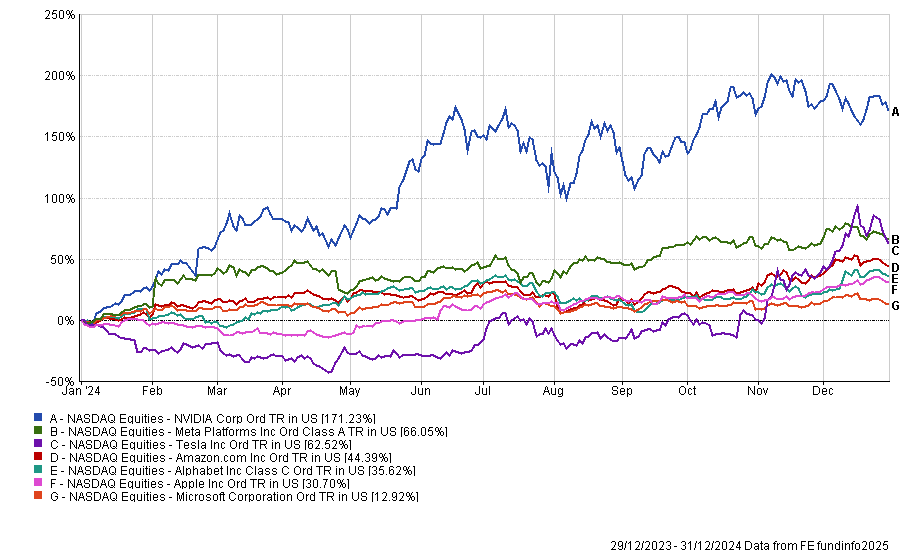

The Magnificent Seven tech stocks remained one of the biggest stories for investors in 2024, spearheaded by market darling Nvidia, which delivered a 171% total return last year.

Excitement around these companies may seem limitless. Indeed, the seven stocks – Amazon, Apple, Nvidia, Microsoft, Tesla, Meta and Alphabet – represent more than 20% of the MSCI World Index.

Performance of Magnificent Seven in 2024

Source: FE Analytics

However, managers cautioned investors not to get swept up by the euphoria and put all their eggs into one basket of stocks. Although exciting, John O’Toole, head of multi-asset at Amundi, argued: “The way to make long-term investment safe is to make it boring.”

The biggest reason to broaden out from the biggest tech winners is the importance of diversification. Portfolios should hold a variety of companies, even if it means underweighting these exciting businesses, which can lead to lower returns, but also mitigates for any issues in the future.

For O’Toole, this is the only way to build long-term strategies and ensure that portfolios do not “get tripped up when something like Nvidia delivers poor earnings”.

Indeed, as the August stock market sell-off demonstrated, poor results from some of these businesses can have big consequences. Although the sell-off was short-lived, investors could view it as a warning sign.

Ian Mortimer, manager of Guinness Global Innovators, said as much. He noted that, with these companies rising to stratospheric heights, the pressure to perform – and the expectations they are under – makes their success more challenging.

“In simple terms, the rule of big numbers means that it is difficult to keep growing your earnings at 50% for long periods”, he explained. Companies such as the Magnificent Seven that demand investors pay a lot for future growth now have such high expectations for earnings that they “do not have to be bad, they just have to disappoint”.

As a result, the Guinness manager said that it was a “reasonable expectation” that these companies’ growth might begin to moderate, and that investors’ portfolios need to prepare for that.

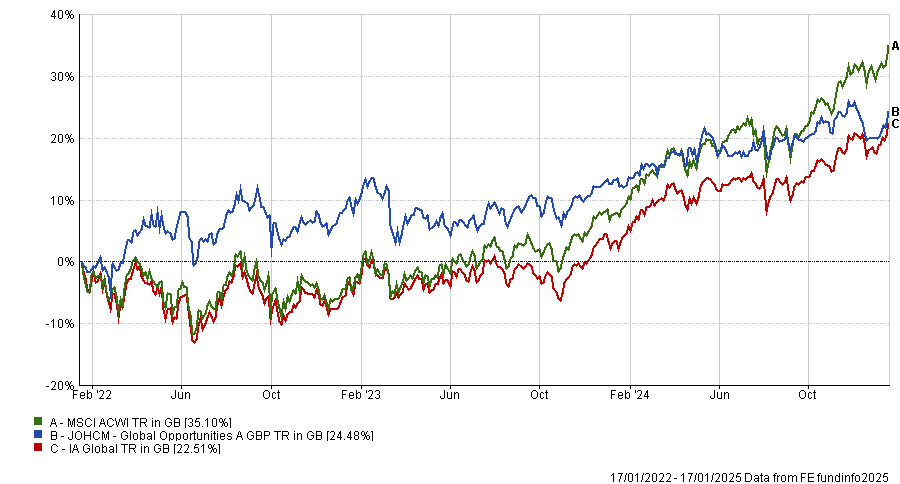

To do this, Ben Leyland, FE Fundinfo Alpha Manager of the JOHCM Global Opportunities fund, said a well-balanced portfolio should include both good-quality companies and underappreciated opportunities that are facing headwinds.

“We see that latter group as the place where investors can sow their acorns and where you will see the fruits of your investment”, he explained.

While he conceded that this approach has dragged on the portfolio’s results, he maintained it will pay off over the longer term, even if it is less immediately exciting.

Performance of the fund vs the sector and benchmark over 3yrs

Source: FE Analytics

Similarly, while Ian Mortimer, manager of Guinness Global Innovators owns six of the Magnificent Seven, his equally weighted approach aims to eliminate stock-specific risk within the portfolio and improve diversification.

As a result, four of the seven US giants are underweight positions in the portfolio relative to the MSCI World Benchmark, while most of the fund's top 10 holdings are composed of businesses outside of the Magnificent Seven, such as the London Stock Exchange, Netflix, or Mastercard, to improve diversification.

He explained: “We are still trying to do what we have been for the past 15 years – maintain a relatively diversified portfolio, trying lots of different companies, different business drivers and sticking to a long-term view because that is what we think will drive performance.”

Investors should also be wary of funds that have high exposure to the Magnificent Seven, including passive trackers and active funds that have added to them to avoid terminal underperformance.

Leyland argued that investors' obsession with the most exciting companies on the market has shaped a trend that he and his co-manager Robert Lancastle called the “tyranny of the benchmark”.

As managers have become more focused on matching or beating the benchmark, deviation has been discouraged and funds have developed “inappropriately large exposures” to parts of the market, such as tech, he said.

The JO Hambro manager added that even some value funds now have very expensive holdings because companies such as the Magnificent Seven represent a large part of the index. As a result, many funds are now less diversified than investors think.

Passive funds no longer offer the diversity they used to either. In March last year, the 10 largest stocks in the iShares MSCI World ETF, for example, accounted for 21.4% of the total index. This has been upped to 26.2% today. It means passive funds investing in indices with high weightings to the Magnificent Seven are no longer a one-stop-shop for portfolio diversity.