Mark Slater, Martin Lau and Richard Woolnough are among the FE fundinfo Alpha Managers to never lose their title since the inception of the rankings, research from Trustnet has shown.

FE fundinfo created the Alpha Manager awards in 2009 to recognise those who have consistently driven high returns for investors across their entire career using metrics including alpha generation and performance, with a bias towards longevity.

Since the awards’ inception just five people have kept hold of the coveted title every year: David Dudding from Columbia Threadneedle Investments; John Chatfeild-Roberts from Jupiter Asset Management; Mark Slater from his eponymous firm; FSSA Investments’ Martin Lau; and M&G Investments’ Richard Woolnough.

David Dudding – Columbia Threadneedle

Kicking off the list, which has been done by the alphabetical order of their first names, is Columbia Threadneedle’s David Dudding. He co-manages three funds: CT Global Focus; CT (Lux) Global Focus; and dVAM Global Equity Focus Strategy PCP.

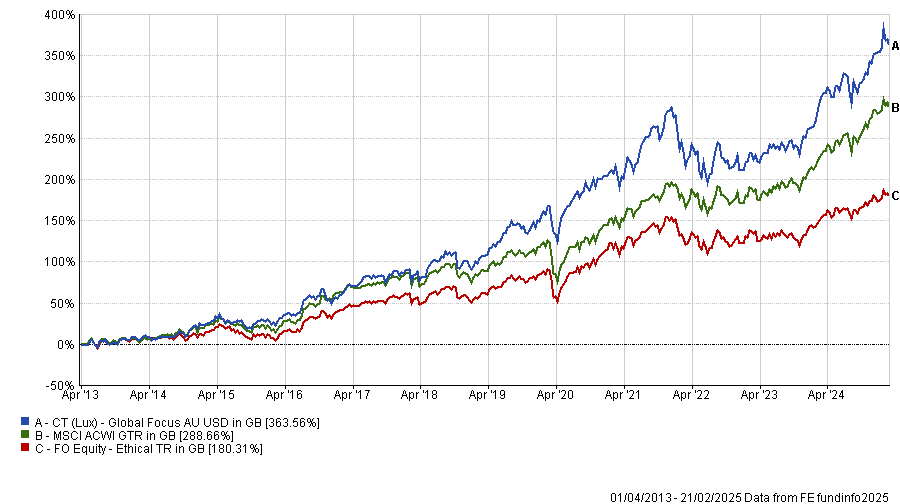

The largest of his portfolios is the offshore CT (Lux) Global Focus, with £3.8bn in assets under management. He has run this since 2013, during which time it has made investors 363.6%, around 80 percentage points more than the MSCI ACWI benchmark.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Recently the firm launched an open-ended investment company (OEIC) version of the fund. Since its inception in April 2018, the fund has made 165.2%, the eighth-best performance in the 280-strong IA Global sector during that time.

Over his career, he has also had stints managing European and smaller companies strategies at the firm, including CT European Select, which he ran from 2008 until 2021.

