RIT Capital Partners and Caledonia Investments have much in common. They are both at the higher risk, higher reward end of the IT Flexible Investment sector. They invest across private and listed assets and use external managers alongside in-house investments. They both benefit from scale; RIT Capital has a market value of £2.7bn and total assets of £4.3bn, while Caledonia has a market value of £2bn and net assets worth £3bn.

And they are both trading on a similar discount (28.1% for RIT Capital and 30.4% for Caledonia as of 28 February 2025), which has been painful for incumbent shareholders but may represent a buying opportunity for new investors.

Anthony Leatham, head of investment companies research at Peel Hunt, said: “We think both trusts are probably 10 percentage points too cheap on a discount basis.”

The trusts also have family office heritage in common. The Cayzer family owns circa 47% of Caledonia’s share capital, whereas RIT Capital was founded by the late Jacob Rothschild, whose daughter Hannah sits on the board, and the family holds a 22.6% stake.

“While this can reduce the effective free float of the trusts and potentially lead to concerns around shareholder concentration, we also see the long-term holding period as supportive of the strategies’ approach to blending private and public investments,” Leatham observed.

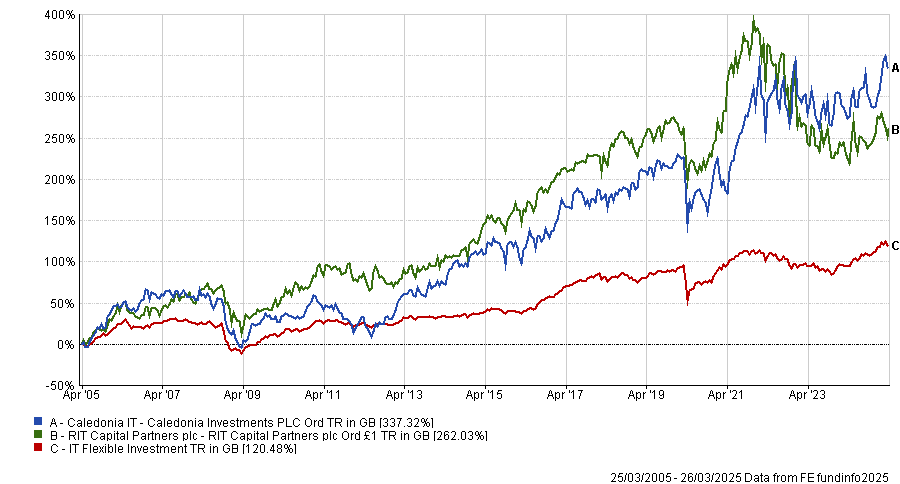

Over the very long term, both trusts have pulled well ahead of their sector, as the chart below shows, although performance has been more challenging in recent years for RIT Capital.

Performance of trusts vs sector over 20 years

Source: FE Analytics

Both trusts are engaging in share buybacks and have consistently grown their dividends.

Caledonia has raised its dividend for 57 consecutive years, making it one of the Association of Investment Companies’ Dividend Heroes, and currently has a 1.9% yield.

RIT Capital has a 2% yield and has grown its dividend for 10 consecutive years. The board has increased the 2025 dividend by 10.3% a part of a multi-pronged strategy to stimulate demand for the trust’s shares, according to analysts at Kepler Partners.

Below, Trustnet asked experts for their views on both trusts and whether they have a preference.

The case for Caledonia

Peel Hunt has an ‘outperform’ rating for RIT Capital and Caledonia but Leatham prefers the latter. “I gravitate towards things that are quite simple to understand and I don’t think Caledonia has ever been tempted to complicate the message or add in lots of bells and whistles,” he said.

“I think investors could easily put it in their portfolio and leave it there for a 10-year period and not necessarily have to worry about it.”

