More than 100 funds could have turned investors into millionaires, had they maxed out their ISAs on 6 April each year since their introduction in 1999. Technology and US equity funds have been the most profitable investments by far over the past quarter century.

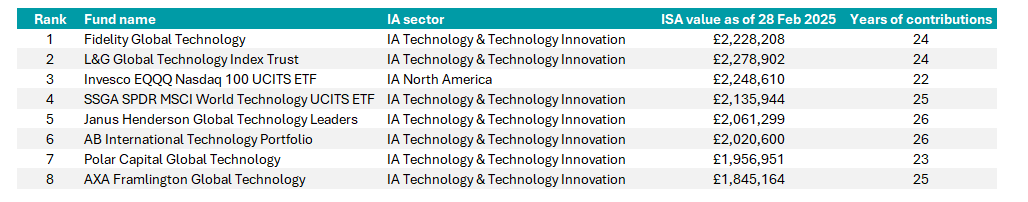

From the 112 ‘ISA millionaire’ funds in the Investment Association universe, the six best-performers – all of which focus on technology – would have amassed more than £2m over 26 years. Fidelity Global Technology and L&G Global Technology Index Trust had the Midas touch, turning £326,560 in total contributions into £2.3m apiece.

Several of the top-performing tech funds do not have a 26-year track record so reached the £2m mark or thereabouts without the full 26 years of ISA contributions, as the table below shows.

Tech funds for a £2m ISA

Source: FinXL

At the top of the list, Fidelity Global Technology has been led since 2013 by FE fundinfo Alpha Manager Hyunho Sohn. He believes euphoric expectations for artificial intelligence (AI) have led to excessively high valuations among certain AI-related stocks, whereas “some companies have been misunderstood and labelled AI losers and we feel that other cyclically underearning stocks have been overly penalised”.

US stocks have driven the technology sector’s momentum so far, but he is finding underappreciated opportunities elsewhere, particularly in China. “Overall, we think a bottom-up stock-picking approach with valuation discipline will be even more critical in 2025,” he concluded.

