Sometimes managers are convinced about something but need a small external nudge to take the plunge. This is exactly what happened to Jason Pidcock, who runs the £1.9bn Jupiter Asian Income fund, in relation to artificial intelligence (AI).

Despite already being positive about AI and holding positions in a few tech companies, he was prompted to increase his weightings after reading ‘The Coming Wave: Technology, Power and the 21st Century’s Dilemma’ by Microsoft AI chief executive Mustafa Suleyman (Crown Publishing Group, September 2023).

“I would urge people to read it, even though it's now just over a year old,” he said.

“From page 50 onwards, it gave me that extra element of clarity that I needed. We raised the weighting of all of our tech stocks and that was just in time before they had a massive uplift in the spring of this year.”

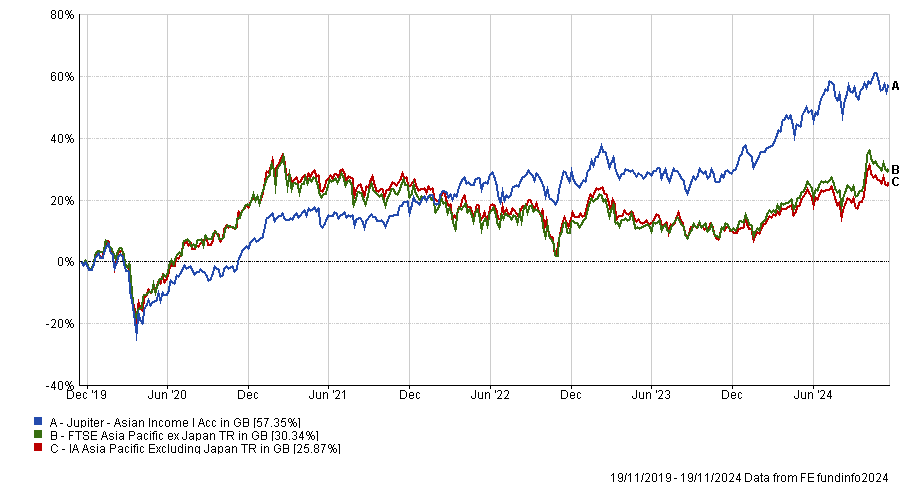

His overweight to technology was a key driver of returns during the past year..

Performance of fund against sector and index over 1yr

Source: FE Analytics

Given the impact the book made on his fund’s performance, Pidcock has “read a lot more since then”. His second recommendation was ‘How AI Thinks: How we built it, how it can help us, and how we can control’ it by Nigel Toon (Random House, 2024), founder of semiconductor company Graphcore.

“On top of that of course, there's masses of information provided by external research providers. We are geared into this,” he said.

The Jupiter Asian Income portfolio currently holds several Taiwanese names – Mediatek in the processors and architecture sector (which makes up 6.9% of the fund), Taiwan Semiconductors (TSMC) in the foundry and memory space (6.8%) and device assembly name Hon Hai Precision Industry (at 7.4%, the fund’s top holding); as well as South Korean Samsung Electronic, which covers both the foundry and memory and consumer devices spaces (5.4%).

“Even though this is an income focused fund, we can invest in tech companies in Asia, they do pay dividends. They have very high payout ratios too, as they're profitable enough to be able to afford that, and the balance sheets are strong enough as well,” He said.

The manager bought – and has been actively trading – a new position that he declined to name, taking the count of AI companies in his portfolio to five.

“These are more than picks-and-shovels companies, they are absolutely essential providers to Nvidia, Apple, Amazon, Microsoft, Google. Without these suppliers, those US companies could not operate,” he said.

“These companies are globally competitive, have the intellectual property and even if they're forced to invest to increase manufacturing capacity in the US or other countries, they are the ones able to do that.”

As for how much further the AI trend can go, Pidcock is confident that earnings growth will be “decent” in 2025 and 2026.

He admitted technology is a very cyclical sector, but he believes we are in the early stages of the current uplift in the earnings cycle.

Hon Hai reported its earnings two weeks ago, when the numbers beat expectations “quite solidly” and with “quite a positive forward-looking guidance”.

In the broader market, the manager has seen “genuine earnings growth” this year as well.

“In the past, the rising part of the cycle for tech has lasted around about 30 or 40 months. We're only about halfway through that, so we do feel that there is more to come, and we have seen decent earnings growth as well.”

He concluded: “It might be an exaggeration to say that one day all companies will be tech companies, but not too much of an exaggeration. Tech companies will grow as a share of total production and total output, I have no doubts about this.

“Asia here is at the forefront, which is why I am delighted that this is the part of the world that I am covering.”