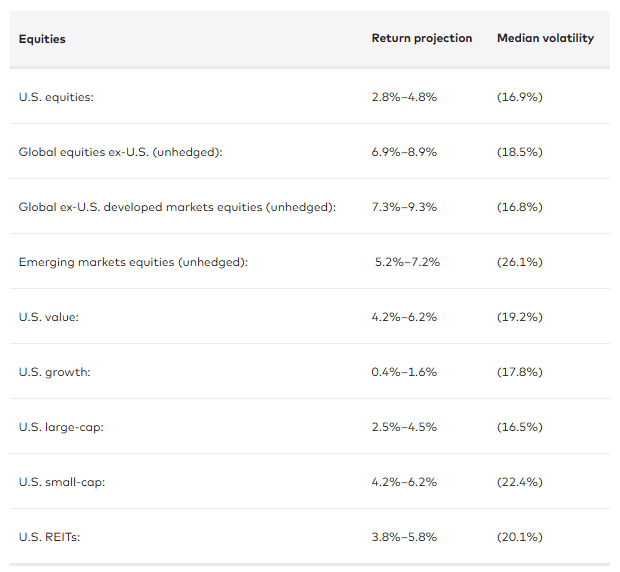

US equities will make a paltry return in comparison to the rest of the world, according to Vanguard’s 10-year annualised return outlook. It is based on the firm’s Capital Markets Model, which looks at the factors that drive long-term returns (such as yield curves and stock valuations) and calculates how much each will generate.

It assesses the likelihood of various investment outcomes and runs 10,000 simulations for each modelled asset class.

Equity forecasts reflect a 2 percentage point range around the 50th percentile of the distribution of probable outcomes, while fixed income forecasts reflect a 1 percentage point range around the 50th percentile.

In its latest model, which is based off data collected in the final quarter of 2024, average annual US equity returns are forecast to be between 2.8% and 4.8% over the next decade. This is down from between 4.2% and 6.2% a year ago.

The US market had another barnstorming year in 2024, with the S&P 500 up 26.7% while the tech-heavy Nasdaq rose 31.9%.

Both indices have made double-digit gains in five of the past six calendar years, with 2022 the only exception – a time when interest rates were on the rise due to rapid inflation.

After another strong year, Vanguard’s model has brought its average return down as valuations have become even more stretched.

Vanguard's equity projections

Source: Vanguard

The worst area will be US growth, which has been on a phenomenal run since the Covid pandemic. Over five years, the S&P 500 Growth index (129.5%) has made almost double the S&P 500 Value index (68.3%). The same is true over the past decade: 397.1% versus 200.3% respectively.

US value stocks should hold up better as they are coming from a lower base, while mid- and small-caps should outperform large-caps, the research showed.

However, the best place to be is developed markets outside the US, namely the UK, Europe and Japan, which are forecast to average returns of between 7.3% and 9.3% with slightly lower volatility. This is marginally higher than a year ago.

Emerging markets sit between the two, with return projections of 5.2%-7.2%, although the volatility is much higher in this area. This is some 1.4 percentage points lower than it was a year prior.

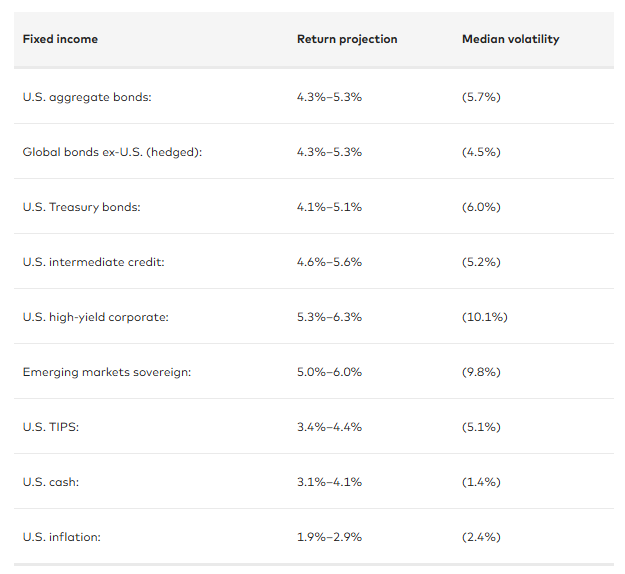

Investors may be better off in bonds than equities – particularly those with a lower propensity for risk. Returns are broadly in-line with equities (and in some cases much more favourable than US stocks) but with much lower volatility, as the below table shows.

Vanguard's fixed income projections

Source: Vanguard

The best returns are projected to come from US high-yield bonds, which could pay between 5.3% and 6.3% per year over the next decade, although investors will still have to stomach double-digit volatility.

Emerging market debt is forecast to pay out slightly less (5-6%) but with slightly lower volatility. However, there are strong gains to be made in Treasuries, credit and from global bonds outside of America.

Even US Treasuries – often viewed as risk-free given the US government’s exceptionally low likelihood to default – are forecast to produce more than American equities, with projected returns of between 4.1% and 5.1%.

Cash will produce returns of 3.1%–4.1% if the projections are correct, more than US growth stocks over the course of the next decade, which will also fail to beat inflation, which is forecast at between 1.9% and 2.9%.

These projections follow Capital Group’s 20-year forecasts last week which, like Vanguard’s, were lower than a year ago.

Maddi Dessner, head of asset class services at Capital Group, said: “While we’ve lowered our return expectations for global equities, we expect to continue to see bright pockets of opportunity driven by structural and cyclical factors.”

Capital Group had higher expectations for US equities, while forecasting returns from non-US developed markets to be lower.