Investment platform Hargreaves Lansdown has added the Baillie Gifford Japanese fund to its Wealth Shortlist, citing its experienced manager Matthew Brett and flexible process as positives.

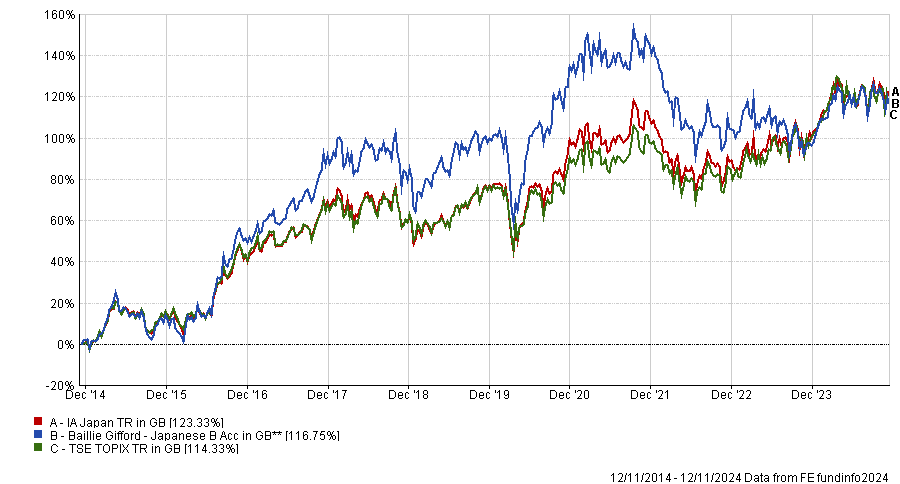

The £1.3bn fund has made 116.8% over the past decade, slightly outperforming its Topix benchmark but putting it in the third quartile of the IA Japan sector. It has made bottom-quartile returns over three and five years.

It is managed in keeping with Baillie Gifford's growth investment philosophy, which has struggled in recent years when interest rates rose from their record lows. However, analysts at Hargreaves Lansdown are optimistic on the Baillie Gifford Japanese fund’s long-term potential.

Performance of Baillie Gifford Japanese vs sector and index over 10yrs

Source: FE Analytics

In explaining why the fund has been added to the Wealth Shortlist, Hargreaves Lansdown lead investment analyst Kate Marshall highlighted Brett’s 21 years of experience in the investment industry. As he has spent his entire career at Baillie Gifford, he is well-embedded in its culture and style of investing.

“Brett is a highly experienced investor, having joined Baillie Gifford and the Japan team in 2003. He has one of the longest track records in the UK asset management industry of investing in Japanese companies,” Marshall said.

“He learned his craft from another experienced and successful Japanese equities investor (Sarah Whitley) over a prolonged period and continues to have the support of a 10-person team focused on Japan. We like the collaborative approach, with ideas coming from across the team and a focus on developing talent.

“We’ve met Brett several times over the years and believe he comes across as a thoughtful and reflective investor. These characteristics demonstrate a focus on client outcomes.”

Baillie Gifford Japanese’s approach is similar to other funds run by Baillie Gifford, in that it focuses on individual companies’ fundamentals and their long-term potential for growth.

It invests in companies at different stages of growth, split into four buckets: secular growth (companies with high growth potential), growth stalwarts (steady compounders that may deliver steadier rates of growth), special situations (larger conglomerates or businesses trading on a low share price that does not reflect their true worth) and cyclical growth (companies that are more sensitive to changes in the economy).

While this means Brett is classed as growth manager, Marshall noted that his flexibility and ability to invest in companies with different drivers of growth or those that are lowlier valued means he is not always a typical growth investor.

Marshall added: “While the growth investment style has been out of favour in recent years, we recognise that different investment styles come in and out of favour.

“Brett has a strong long-term track record, with evidence of adding value through stock picking – the ability to invest in companies that go on to perform well, regardless of what sector they’re in, and without making ‘bigger picture’ economic calls.”

The Baillie Gifford Japanese fund could be used as a geographical diversifier to global equities, to add long-term growth potential or to take specific exposure to Japan, Marshall said. It could also be used alongside funds with a value approach and a focus on companies that have recovery potential, to diversify investment styles.