Chancellor Rachel Reeves’ first Budget did not pass without controversy. Tax hikes worth £40bn, more than half of which will come from employer national insurance contributions, have prompted concerns about the future for UK businesses, especially small and mid-size companies.

However, it is not all doom and gloom. While businesses are certainly being challenged, several mid-market companies are finding opportunities, not adversity, in the Budget.

Below, fund managers highlight UK small and mid-caps poised to thrive in a post-Budget landscape, with an optimistic outlook for infrastructure and defence companies, in particular.

Marshalls

Infrastructure, housing and construction companies are some of the major beneficiaries following the Budget.

Simon Murphy, portfolio manager of the VT Tyndall Unconstrained UK Income fund, noted: “The Labour government seems intent on, by hook or by crook, finding additional ways to invest in infrastructure in the UK.”

Following Labour’s stated commitment to build 300,000 new houses per year for the next five years, domestic housing businesses such as Marshalls, are poised to surge in value.

Over the past 12 months, Marshalls' share price has already swelled by 55.4%, but Murphy and Nigel Yates, portfolio manager of the AXA Framlington UK Equity range, believe the company still has room for further progress following the budget.

Share price of Marshalls over 1yr

Source: Google Finance

With interest rates and inflation falling, housebuilders such as Marshalls will benefit from a more favourable economic backdrop over the next 12-18 months, Murphy said.

For Yates, one of the most attractive parts of Marshalls' business is its efforts to provide sustainable building solutions. Indeed, the new government aims to encourage better-regulated house building, with a greater push for airtight, insulated and energy-efficient properties.

Galliford Try

James Thorne, UK small-cap manager at Columbia Threadneedle, identified another infrastructure firm, Galliford Try.

The company rose in value over the past 12 months, with its share price up by over 60%, with notable surges in July and October.

Share price of Galliford Try over 1yr

Source: Google Finance

Despite this, it remains attractively valued, with a price-to-earnings (P/E) ratio of just 10x at the time of writing and a dividend yield of 4.1%

For Thorne, Galliford has “proven strengths in key areas of focus for the government: infrastructure, education, defence, custodial, water and health”. Indeed, the firm has partnered with the government for infrastructure projects, such as providing new hospitals for the NHS.

Moreover, the business is generally risk-averse and tends to avoid large-scale projects such as HS2. Given its £155m balance sheet, the company makes for a relatively safe investment, he said.

Thorne concluded: “We believe the company has a great market backdrop for the next five years. Although some stocks will suffer from the increase in national insurance, many will be able to pass it onto their customers without destroying demand.”

Chemring

Alexandra Jackson, manager of the Rathbones UK Opportunities fund, believes the Budget is a major tailwind for defence stocks.

With around £2.9bn of extra expenditure committed to defence and the government’s long-term goal to commit 2.5% of GDP to military spending, stocks such as Chemring Group are poised for a great year.

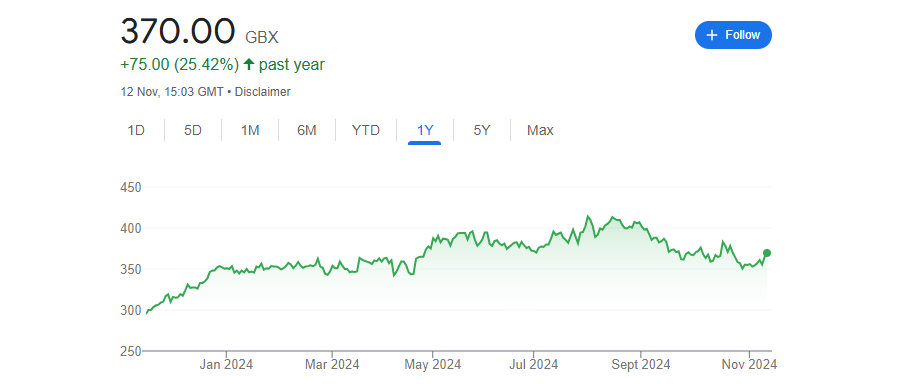

As a defence-focused contractor, the stock has benefitted immensely from geopolitical concerns, with the share price up by 25.4% over the past year.

Share price of Chemring over 1yr

Source: Google Finance

“This increase in defence spending not only strengthens NATO collaboration but also signals enduring demand for companies developing technologies that bolster UK and allied forces’ operational readiness,” Jackson said.

Chemring received an order this month for energetics (explosives, rocket motors, warheads and ignitors) and frequently receives orders from European governments.

Despite its growth potential, Jackson said the stock has a surprisingly cheap valuation, trading on less than 18x expected earnings.

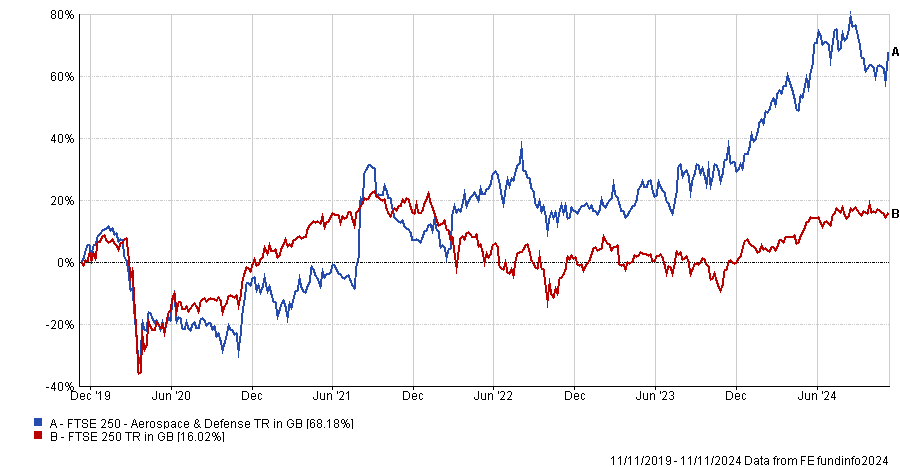

Moreover, defence stocks have been more widely in demand over the past five years, with the FTSE 250 Aerospace and Defence index up by 68.2% over the past half a decade. By contrast, the wider FTSE 250 was up by 16% over the same period.

Performance of indices over 5yrs

Source: FE Analytics

“Much hoped for peace won’t change the fact that countries need to re-arm”, Jackson concluded, providing opportunities for companies such as Chemring to thrive.