As investment professionals contemplate their outlooks for next year, forecasts are mixed. In one camp sit the cautious and the downright pessimistic. These experts worry about political risk, impending trade wars sparked by Trump’s tariffs, sky-high US equity valuations and stock market concentration, all of which could drive up volatility next year.

Optimists in the opposing camp cite falling interest rates, resilient corporate earnings, the artificial intelligence boom and Donald Trump’s pro-growth policies as reasons to believe global stock markets can continue their upward trajectory.

Between these two diametrically opposed views are those who think the overall direction of equity markets will be upwards but there will be air pockets of substantial volatility along the way.

To prepare portfolios for any eventuality, Trustnet petitioned fund selectors for strategies that should do well if global stock markets continue to be buoyant, which we revealed yesterday.

Today, we asked for funds that have a track record of preserving wealth during market corrections.

Bevan Blair, chief investment officer of One Four Nine Portfolio Management, prefers funds with low downside capture ratios. He doesn’t mind if funds lag their benchmarks in raging bull markets so long as they protect wealth during tumultuous years. “If we do see a downturn, I want them to show their spots,” he said.

“If markets go up strongly, we're there or thereabouts, but we're never blowing the lights out. When markets struggle, that's when our managers really earn their fee. If you can protect in a downturn, you don't need to work as hard in the upturn to get back to par.”

One example of a steady performer which Blair has held for years is the £6.4bn Stewart Investors Asia Pacific Leaders, helmed by FE fundinfo Alpha Manager David Gait and Sashi Reddy.

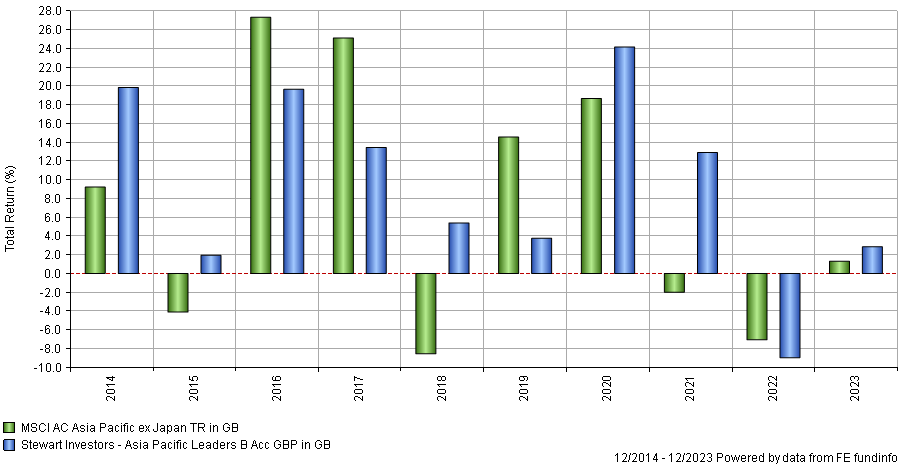

The fund’s performance is nothing like its benchmark. Asia Pacific equities lost money in 2021, 2018 and 2015 yet the fund was in positive territory, although in 2022 it lost more than its benchmark. The flip side to its defensive credentials is underperformance this year and in the strong markets of 2016 and 2017.

Performance of fund vs benchmark in discrete calendar years

Source: FE Analytics

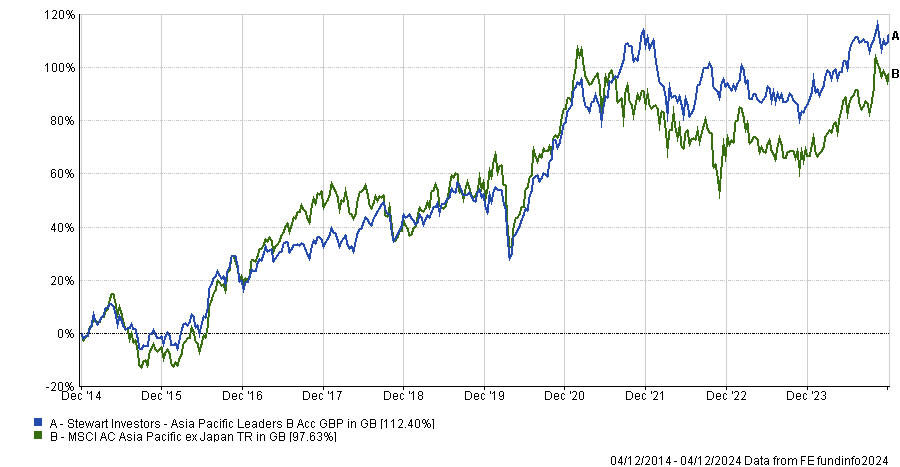

Asia Pacific Leaders’ downside capture ratio is low – 64.4% over three years and 72.5% over 10 years to 30 November 2024 – and it captured even less of its benchmark’s upside: 47.8% and 47.1% over three and 10 years, respectively. Nonetheless, by keeping a lid on losses, it is comfortably ahead over a decade.

