Asset management groups are falling over themselves in a bid to prove their ethical and sustainability credentials as what was once regarded as a niche area of the market threatens to become all-encompassing.

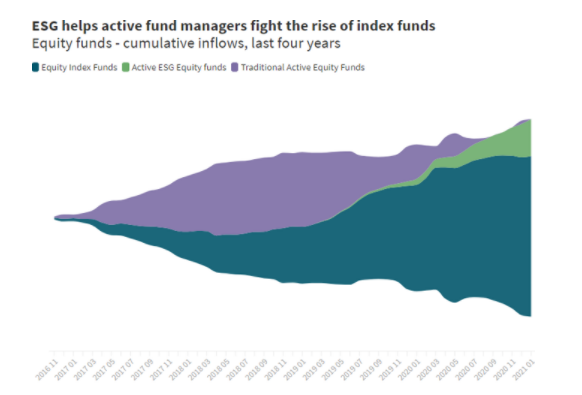

According to global funds network Calastone, ESG funds “enjoyed phenomenal growth all year” in 2020, accounting for more than half of all the flows into active equity funds.

Source: Calastone Fund Flows Index (FFI)

Asset managers are unsurprisingly following the money and over the past year there has been a wave of newly launched and repurposed portfolios in the sustainable investment space.

But while the industry’s direction of travel on this topic seems clear, will it be in everyone’s interests if every fund becomes aligned with sustainability and ESG practices? Should there always be space for funds that consider ESG risks, but only focus on financial returns? Is it right to deprive investors of the right to invest in morally-questionable industries such as tobacco, oil and armaments?

Adrian Lowcock, an independent commentator, said it is likely that sustainable investing becomes more widespread in markets, but that doesn’t mean there won’t be opportunities outside of that remit.

“It makes sense as, at its core, a sustainable business is a company that could in theory operate indefinitely, which is more attractive than a company which will need to completely reinvent itself in a few decades’ time,” he explained.

“Fund managers look to reduce risks and gain some marginal advantage when investing and a business that is sustainable will help achieve this.

“Many funds will incorporate some analysis in their stock-selection process which assesses this risk and even filters out companies which don’t have a high enough sustainability criteria. In this way, sustainability becomes another consideration, just as governance has.”

However, he said there are still opportunities for investors in ‘unsustainable’ businesses, both in the short and long term.

For example, he said managers whose investment style is focused on valuation, cashflow and return on capital may not put as much emphasis on the sustainability of a business.

“The likely outcome is that sustainability will become another factor managers will use to analyse and assess a company’s risk and return potential,” he continued, “but there is likely to remain a demand for strategies that put greater emphasis on it just like we have funds today that put a greater emphasis on income, value or growth.”

David Harrison of the Rathbone Global Sustainability fund agrees with Lowcock that opportunities still exist outside of this remit.

“As more money flows into the sustainable market, that could create pockets of value in other parts of the market,” he said.

“Without a crystal ball, I think we'll see a sliding scale: sustainable funds at one end, and then funds that are not sustainable but think about ESG considerations that can invest in the whole market at the other end, and I think you'll see different flavours.”

Rathbones multi-asset and sustainable fund manager Will McIntosh-Whyte thinks it is more likely markets will operate on a “spectrum of sustainability” rather than have every fund prioritising ESG factors. This is because it will ultimately reflect consumer demand.

“By consumers, I mean ultimate end-client investors and where they want to go,” he said. “Yes, we want to be sustainable, I'd like to see that of course, but does that mean that's necessarily going to happen?

“To be honest, for a long time there'll be a place where it's about considering the risks and some people will be happy to take those ESG risks.

“It would be nice if we got there. But I do think there will always be a place for people that have different values.”

For example, McIntosh-Whyte said some people want to be in a fund that excludes certain areas, while others want to help drive the businesses they invest in to become more sustainable.

“And so, you know, if we all move to that higher plane, who's going to be involved in trying to drive those companies to become more sustainable? I think that is also a really important part of the investment spectrum,” he added.

But ultimately, not all investors have a sustainability goal. They may want to invest in tobacco for example because they think it’s a good industry that has a high return on capital and pays good dividends.

“I think there should be a broad enough market to cater to that,” said Declan McAndrew, Foster Denovo’s head of investment research.

“You can educate people all you like, but ultimately there will always be people who stick to their existing beliefs and don’t take that evidential consideration.”

Looking at the trajectory of the market today, McAndrew said he thinks there will be a gradual migration to sustainability rather than a sudden switch away from ‘standard’ portfolios.

“Embedding of ESG in the fund manager’s toolkit will absolutely be there, the explicit sustainability will gradually eat into that traditional portfolio,” he said.

“So when will [the name ‘sustainability’] be dropped? I don’t know. You kind of hope that it becomes so embedded that it doesn’t have to have a separate tag and end clients know intuitively that that’s underneath it.

“I think it’s a nice ideal to make it mainstream. [But] the market moves gradually and it has kicks and starts, as this will inevitably have as well. You think about the media coverage of climate change and societal inequality: that’s not in a niche 24-hour news channel, that’s the main bulletin so they’re much more front and centre to the public’s mind who have an obvious interest within that.”