UK retail investors sold a range of funds in the run up to October’s Budget to crystallise capital gains ahead of potential tax rises, according to the latest Pridham report.

While 38% of the UK's largest fund groups experienced a rise in net retail sales of onshore funds during the third quarter, the majority of firms faced selling pressure in late summer and early autumn.

Benjamin Reed-Hurwitz, EMEA research leader at ISS Market Intelligence (ISS MI) and lead author of the Pridham report, said: “Q3 is often a weaker quarter, and this year’s drop is not the largest in recent history. However, it is noteworthy that the weakness came predominantly in September – a time when we saw the US equity market wobble, the unpredictable US election was looming and fears over the potential consequences of the pending U.K. budget mounted.

"There seems to have been selling pressure ahead of possible capital gains tax increases. Offshore retail net sales also trended negative, adding to an overall picture of waning risk appetite and investment activity amongst retail investors.”

Source: The Pridham Report

Passive funds recorded significant declines in net and gross sales during the third quarter, a departure from their powerhouse results in the previous Pridham report. Nonetheless, passive funds continued to post positive net sales, whereas actively managed funds had negative net sale rates.

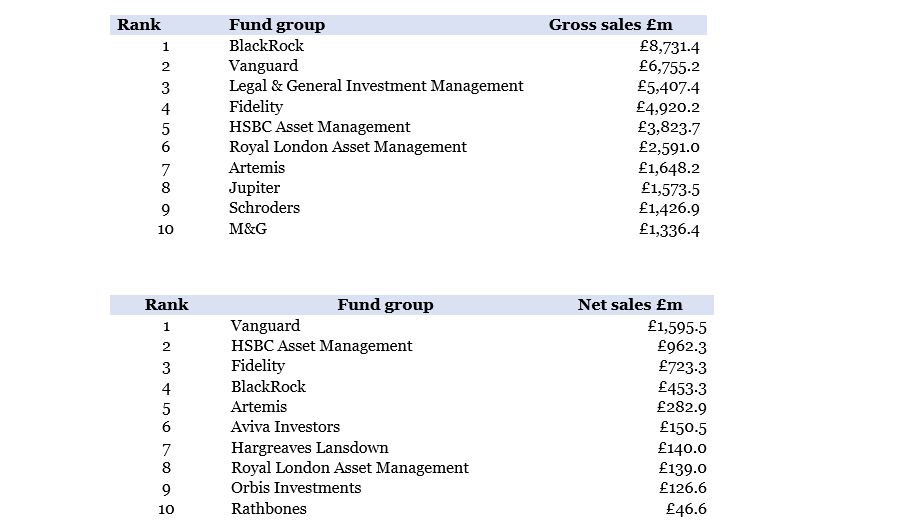

Amongst the 45 UK fund groups that supplied data, Vanguard raked in the most money, recording close to £1.6bm in net sales. It was well ahead of the next contender, HSBC Asset Management, which brought in a net £962m.

Demand for equity income strategies continued to improve, with Artemis Income, Jupiter UK Multi-Cap Income fund and Aviva Global Equity Income all proving popular. However, Richard Saldanha and Matt Kirby, who managed the £673m Aviva Global Equity Income fund, are moving to Royal London Asset Management.

The £410m Jupiter UK Multi Cap Income fund is managed by Adrian Gosden and Chris Morrison, who joined Jupiter in January 2024 from GAM Investments, where they previously ran the strategy under its former name, GAM UK Equity Income.

Artemis Income is the largest and most stable of the three funds, helmed by FE fundinfo Alpha Manager Adrian Frost for 22 years. He was joined by Nick Shenton in 2012 and Andy Marsh in 2018.

“That multiple fund groups found success with equity income strategies in Q3 could either be a response to falling interest rates across the US, UK and Europe, which has left cash savings looking less attractive, or a move to diversify equity exposures,” Reed-Hurwitz commented.

Sustainable funds finally turned the corner after a relatively tough period for the market, with outflows slowing significantly. “If this signals that the resetting of investor expectations and appetite coming out of the post-Covid boom is largely complete, then the upside for sustainable funds may shine brighter than the downside,” he concluded.