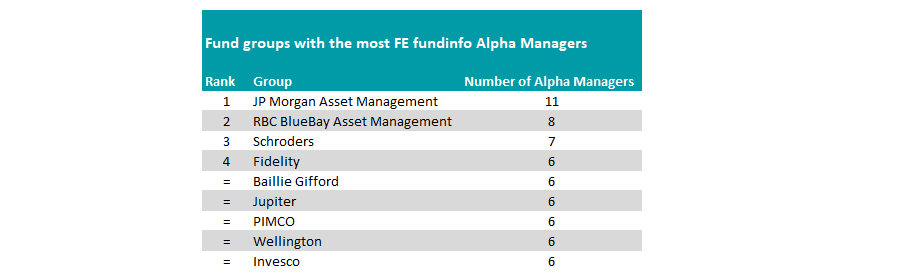

JP Morgan Asset Management now houses the most FE fundinfo Alpha Managers after the latest rebalance, knocking Fidelity International off the top spot.

The firm now boasts 11 Alpha Managers, two more than last year, although not all are the same. Mark Davids and Amit Mehta lost their Alpha Manager status this year, while Andrew Headley and Jonathan Simon regained theirs in 2025. James Cook and Scott Davis, meanwhile, achieved the feat for the first time in the latest rebalance.

In second place, there was a meteoric rise up the rankings from managers at RBC Bluebay Asset Management, where the number of Alpha Managers has doubled from four to eight over the past year.

Schroders was in third place with seven names. There were three changes here. Losing the Alpha Manager ratings were Masaki Taketsume Julia Ho and John Warren, while Frank Thormann, John Bowler and Scott MacLennan gained it. All three got the coveted title for the first time in the latest rebalance.

Formerly top of the rankings, Fidelity dropped down to joint fourth place with six Alpha Managers. Nitin Bajaj, Jeremy Podger, Rosanna Burcheri and Leigh Himsworth dropped out of the rankings, while only Ashish Kochar was added this year. Burcheri moved from Fidelity to Artemis and has lost her title, while Himsworth left the firm last year.

Baillie Gifford, Jupiter, PIMCO, Wellington and Invesco were the other firms in joint fourth place with six managers gaining or maintaining the coveted title.

Source: FE fundinfo

In total, there were 55 new Alpha Managers crowned in 2025, with 42 awarded it for the first time, including Raheel Altaf, who runs Artemis SmartGARP Global Emerging Markets Equity, Rory Powe, who manages MAN GLG Continental European Growth (among others) and Vivek Taneeru, who heads Matthews Asia Sustainable Future.

Charles Younes, deputy chief investment officer of FE Investments, said: “Altaf and Powe stand out as exceptional performers. Altaf’s disciplined quantitative approach has been a key driver of success for his fund, while Powe’s fund, despite periods of underperformance, has ultimately delivered stronger returns over the long-term in comparison to many of his peers at other European equity funds.”

There was also a rise in the number of environmental, social and governance (ESG)-related fund managers on the list, who have historically struggled to gain the award due to short track records.

Alongside Powe and Taneeru, other notable sustainable fund managers who were ranked as Alpha Managers this year include Scott MacLennan of Schroders and Andrew Hill of Invesco.

There were 13 managers who previously held the award that were reintroduced this year, including M&G’s Leonard Vinville, who has been an Alpha Manager nine times but was excluded last year.

FE Alpha Managers represent the top 10% of the UK retail-facing and wholesale investment industry based on their entire career performance. Rebalanced once a year, the ratings are based on risk-adjusted alpha (using the Sortino ratio) with a bias towards those with longer track records who have consistently outperformed the relevant benchmark.

Among the longstanding Alpha Managers, some 29 names have kept their title for 10 consecutive years, including Mark Slater (Slater Investments), Richard Woolnough (M&G), James Thomson (Rathbone), Nick Train (Lindsell Train), Alex Wright (Fidelity), Alex Grispos (Ruffer LLP), Barry Norris (Argonaut), David Gait (Stewart Investors), Sebastian Lyon (Troy) and Ezra Sun (Veritas).