Performance of fund vs benchmark over 10yrs

Source: FE Analytics

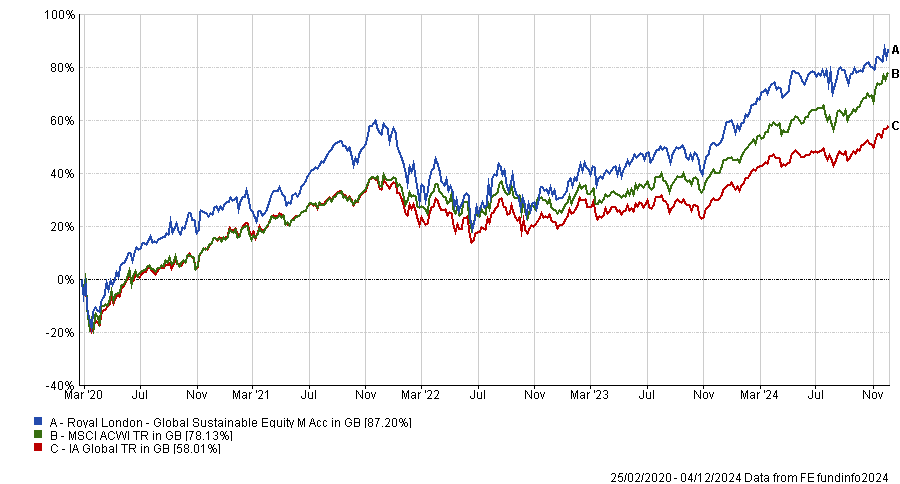

Blair recently added Royal London Global Sustainable Equity to his portfolios. It was launched in 2020 so has a relatively short track record but lead manager Mike Fox has proven his credentials in the UK version of the strategy and now has a broader universe, he said.

Performance of fund vs benchmark and sector since inception

Source: FE Analytics

Fox and his team follow a “very measured process”, Blair said. “They don't have to shoot the lights out and they don't feel the pressure to do that. They can still run concentrated, conviction portfolios without having to have huge weights in stocks, so they have a good capital allocation discipline.”

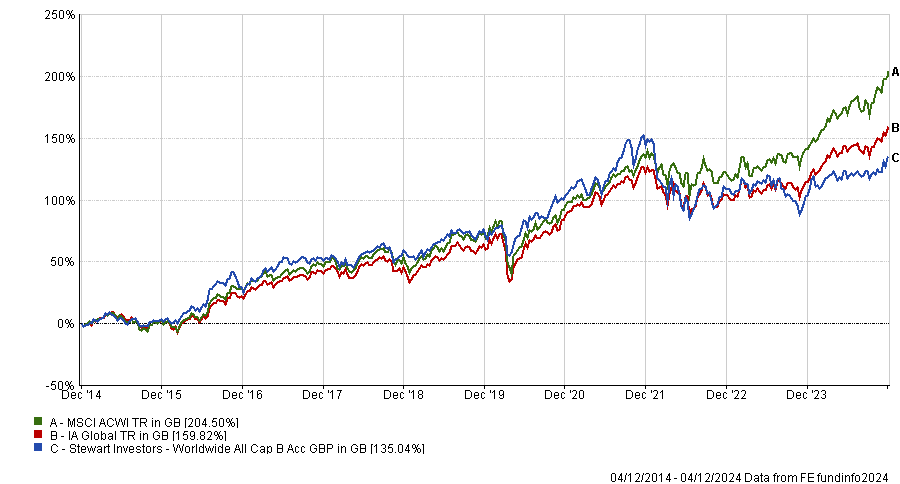

Charlie McCann, investment research analyst at Square Mile Investment Consulting & Research, picked Stewart Investors Worldwide All Cap, which is also managed by Gait and Reddy. It holds a Square Mile Responsible A rating and should appeal to savers who want to invest in companies contributing to a more sustainable future.

