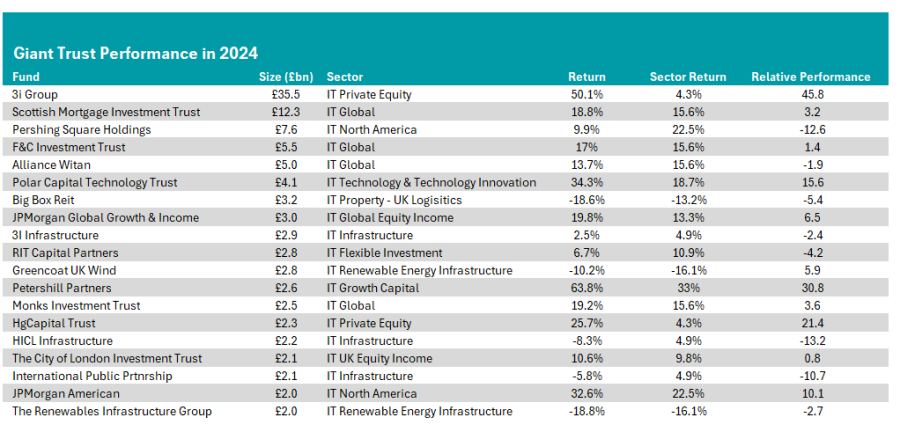

The performance of the largest and most well-known investment trusts was mixed in 2024. Of the 20 largest investment trusts in the AIC universe, nine failed to beat their sector average last year, and six more failed to deliver positive returns.

Nevertheless, it was not all doom and gloom, and some giant trusts rewarded investors in 2024, with 11 trusts beating their sector average, while five posted a double-digit outperformance relative to the average peer.

Below, Trustnet looks at the performance of the 20 largest trusts in the AIC Investment Companies universe. We have removed all unclassified trusts from the list.

Source: FE Analytics

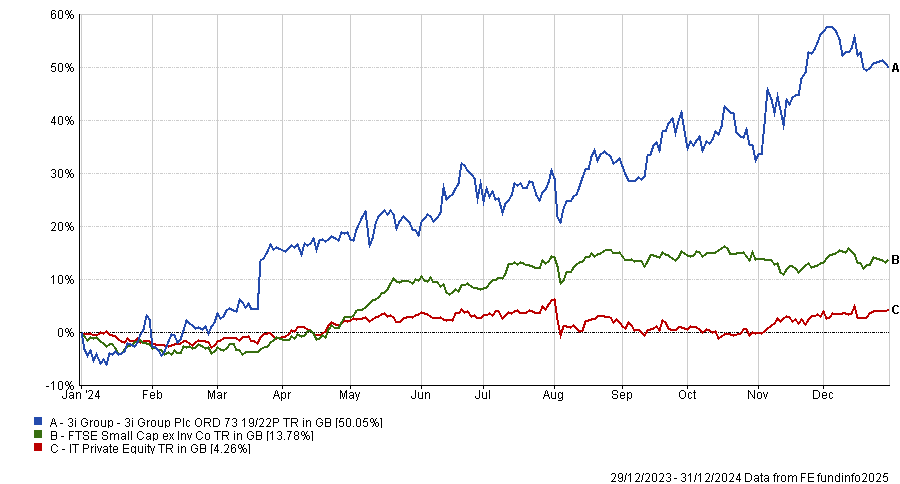

It was a good year for the £35.5bn 3i Group, which was up 50.1% in 2024. This was the best result in the IT Private Equity sector, beating its average competitor by 46 percentage points. By comparison, HgCapital Trust, the second best-performing private equity trust last year, was up 25.7%.

This made 3i one of the best-performing investment trusts in 2024 overall.

Performance of the trust vs the sector and benchmark in 2024

Source: FE Analytics

Additionally, over the past three years, 3i posted a return of 180.7%, the best performance in the IT Private Equity sector. However, it is one of the more expensive investment trusts on the market trading at a premium of 60.2%, according to the latest data available.

