St James’s Place, Liontrust Asset Management and Fidelity International are all prominently highlighted in the latest ‘Spot the dog’, the biannual report by Bestinvest highlighting funds that have lagged behind a relevant benchmark by over 5% for the past three years as well as in each individual year.

Since the last edition in August 2024, the kennel didn’t grow any larger, with the same number of funds (137) meeting the criteria. However, the size of assets represented has increased over this time from £53.4bn to £67.3bn – some 26%.

Bestinvest director Jason Hollands suggested investors take this as an invite to review their portfolios regularly.

“While the report should never be treated as a ‘sell’ list, it highlights the importance of keeping a close watch on your investments and assessing what action, if any, is required and when,” he said.

“Actively managed funds can underperform for a variety of reasons – from a run of bad luck to instability in the team or simply bad decision making. Investors should endeavour to find managers with the right skills to deliver superior long-term returns. This is imperative to justify paying the fees to be invested in those funds.”

Lindsell Train UK Equity has made its second appearance in the list. The popular fund run by Nick Train was found to be a ‘dog’ fund for the first time last year and comes back to the dog house after a short break in August 2024. It is accompanied by its US cousin, WS Lindsell Train North American Equity.

Train’s fund was one of 15 ‘Great Danes’ – funds with more than £1bn in assets under management (AUM) to have made the list. Their number has grown from 10 in the last edition and together, they account for £40bn – 60% of the assets reported.

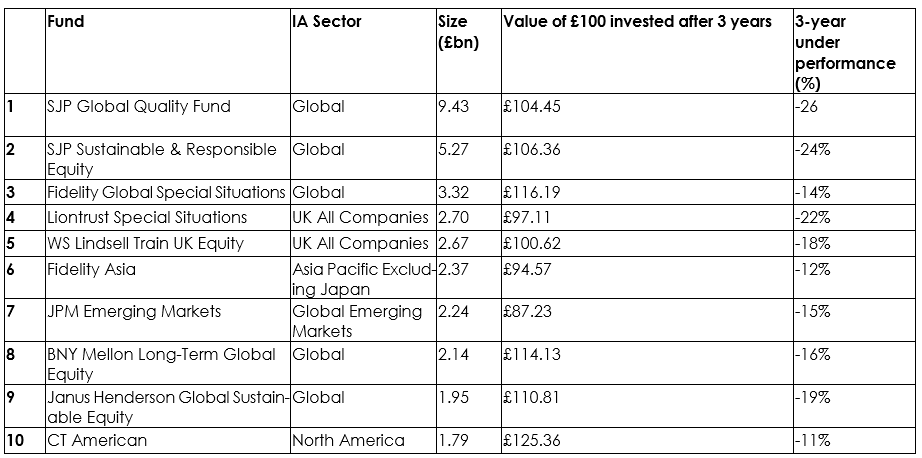

Largest underperforming funds

Source: Spot the Dog report

With a portfolio of just over £9.4bn, the largest of all was SJP Global Quality, whose style has long been out of favour, Hollands said. It was followed in second place by another vehicle run by St. James’s Place: Sustainable & Responsible Equity.

Both strategies have been recently revised by the management house and will continue the year on a new footing without Impax Asset Management in the advisory role it had since October 2024.

This is an improvement from the last report, when St. James’s Place had three funds in the list. Fidelity and Columbia Threadneedle also redeemed somewhat, the former with seven dog funds instead of eight, the latter seven instead of nine.

Liontrust Special Situations was another prominent name included in the list, an eyebrow raiser for Hollands as it was once seen as a flagship fund. It holds significant exposure to smaller companies, which have struggled in recent years.

With seven funds in the kennel, Liontrust is faring worse this year compared to last year, when it had six.

Other underperformers included Liontrust Sustainable Future Global Growth and the Liontrust Sustainable Future European Growth fund, which demonstrates another trend in the report: an abundance of environmental, social and governance (ESG) strategies.

“The financial markets have been unsympathetic to funds with ESG properties in recent years in part because of soaring energy prices but also owing to negative returns from alternative energy shares both in 2023 and 2024,” Hollands said.

“Over the three-year period covered in our latest report, the MSCI World Energy Index delivered a total return in GBP of 71.3%, well ahead of the MSCI AC World Index total return of 28.6%.

“Compare this to the alternative and renewable energy market, which fell out of favour during the post-pandemic surge in energy demand, and the story is very different. The MSCI Global Alternative Energy Index declined by 48.8% over the same three-year period highlighting why managers focused on green energy may have faced some challenges,” he added.

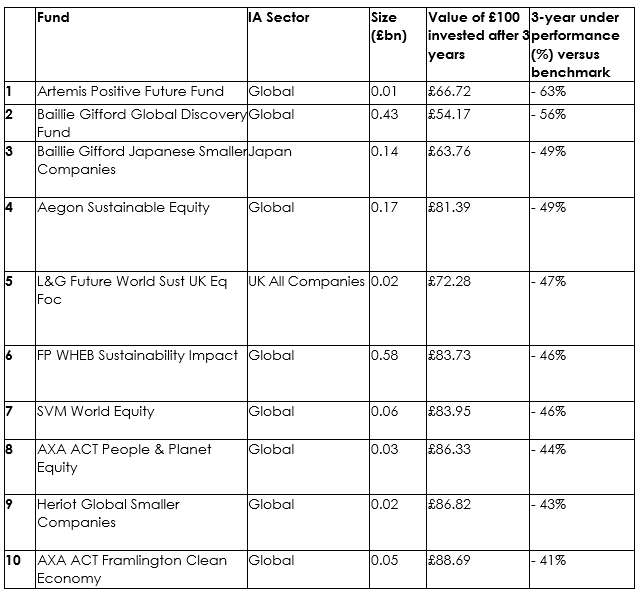

In fact, the worst performance overall came from a fund in this category, Artemis Positive Future, which lost a substantial 63% in the past three years. Other examples include Aegon Sustainable Equity (-49%), L&G Future World Sustainability UK Equity Focus (-47%) and AXA ACT Framlington Clean Economy (-41%).

Top 10 worst-performing funds overall

Source: Spot the Dog report

Baillie Gifford funds continue to need some dog training, with both the Global Discovery and Japanese Smaller Companies portfolios on the podium among the worst performers, as the table above shows.

While the IA Global sector had the largest number of problem pooches, the peer group with the highest percentage of dog funds was IA UK Smaller Companies, where 11 yappers made up 28% of the whole sector.

FP Octopus UK Micro Cap Growth (28 percentage point below the benchmark), WS Amati UK Listed Smaller Companies (21 percentage points) and Schroder UK Dynamic Smaller Companies all made the list.

Hollands said: “Only a few years ago, smaller-company-focused dog funds were a breed at risk of extinction but they have now made a comeback. The past three years have been tough for UK smaller companies, but especially so for the Alternative Investment Market (AIM) market.”