Volatility has been a key feature not only in the investment world but also within savings. Savers are finding that many former top-paying accounts are not offering the best deals anymore, as rates remain changeable.

During the run-up to the new 2025/26 tax-year, easy-access cash ISAs thrived, as providers battled it out for the top spot, while other ISA rates also saw some improvements, as Caitlyn Eastell at Moneyfactscompare noted.

Since then, some of the top rates have tumbled, with three-year fixed ISAs taking a 0.22 percentage point drop in just three weeks.

“Consumers still waiting to pull the trigger on a deal would be wise to act fast as the current market leaders may not stick around for long. Following the recent market turmoil, it is likely that providers will be closely watching swap rates for any volatility,” she said.

“Investors should also be cautious to avoid making any spur-of-the-moment decisions with their pots because, despite savings rates falling in recent times, the number of deals paying inflation-busting rates has surpassed 1,600.”

The Consumer Price Index (CPI) fell to 2.6% in March from 2.8% in February, as reported this morning on Trustnet, and there are currently 1,608 savings accounts that beat this figure (based on a 10,000 deposit and excluding regular and children savers accounts).

This is higher than in April 2024, when 1,364 deals beat the previous monthly CPI of 3.2% and higher than in April 2023, when no deals could beat 10.1% of the previous month.

But April is predicted to be an inflationary month due to increasing energy prices and the picture is very uncertain further into the year, with the global trade war having unpredictable implications for rates.

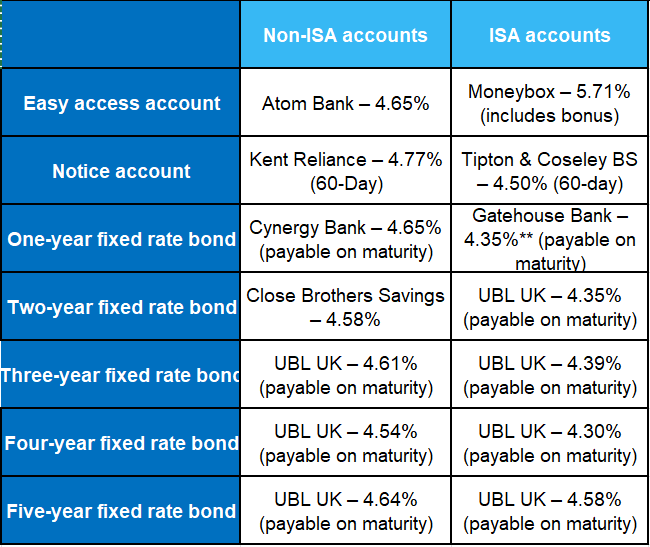

Right now, savers looking for the most competitive returns should look at easy-access accounts. Here, Moneybox is the top-payer, offering a bonus rate of 5.71%. The best non-ISA account, offered by Atom Bank, has a lower 4.65% yield, as the table below shows.

Today’s top savings deals based on a £10,000 lump sum

Source: Moneyfactscompare

Among the fixed-term options, longer-dated accounts are the most rewarding. Savers who are willing to lock their money away for at least five years can get 4.64% at UBL UK, which is also the top payer for four- and three-year deals. Shorter terms have lower, but comparable rates.

While fixed-term accounts continue to pay higher rates, savers will need to be more cautious with these, Eastell warned, as they could breach their Personal Savings Allowance (PSA).

PSA is £1,000 for basic-rate taxpayers, meaning they can earn up to £1,000 in interest a year without paying tax on it; higher-rate taxpayers have a PSA of £500.

According to Eastell, switching accounts is “key for any saver who finds that their loyalty is not being rewarded”, and they should be open to considering lesser-known brands, as most of these options are FSCS-protected.