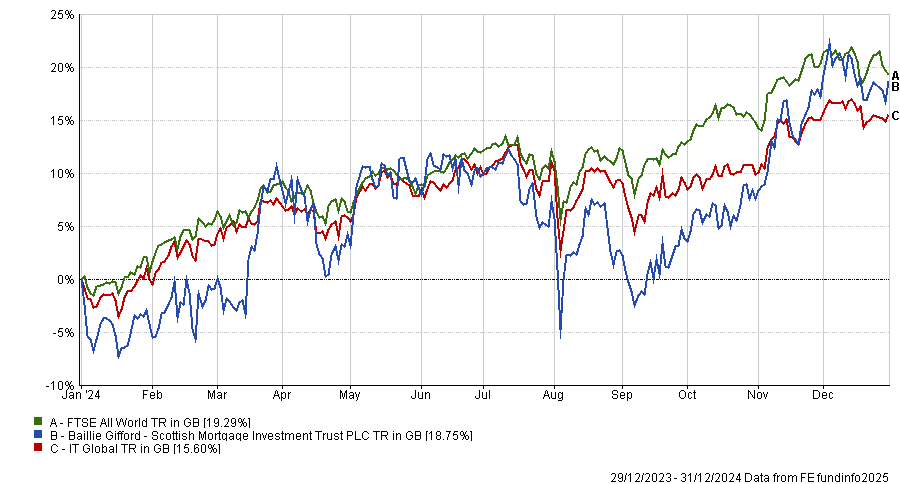

The second largest investment trust, the £12.3bn Scottish Mortgage Investment Trust, led by FE Fundinfo Alpha Manager Tom Slater and Lawrence Burns, was up by 18.8% last year, outperforming the IT Global sector average by 3.2 percentage points.

Performance of the trust vs the sector and benchmark in 2024

Source: FE Analytics

This performance was the result of stock selection, with holdings such as Amazon, Meta, Nvidia and Mercado Libre all performing well. Moreover, the trust embarked on a large share buyback initiative, repurchasing more than £1bn of its own stocks, significantly narrowing its own discount.

With the best in-sector five-year performance and the second-best over the past decade, it has put behind its poor 2021 and remained a favourite trust for UK investors. It is also still one of the most researched trusts on Trustnet.

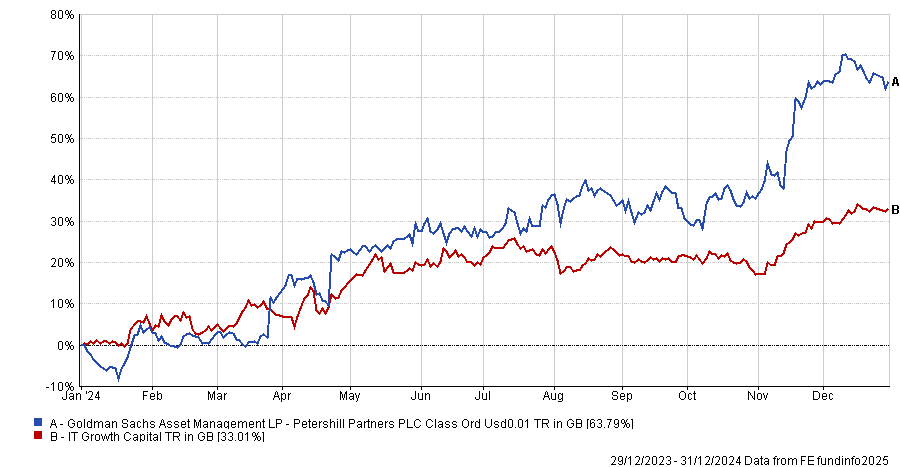

Meanwhile, FTSE 250 constituent Petershill Partners was the best-performing giant trust on our list. It invests in a variety of alternative asset managers and private equity firms and so participates in fee income from around 200 underlying funds.

Performance of the trust vs the sector in 2024.

Source: FE Analytics

Last year, it surged by 63.8%, against the IT Growth Capital average of 33%, the second-best performance amongst investment trusts overall. Despite this strong performance, the trust trades at a discount of 39.9% to NAV.

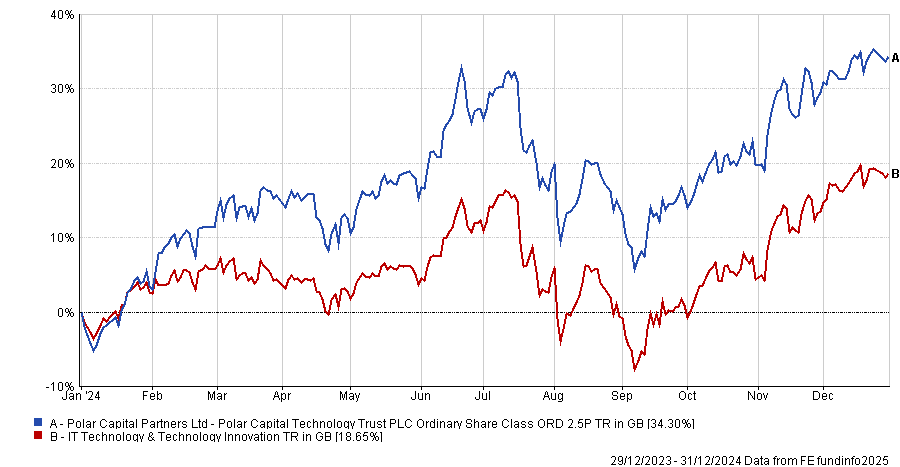

Technology-focused trusts, such as the £4.1bn Polar Capital Technology Trust, also did well last year. It rose by 34.3% last year, compared to the peer group average of 18.7%.

