The latest Bank of America Global Fund Manager Survey is one of the most bearish on record, after global growth expectations collapsed to 30-year lows on US president Donald Trump’s trade tariffs.

The closely watched survey, which polled 164 investment professionals running a total of $386bn, was carried out between 4 and 10 April – when markets were reeling from the ‘Liberation Day’ tariffs unveiled by Trump on 2 April.

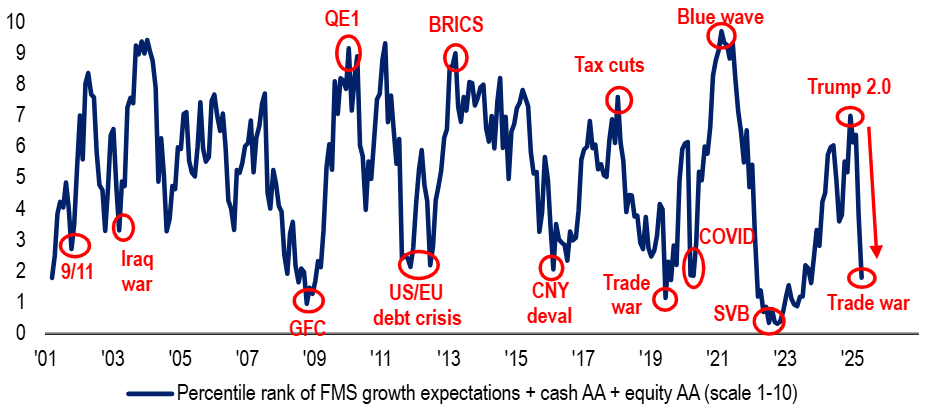

Bank of America’s broadest measure of fund manager sentiment, which looks at their global growth expectations, equity allocations and cash balances, fell to 1.8 in April, down from 3.8 in March and the lowest level since October 2023.

Percentile rank of fund manager growth expectations, cash levels and equity allocations

Source: BofA Global Fund Manager Survey – Apr 2025

The current level of sentiment is the fifth lowest on record, behind 2001, 2009, 2019 and 2022, Bank of America’s strategists pointed out.

The allocation to global equities fell to net 17% underweight in April, the most underweight since July 2023 and down 52 percentage points since February.

When it comes to tech stocks, which have led the stock market for an extended period, managers pulled back to a net 17% underweight. This is the lowest allocation since November 2022 and more than two standard deviations below the average of the past 23 years.

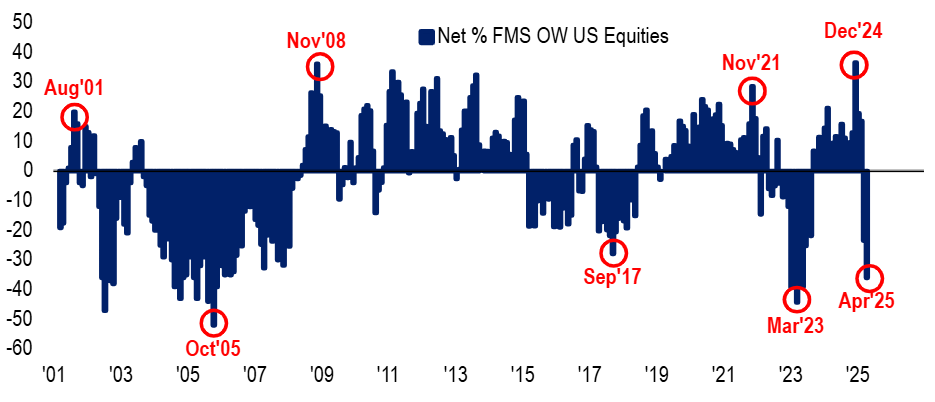

The allocation to US equities fell to net 36% underweight, meaning investors are at their most underweight since May 2023. The 53 percentage-point fall in the US equity weighting since February is the biggest two-month decline on record.

Net % of fund managers overweight US equities

Source: BofA Global Fund Manager Survey – Apr 2025

Expectations for the global economy fell to a record low in April, with a net 82% of asset allocators expecting weaker global growth. This is down from 44% in March.

A net 42% of investors now expect a global recession, which is the most since June 2023 and the fourth highest level of the past 20 years. Bank of America’s strategists noted that this is a “big flip” from March, when 52% said a recession was unlikely.

Meanwhile, managers’ average cash levels rose to 4.8%, up 125 basis points since February 2025. This is the largest two-month increase since April 2020.

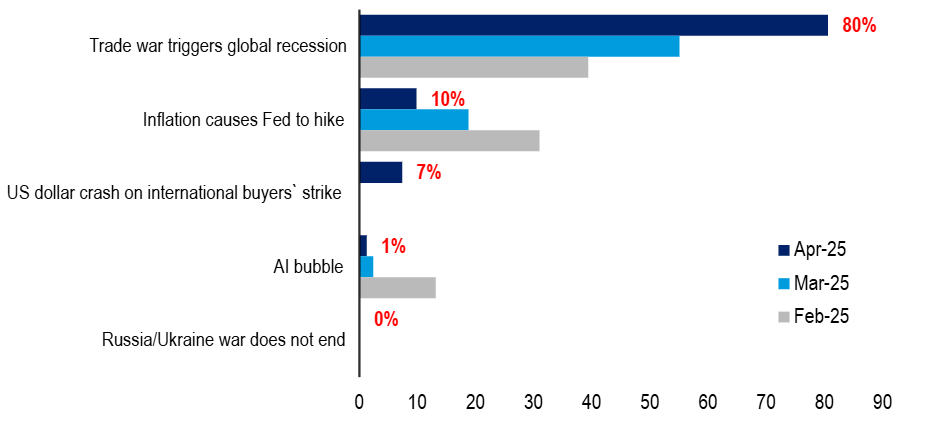

What fund managers consider the biggest tail risk

Source: BofA Global Fund Manager Survey – Apr 2025

A trade war triggering a global recession is viewed as the biggest ‘tail risk’ in the market, cited by 80% of fund managers. Bank of America strategists said this is the largest concentration for a tail risk in the 15-year history of the metric.

Concerns about inflation causing the Federal Reserve to hike interest rates and a potential bubble in artificial intelligence stocks have receded in April.

However, a crash in the US dollar because of an ‘international buyers’ strike’ was a new tail risk, worrying 7% of investors. A net 61% expect the US dollar to depreciate over the coming year, the most since May 2006

Gold is expected to be the best performing asset in 2025, favoured by 42% of fund managers. This is up from 23% in March and reflects the strong rise in the yellow metal as investors sought out safe havens during tariff volatility.

However, 49% of investors also said being long gold was the most crowded trade in the market, ending a 24-month run for the Magnificent Seven stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla).