It has been five years of ups and downs for markets since the outbreak of Covid towards the end of February 2020, with next month marking five years since the first lockdown in the UK. Since then, Fidelity International investment director Tom Stevenson said it has been “a rollercoaster for investors”.

Next month will mark the fifth anniversary of the UK’s first lockdown in response to the Covid pandemic. Back in 2020, the MSCI World fell by more than 20% in the month of March – something that proved a buying opportunity. Indeed, since the end of March the global market index is up some 135.3%.

Even accounting for the drop, the MSCI World is up 87.6% over the past five years, while other markets have also risen strongly. Although the past five years may have been volatile, Stevenson said there are crucial lessons that investors can learn from the post-pandemic world.

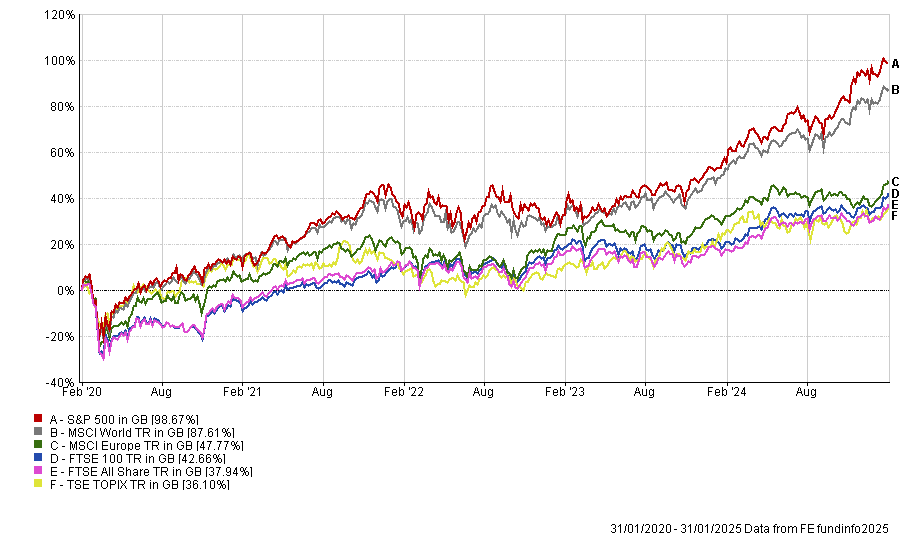

Performance of global equity markets

Source: FE Analytics

Firstly, he argued that the pandemic should remind investors about the stock market's resilience. "Time is a great healer for investors", he said. Despite high levels of volatility, most major stock markets have risen over the past five years.

The S&P 500 is the most notable, surging 98%, but it was far from the only market to rise. Indeed, the MSCI Europe, FTSE 100, TSE Topix and FTSE All-Share have all risen from pre-pandemic levels.

As a result, Stevenson explained that even a poorly timed investment during the pandemic would have now recovered. Managers at Vanguard agreed, noting even the “world’s unluckiest investor” would have made stellar returns during the post-pandemic recovery.

Stevenson’s second lesson may prove more controversial. He argued the pandemic proved that diversification could be a mixed blessing.

Conventional wisdom dictates that diversification is key to a successful portfolio. For example, last week, St James's Place’s chief investment officer Justin Onuewkusi said the best way to navigate unchartered territory is diversification. “Predictions fail, but diversified portfolios succeed,” he said.

However, Stevenson argued that post-pandemic, the traditional 60/40 approach to diversification offered “mixed results”. He explained that this was because bonds moved in line with equities, which diluted returns for investors.

Last month, Ernst Knacke, head of research at Shard Capital agreed, arguing the traditional 60/40 portfolio was “broken” in the current period of high volatility and high costs.