“The managers at Stewart have long held caution over the valuations in US equities, which they believe to be over-extended. As a result, the fund has a significant underweight to the US market, seeking opportunities in high-quality companies elsewhere in the world, which on a relative basis look far more attractive,” he explained.

“The focus on durable business models, often founder/family-led, means the fund should offer some defensive characteristics in the event that global markets face headwinds in the coming year.”

Performance of fund vs benchmark over 10yrs

Source: FE Analytics

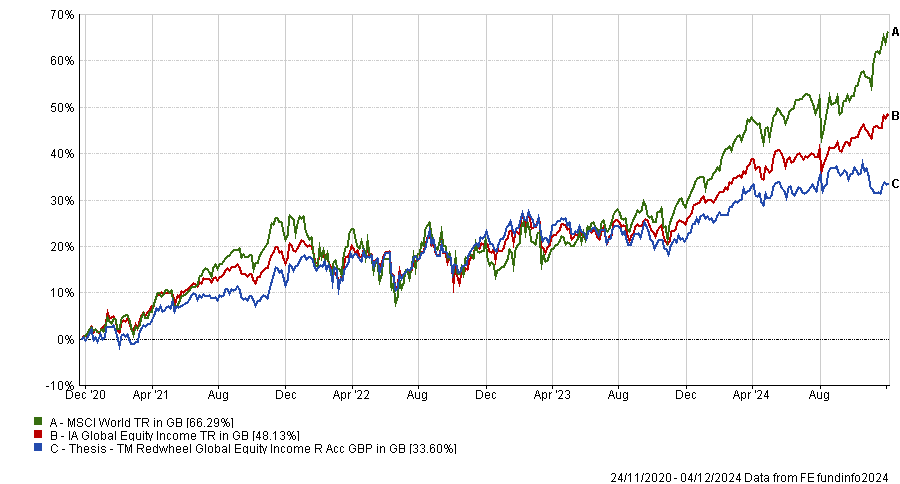

McCann also chose Redwheel Global Equity Income as a defensive play for investors seeking income and capital growth.

Its manager Nick Clay is particularly bearish on the outlook for the Magnificent Seven. Expecting a global recession, he is positioning his portfolio towards high-quality, defensive businesses with a history of resilient cash flow generation and dividend payments, McCann said.

“Historically, the fund has displayed lower volatility and downside capture than the broad market and we would expect this to be the case if the global economy weakens next year,” the Square Mile analyst added.

Its downside capture is 56.2% compared to the MSCI World over three years.

Performance of fund vs benchmark over 10yrs

Source: FE Analytics

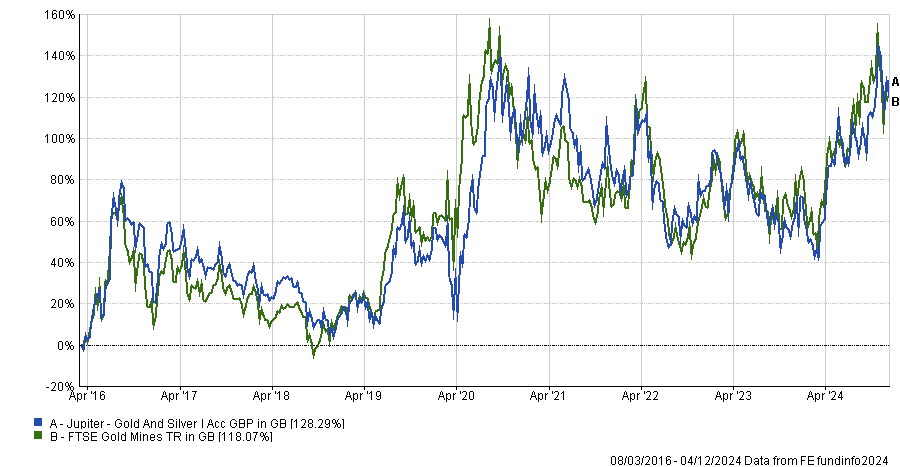

To add a different flavour to portfolios, Darius McDermott, managing director of Chelsea Financial Services, suggested the Jupiter Gold & Silver fund. It owns a diversified portfolio of physical gold and silver bullion alongside mining stocks.

Performance of fund vs benchmark since inception

Source: FE Analytics

Its manager, Ned Naylor-Leyland, has a bearish outlook. “He warns that unsustainable government deficits could push central banks to slash interest rates, even in the face of persistent inflation,” McDermott explained.

“Such a move, he argues, could destabilise the financial system, creating the perfect storm for a significant surge in gold prices.”