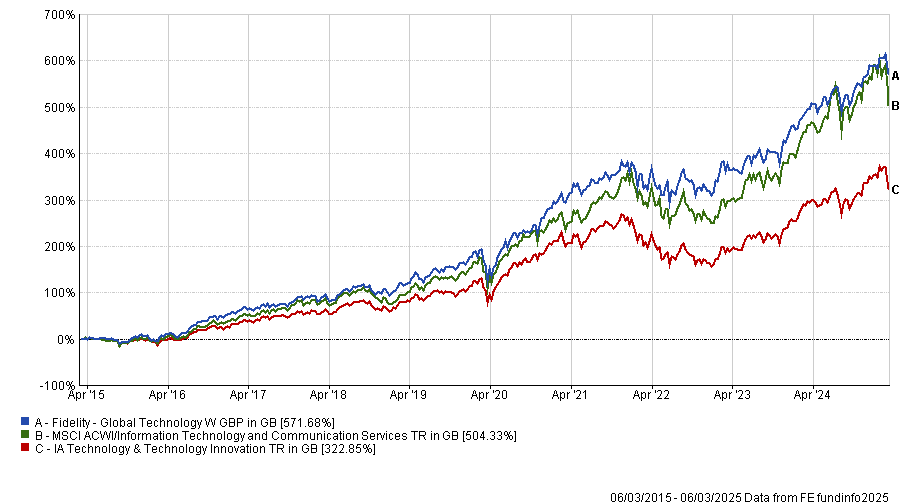

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

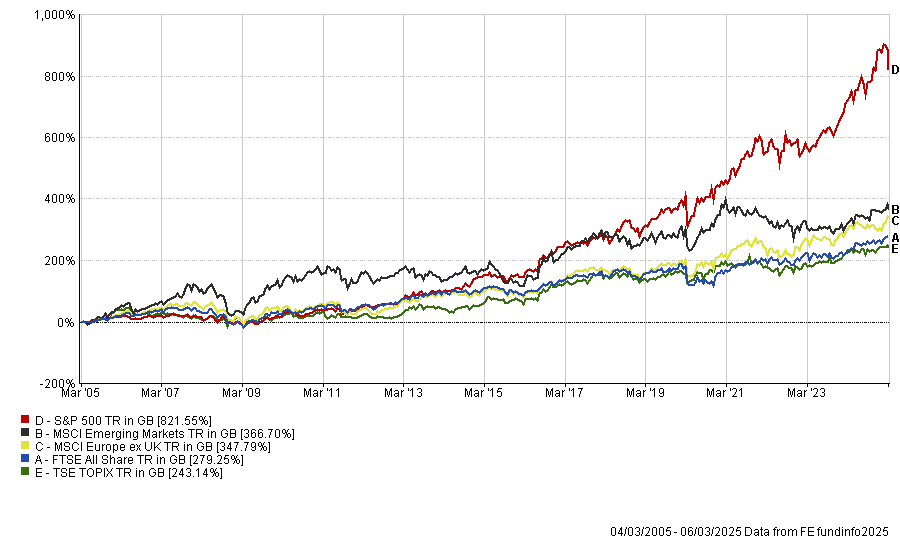

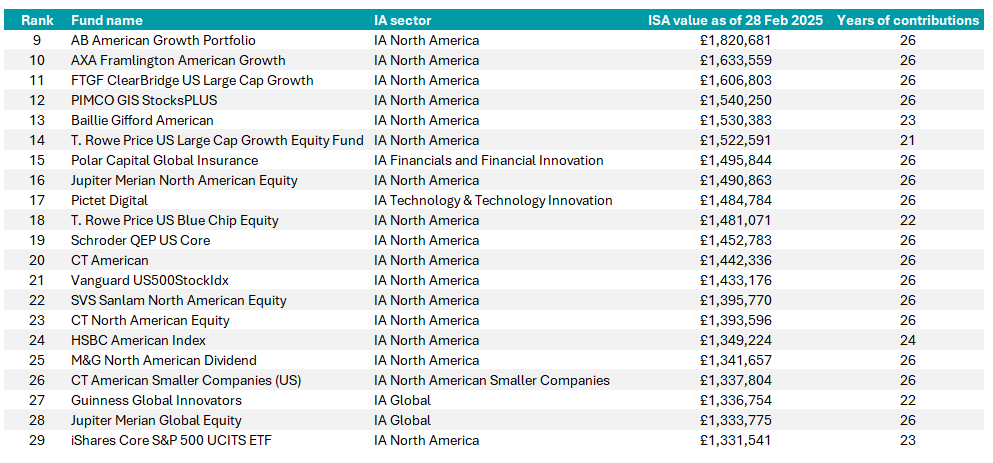

Below the top eight tech funds, the next batch of strong performers focus almost exclusively on US equities, the only exceptions being Polar Capital Global Insurance, Pictet Digital and CT American Smaller Companies. This reflects the considerable outperformance the US equity market has achieved over other regions.

US vs other regional equity markets over 20yrs

Source: FE Analytics

What may come as a surprise, however, is that the best actively-managed US equity funds outstripped index trackers – despite the US being generally regarded as the world’s most-efficient market and its benchmarks as being some of the hardest to beat.

AB American Growth Portfolio, led by Alpha Managers John H. Fogarty since 2012 and Vinay Thapar since 2018, would have transformed £326,560 of contributions into £1.8m over the course of 26 years.

AXA Framlington American Growth and FTGF ClearBridge US Large Cap Growth are close behind at £1.6m apiece.

The first IA Global funds to make an appearance are Guinness Global Innovators and Jupiter Merian Global Equity, both of which would have generated £1m of profit on top of the original ISA contributions – a feat that 29 funds in total achieved.

Funds that would have delivered £1m of profit (excluding the top eight)

Source: FinXL

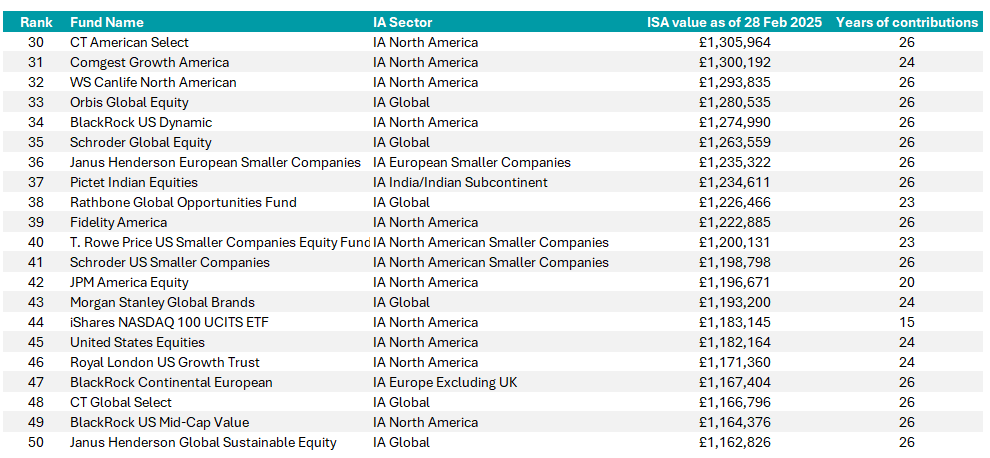

US equity strategies continue to dominate the top 50 within the list of ISA millionaire funds. Six more global funds also made the grade: Orbis Global Equity, Schroder Global Equity, Rathbone Global Opportunities, Morgan Stanley Global Brands, CT Global Select and Janus Henderson Global Sustainable Equity.

Elsewhere, Pictet Indian Equities, Janus Henderson European Smaller Companies and BlackRock Continental European were the only funds within their respective sectors in the top 50.

Funds 30 to 50 in the ISA millionaire league table

Source: FinXL

The second half of the ISA millionaire funds league table (funds ranking 51 to 112) is more diverse, with a smattering of Asia Pacific, European, UK, healthcare and regional small-cap funds breaking up the preponderance of US and global equity names.

