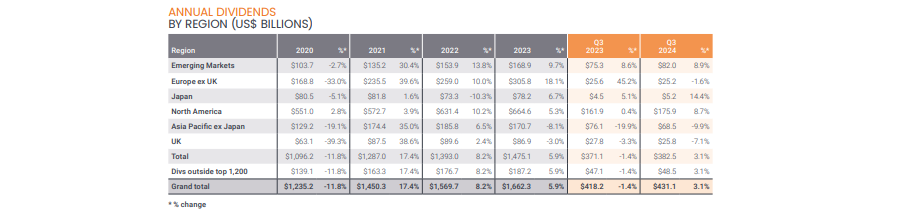

Janus Henderson has trimmed its 2024 dividend forecast down to $1.73trn, predicting a headline increase of 4.2%, down from its previous estimate of 4.7% headline growth.

Despite this, global dividends rose significantly in the third quarter, reaching a record payout of $431.1bn. Globally, 88% of companies either raised or held dividends during this period.

Source: Janus Henderson

The US was one of the biggest beneficiaries, with a 10% total dividend growth in the period, leading to a total payout of $159.8bn. More than a quarter of this growth came from Meta and Alphabet, who began paying dividends this year, with the rest of the growth filled in by companies such as Walt Disney, which finally enjoyed its post-pandemic resurgence.

Jane Shoemake, client portfolio manager on the global equity income team, was optimistic about the future of US dividends. She explained that companies such as Alphabet still have around $80.9bn on their balance sheet, despite spending almost $5bn on dividends and $46.7bn on share buybacks year-to-date. This suggests they have the potential to continue growing their dividends sustainably.

Elsewhere, emerging markets impressed. Despite China’s turbulent domestic economy, dividends surged by 15.4% in headline terms. Three-quarters (75%) of this surge was due to Alibaba’s choice to distribute cash to shareholders.

Meanwhile, Indian dividends soared by 27% to $16.2bn, a new regional record, and Singapore similarly broke records with $6bn in payouts.

“More than one-sixth of the underlying growth this year is coming from companies like Alibaba and Meta paying their first-ever dividends, demonstrating how these relatively new sectors are maturing and beginning to return some of the large amounts of cash they are accumulating to shareholders,” Shoemake said.

Banks enjoyed a good quarter. With a 6.6% underlying rise in dividends, banks contributed to a fifth of the global payout in the past quarter.

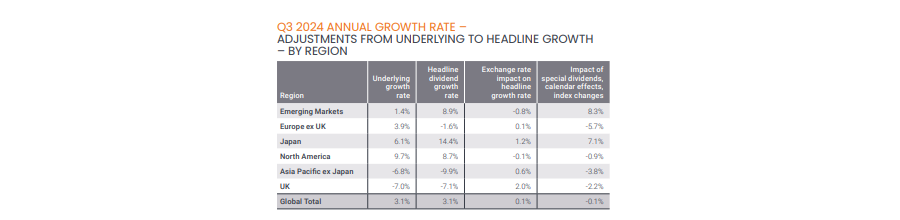

However, dividend growth was muted due to cuts from just five major companies, including Taiwan’s Evergreen Marine and the UK’s Glencore, which caused global dividend growth to fall below its expected level of 6.5%.

Evergreen’s decision to slash dividends impacted the performance of Asia Pacific excluding Japan. In a “seasonally important quarter for the region”, weaknesses in Taiwan, Australia and Hong Kong drove payouts to $68.5bn – 6.8% lower underlying growth.

Meanwhile, UK dividend payouts fell by an underlying 7% to $25.8bn. Most of this was because of Glencore's large dividend cut, but other companies also played their part. For instance, energy business SSE reduced its dividend by two-fifths to help fund investment in renewables.

Source: Janus Henderson

Andrew Jones, portfolio manager on the global equity income team, said: “UK dividends have continued to reflect sector-specific challenges in Q3, with underlying growth dampened by reductions among major commodity firms.”

However, Jones remained positive and noted that the broader market remained relatively steady, with 84% of companies maintaining or moderately increasing payouts. “Looking ahead, we anticipate a stable landscape for UK dividends as companies respond to an improving economic climate.”

Shoemake concluded: “Concerns that higher interest rates might cause significant strain on the global economy have so far been misplaced. Dividends show more steady growth than profits over time as companies seek to manage payout ratios over the business cycle.

“We remain confident that underlying growth this year will be in line with the strong showing in the first half,” she added.