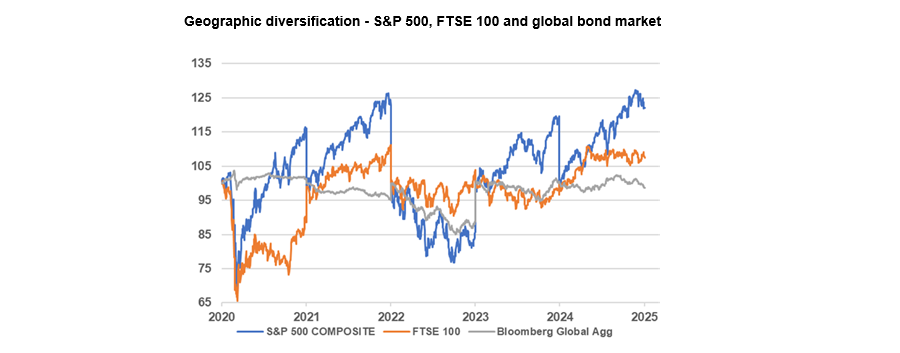

However, while asset diversification may have failed, Stevenson said that geographic diversification proved more successful. For example, during the 2022 bear market, holding the FTSE 100 would have insulated investors from the tumble experienced by the S&P 500.

Source: Fidelity International. LSEG Datastream, 14/01/2020-14/01/2025. Source: Rebase to 100, S&P 500 Composite, FTSE 100, Bloomberg Global Aggregate USD

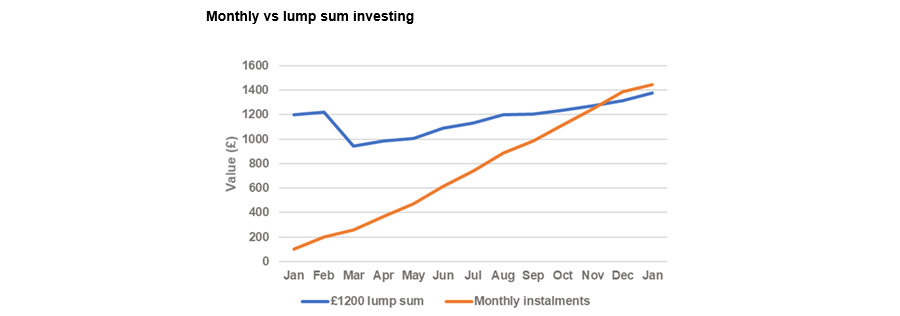

The pandemic also demonstrated the importance of regular investing. He said putting £1,200 into the market during the March 2020 low would have grown by 15% for investors over the first year. However, data indicates that a slower and steadier approach would have proven more effective.

Indeed, data from the London Stock Exchange found that investors who spread out £1,200 through 12 monthly sums would have been up by 21% over the same period, a difference of six percentage points.

Source: Fidelity International. LSEG Datastream. 13/01/2020 - 13/01/2021. MSCI World U$

While Stevenson conceded, “this approach does not maximise returns in rising markets”, he noted it can “shield investors from severe market drops”

Another lesson the pandemic demonstrated is the difficulty of picking winning stocks for even the most talented investors. As countries locked down and videoconferencing became more common, stocks such as Zoom experienced a meteoric rise in value, peaking at $559 per share. This proved to be a “flash in the pan”, with shares now back down to $87.

Share price performance of Zoom over the past 5yrs

Source: Google Analytics

Equally, not all businesses that underperformed during the pandemic stayed that way. International Consolidated Airlines' shares fell around 75% during the pandemic, but it has started to rally this year and is now down just 9%.

Performance of IAG over the past 5yrs

Source: FE Analytics.

For Stevenson, the pandemic also reminded investors that contrarian investing was “not for the faint-hearted” but can be rewarding. A willingness to be contrarian can sometimes pay off handsomely but investors will need to take some lumps along the way.

If an investor had been brave enough to invest £100 in the MSCI World in March 2020, it would now be worth £230, but they would have had to stomach losses of up to a third in the short term.

However, Stevenson argued: “To achieve this would have required perfect timing, which is nearly impossible”.

Indeed, the market rebounded quickly, recovering to pre-pandemic levels by August. As a result, investors had less than half a year to get the timing right.

Stevenson said: “The hardest thing about market timing is less knowing when to get out and more having the courage to get back in again before the moment has passed.”