Performance of the trust vs the sector in 2024.

Source: FE Analytics

This performance may be a consequence of the trust’s allocation towards the top-performing US stocks. It has 6-11% allocations to Apple, Meta, Microsoft and Nvidia, allowing investors to benefit from the ongoing excitement over the ‘Magnificent Seven’ companies.

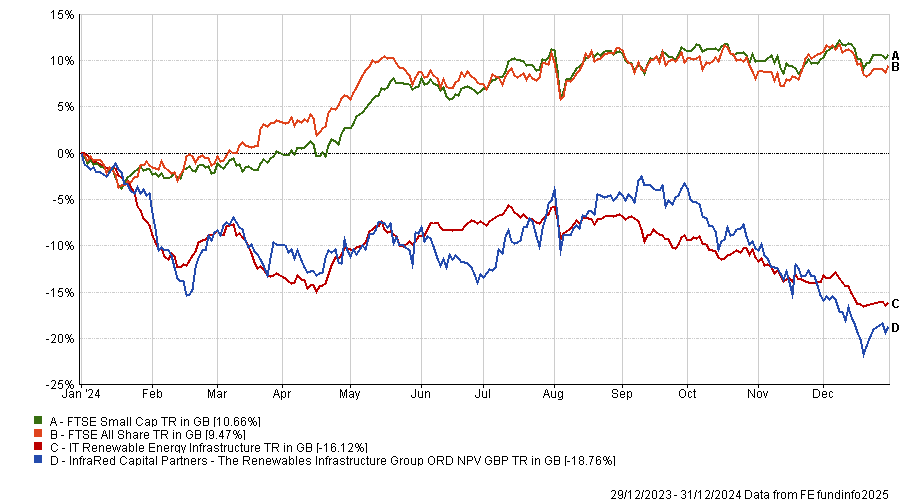

However, it was not all plain sailing for giant trusts last year. The worst performer in absolute terms was the Renewables Infrastructure Group. The renewable energy infrastructure sector had a poor year, with the average trust down by 16.1%, but this strategy slid by a further 2.7 percentage points

The trust has now failed to deliver positive returns over the past three and five years. However, over 10 years, it was up by 50.3%.

Performance of the trust vs the sector and benchmark in 2024

Source: FE Analytics

Indeed, some experts suggested it may be poised for a resurgence, with its significant exposure to UK offshore wind farms likely to thrive if the government delivers on promises of further green energy and infrastructure investment.

It was not the largest relative underperformer however, as the £2.2bn HICL Infrastructure trust underperformed its sector by 13.2 percentage points.

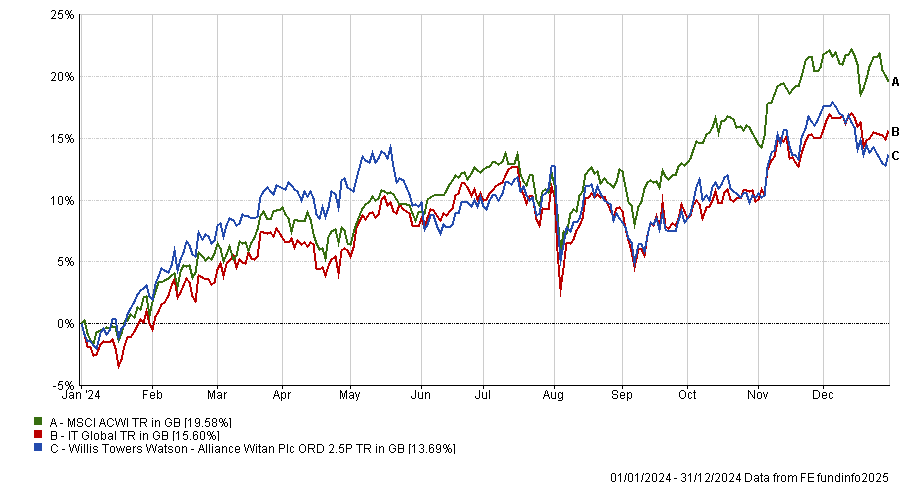

Elsewhere, despite making a 13.7% return, the £5.1bn Alliance Witan trust, managed by Craig Baker, Mark Davis and Stuart Gray, underperformed its IT Global sector average by 1.9 percentage points.

Performance of the trust vs the sector and benchmark in 2024.

Source: FE Analytics

As the Alliance Witan team explained in their December factsheet, underperformance last year was due to underweighting significant US stocks, most notably Apple, Nvidia and Broadcom. Additionally, analysts on the team noted that the 2.4% allocation towards UnitedHealth Group caused a decline following the assassination of its CEO in early December.