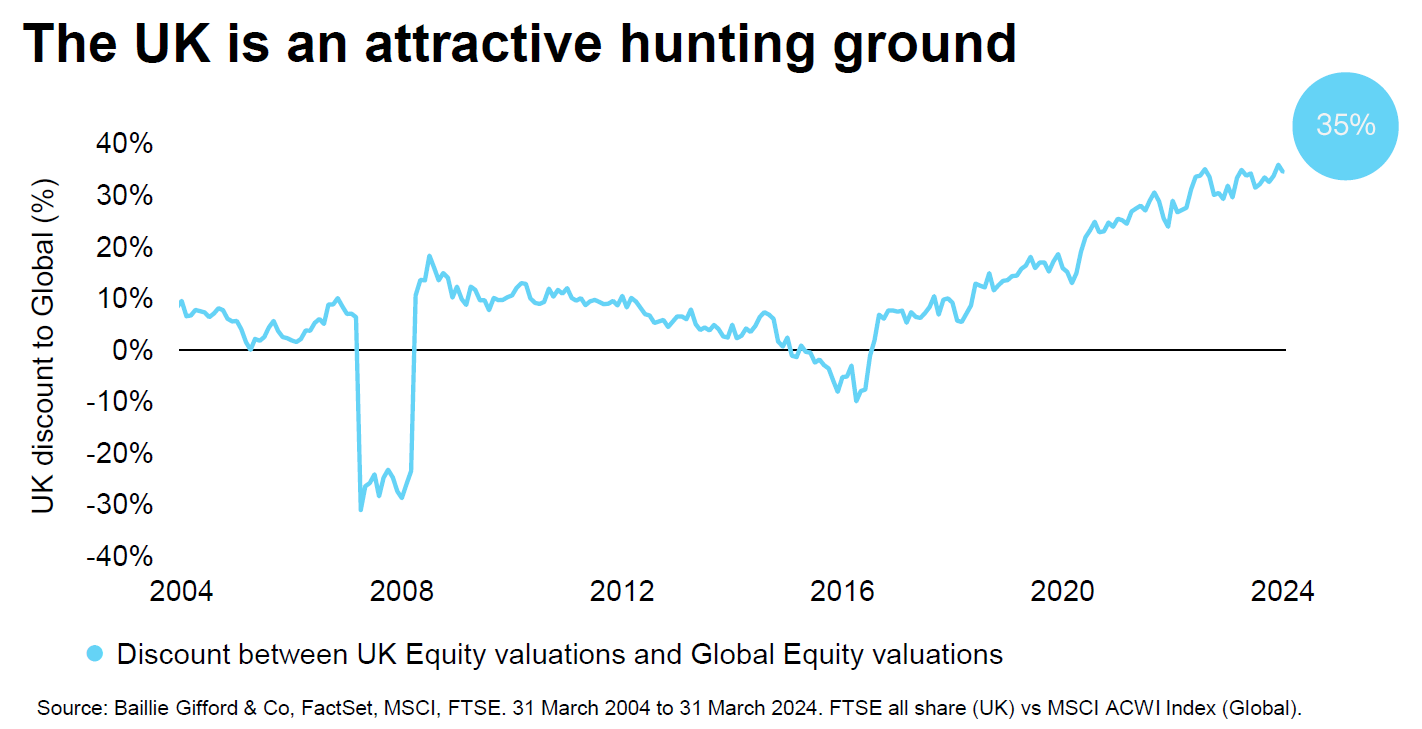

McCombie thinks this is an opportune time to invest in the UK from a valuation perspective given that the UK is historically cheap in comparison to global and US stock markets.

However, those low valuations have led to a flurry of merger and acquisition activity. The trust has lost Euromoney, Hargreaves Lansdown and HomeServe to takeovers but McCombie was relieved when Rightmove rejected a bid from REA.

“You lose businesses you don’t want to lose,” McCombie said. “There’s a smaller number [of growth companies] than you might think and you don’t want to lose them.”

Rightmove is the cheapest property portal in Europe and has operating margins of 75% – “one of the highest we’ve ever found”, he said.

“Why would you want to give that stock up for a 20% uplift? It makes no sense to me.”