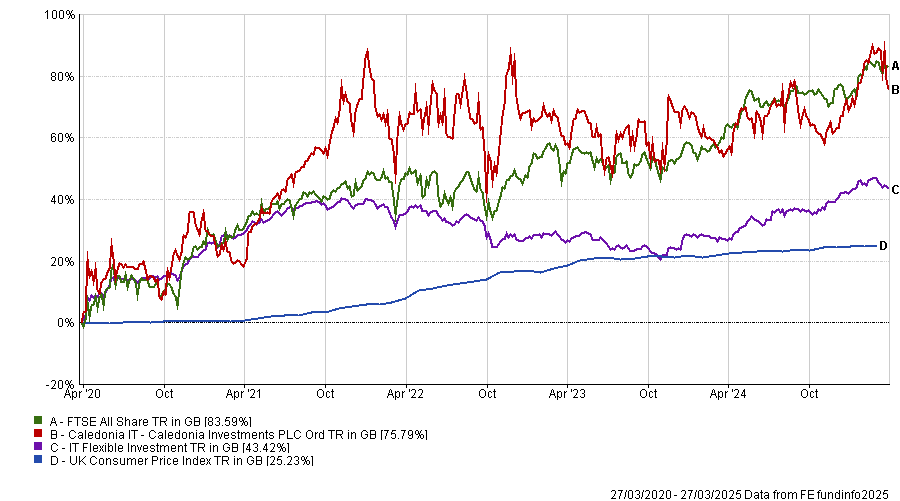

Caledonia has a strategic asset allocation of 30-40% in public companies, 25-35% in private capital and 25-35% in private equity funds. It aims to outperform inflation by 3-6% over the medium to long term and beat the FTSE All Share over 10 years.

Performance of trust vs benchmarks and sector over 5yrs

Source: FE Analytics

“The idea is to generate attractive long-term returns with lower than market volatility and maximise the use of the investment trust structure [by going] into less liquid investment opportunities,” Leatham said. There is a dual focus on building generational wealth and capital preservation.

The trust has “a very long-term, very deliberate investment style” stemming from its family office heritage and sticks to its knitting, he continued. The private capital team under Tom Leader focuses on robust, high-quality businesses with good cash generation and strong management teams, ideally operating in niche areas so they can take market share.

Caledonia is Winterflood’s sole recommendation from the Flexible Investment sector for 2025. Emma Bird, head of investment trusts research, said the discount offers an attractive entry point, “particularly given that shareholders recently approved a takeover waiver in relation to the Cayzer family ownership stake, which opened the door to a 5% buyback programme and removed a key constraint to buybacks over recent periods”.

Chris Salih, head of multi-asset and investment trust research at FundCalibre, is taking a “wait and see” approach to both trusts but has a slight preference for Caledonia, “given the strong dividend growth characteristics and stronger performance in recent times”.

In defence of RIT Capital

RIT Capital has a well-diversified portfolio with about 32% in private assets, 24% in uncorrelated strategies, mostly liquid credit, and the remainder in quoted equities, split between direct investments and third-party managers. The public equity portfolio includes opportunities in China, Japan, biotech and small- and mid-caps.

Prudence is a watchword for the investment team, analysts at Kepler Partners said: “Changes are made incrementally and the idea is that no one factor should knock returns significantly off course.”

The portfolio is constructed to preserve capital, generate real returns over time and deliver an element of protection during equity market downturns, they added.

The trust has a strong long-term track record but the past three calendar years have been much harder. “Equity risk exposure in the trust is much higher than many other constituents in the sector, but it also has had very little invested in the narrow cohort of mega-cap technology stocks,” Kepler’s analysts explained.

“Private companies (which RIT Capital has much more exposure to than most peers) drove very strong returns in 2020 and 2021 but have not contributed positively since then.”

Bird attributed the trust’s “significant de-rating” to public scrutiny of its unquoted investments but said there are signs performance is improving. “In its latest annual results for 2024, the fund delivered a NAV total return of 9.4%, outperforming the 5.5% return of its CPI plus 3% performance hurdle.”

Ewan Lovett-Turner, head of investment companies research at Deutsche Numis, said RIT Capital fell out of favour due to “questions raised over unquoted valuations, cost disclosure rules, limited promotion and unclear portfolio disclosures” but some of these headwinds are abating.

Cost disclosure rules have been amended and the private portfolio’s performance has been more resilient than expected, he said. Furthermore, J. Rothschild Capital Management has a new senior leadership team, which has improved the trust’s transparency and communication with shareholders.

Chief executive officer Maggie Fanari joined in March 2024 from the Ontario Teachers Pension Plan and brought in Mike Dannenbaum from Alliance Bernstein as head of public equities. Nick Khuu, who has spent over five years at J. Rothschild Capital Management, was promoted to chief investment officer at the end of 2023.

Caledonia and RIT Capital are both on Deutsche Numis’ recommended list but Lovett-Turner thinks RIT Capital has the edge currently. “The 28% discount offers an attractive entry point for a multi-asset portfolio, which we believe has the potential to deliver an attractive risk/return from exposures that are hard for investors to replicate. We believe downside to the shares is limited by share buybacks,” he said.

Hard-to-access investments include the Thrive and Iconiq funds, alongside private companies such as Motive (fleet management tech) and Epic Systems (healthcare records systems). “The strength of the new management team’s network has been demonstrated by an investment in SpaceX, which has delivered early gains,” Lovett-Turner added.