John Chatfeild-Roberts – Jupiter

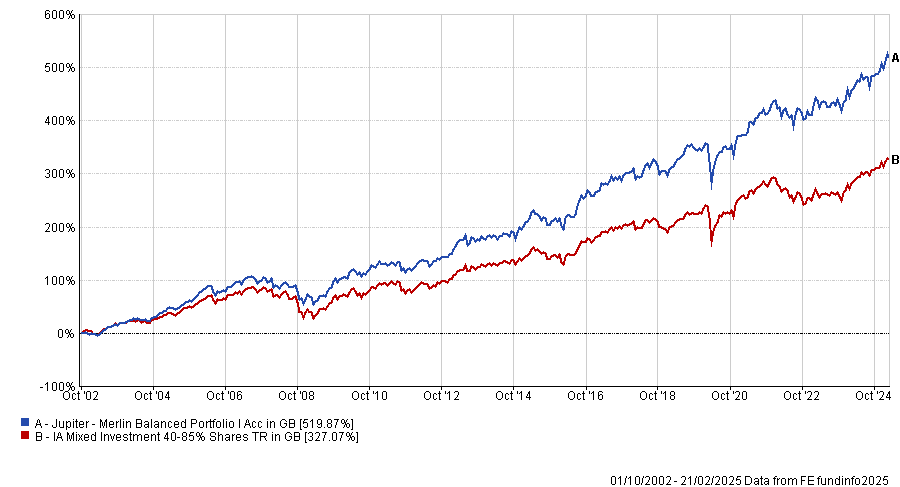

Up next, Jupiter’s John Chatfeild-Roberts heads up the Jupiter Merlin team, which runs a combined £6bn of investors’ cash in its fund-of-fund portfolios. The largest under his team is the £2bn Jupiter Merlin Balanced Portfolio, which has been a top-quartile performer over three, five and 10 years, as well as since inception in 2002, during which time it has made investors 519.9% – or more than six times their money.

Performance of fund vs sector since launch

Source: FE Analytics

Analysts at Square Mile gave the fund an ‘AA’ rating and said the team is “one of the most respected and experienced in the UK market”.

“Although the team of six is led by Chatfeild-Roberts and David Lewis, the day-to-day management of this fund is a collegiate effort, with input provided by all the team members,” they said, but noted that “much of the fund's longer-term success can be attributed to Chatfeild-Roberts and Algy Smith-Maxwell”.

Mark Slater – Slater Investments

Third alphabetically is Mark Slater, who runs four funds for his eponymous asset management group: Slater Recovery, Slater Growth, Slater Income and Slater GF Growth.

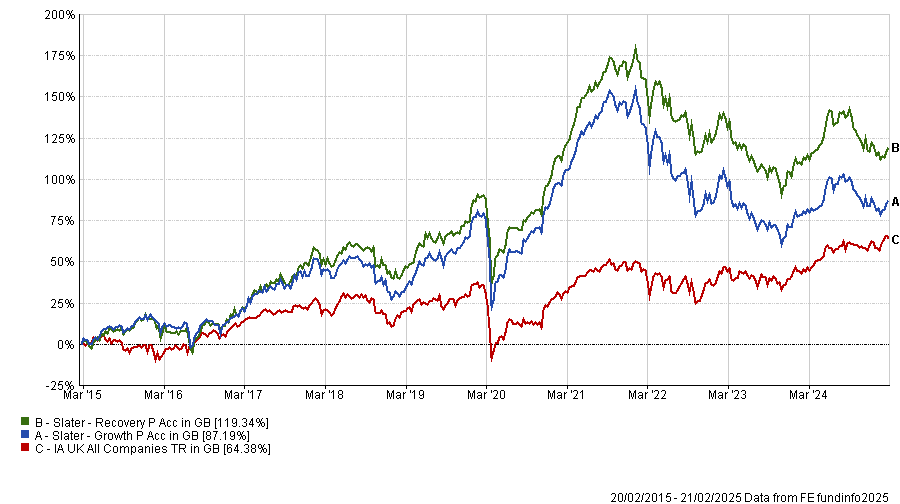

Although the returns from Slater Income have been less stellar over the past decade, Recovery and Growth both are top-quartile funds in the IA UK All Companies sector over 10 years, with the latter among the top five portfolios in the peer group.

Performance of funds vs sector over 10yrs

Source: FE Analytics

Slater Recovery is the fund he has managed the longest. Launched in 2003 it has a strong track record, up 599.9% under his tenure, some 160 percentage points ahead of the peer group average.

However it is Slater Growth that has more assets under management (£573m) and drew a recommendation from analysts at FE Investments.

“Prior to 2010, the fund used to be called Slater Pension and was run for a single pension client. Little has changed in the process, but a key difference was the removal of the market-cap limit, further allowing for investing in faster growing micro-cap stocks, which coincided with the strong outperformance thereafter,” they said.

“Although stock-picking has been positive for the fund, it is run as a concentrated approach and is thus potentially susceptible to significant losses from single names. Its structural avoidance of commodity and banking sectors, which make up a material part of the market, could lead to periods of underperformance should these sectors prevail.”