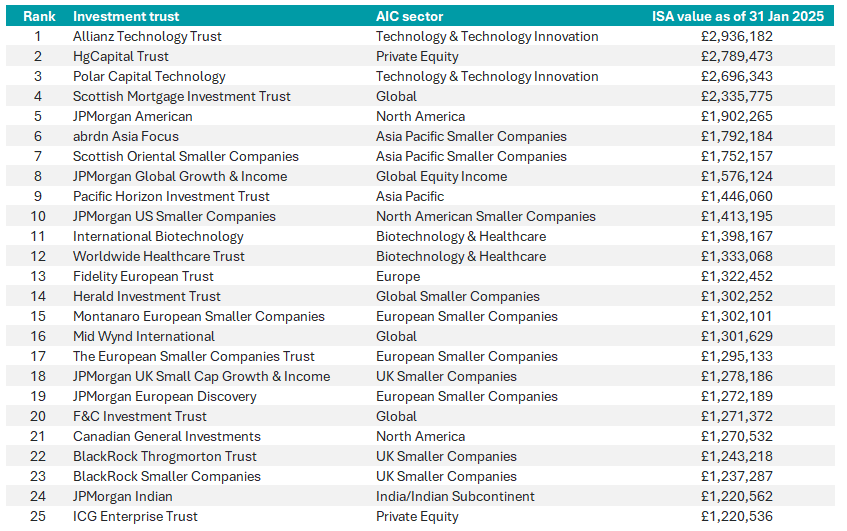

In addition to 112 open-ended funds, 50 investment trusts would have turned their investors into millionaires, had they invested their full ISA allowance since 1999.

The top four trusts – Allianz Technology Trust, HgCapital Trust, Polar Capital Technology and Scottish Mortgage – would have made investors more than £2m, according to the Association of Investment Companies.

HgCapital Trust* stands out for giving its investors exposure to the alpha from private companies as well as the tech theme due to its focus on software and technology services.

Close behind, JPMorgan American amassed a £1.9m war chest, while two trusts in the Asia Pacific Smaller Companies sector were not far off £1.8m: abrdn Asia Focus and Scottish Oriental Smaller Companies.

Top 25 ISA millionaire investment trusts

Source: Association of Investment Companies

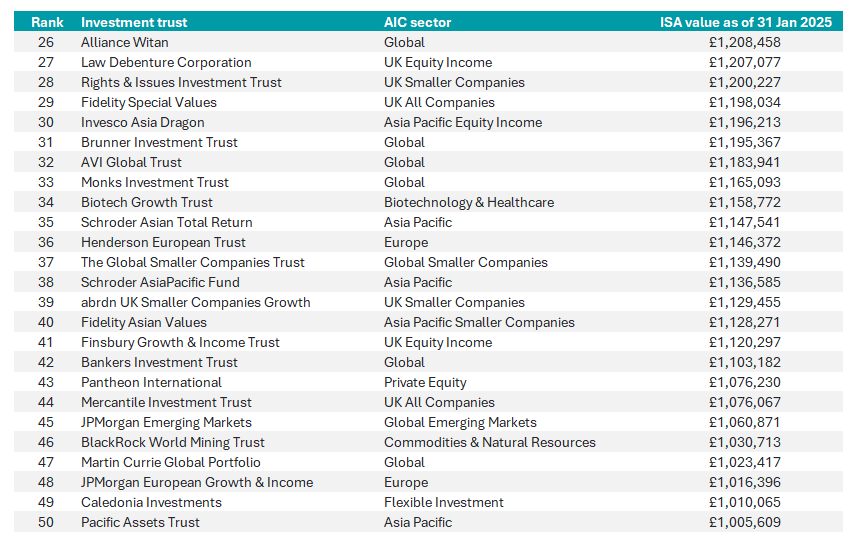

Another feature amongst the ISA millionaire investment trusts is the outperformance of small-caps, with 14 of the 50 trusts investing in smaller companies.

Annabel Brodie-Smith, communications director of the Association of Investment Companies, said: “With their permanent capital structure, investment trusts can take a long-term view and are never forced sellers. This makes them particularly suitable for hard-to-sell assets like smaller companies and unquoted companies.”

ISA millionaire investment trusts, ranking 26 to 50

Source: Association of Investment Companies. Performance record used for Asia Dragon is from Invesco Asia, which merged with Asia Dragon on 13 Feb 2025.

Despite the powerful numbers in this research, somebody who could afford to put £20,000 into an ISA every year would probably pick more than one fund and would seek to diversify across strategies, styles, managers, sectors and regions.

People who are already ISA millionaires tend to favour investment trusts, putting 40.9% of their ISAs in them on average, according to data from interactive investor (ii). Direct stocks attracted 35.1% of ISA millionaires’ portfolios and open-ended funds received just 13.3%.

The most popular investment trusts amongst ISA millionaires using ii’s platform are Alliance Witan and Scottish Mortgage – both of which could have single-handedly made someone into a millionaire, had they maxed out their ISA contributions every year since 1999.

*HgCapital is an investor in Trustnet’s parent company, FE fundinfo