Martin Lau – FSSA Investments

Veteran Asia specialist Martin Lau has run a plethora of portfolios during his more than 20-year career at FSSA Investments. He runs a multitude of offshore funds, including FSSA China Growth, FSSA Hong Kong Growth and FSSA Greater China Growth, which he has managed since 2002.

The OEIC version of the latter fund launched in 2003 and is his longest-tenured fund within the Investment Association (IA) universe. Over the past decade it is up 119.9%, the third-best performance in the IA China/Greater China sector.

Launched in 2015, FSSA Asia Focus is the other in the IA universe, although performance here has been less impressive. It sits in the second quartile of the IA Asia Pacific Excluding Japan peer group since launch, up 146.9%, although it has fallen to below-average over five years.

Analysts at Hargreaves Lansdown decided both warranted inclusion on the firm’s Wealth List of recommended funds.

“We hold Lau in high regard and his long term track record is exceptional,” they said.

On the China fund specifically, they added it “could form part of a broader global portfolio, or diversify the Asian and emerging markets equities portion” as a fund focused on a single emerging country is a “high-risk option”.

Richard Woolnough – M&G Investments

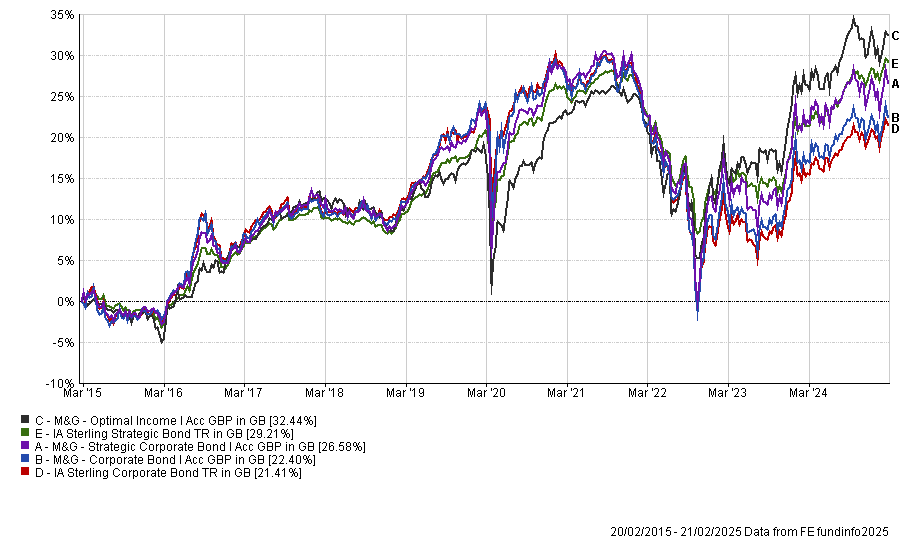

Last but not least is bond manager Richard Woolnough, who has run the M&G Strategic Corporate Bond and M&G Corporate Bond funds since 2004. He is also known for his M&G Optimal Income fund, which at one point was one of the largest funds in the UK. The portfolio remains hefty with £1.4bn but assets in the OEIC dropped when M&G moved the bulk of investors’ cash to an offshore version of the portfolio post the Brexit referendum.

All three have beaten their respective sectors over 10 years but the £1.3bn M&G Corporate Bond fund has drawn the eye of analysts at both Barclays and Fidelity, with both adding it to their respective best-buy lists.

Performance of funds vs sector over 10yrs

Source: FE Analytics

Analysts at Barclays said the fund offers a good way to gain exposure to the sterling corporate bond market, describing Woolnough as “an excellent manager”.

“Investment decisions are taken strategically and based on Woolnough’s economic outlook on global markets. This long-term view is then complemented by shorter-term views on specific markets and companies, which are usually driven by ideas sourced from the large team of analysts,” they added.

Analysts at Fidelity noted the fund mostly lends money to lower risk companies and that the managers will remove any foreign currency risk by ensuring they either lend in sterling or hedge any foreign currency loans to sterling.

“This fund can be a helpful addition to many portfolios, including those that seek a low-risk investment. It offers a reasonable increase in interest above the prevailing cash rate. The fund may be affected by any changes to interest rates and, if they rise, this fund may lose value,” they said.