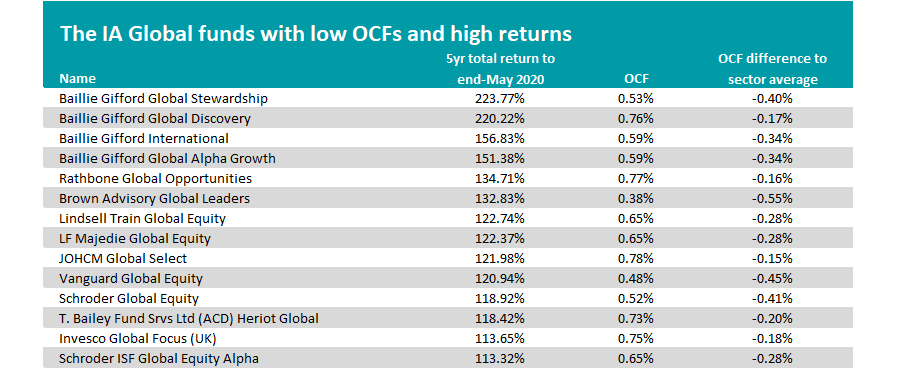

Global equity funds managed by Baillie Gifford, Vanguard and Lindsell Train are among those that have managed to combine some of their sector’s highest returns with the lowest active fees, Trustnet research shows.

Fees are an important consideration for investors as they are one of the biggest determinants of long-term returns. The adage of ‘you get what you pay for’ doesn’t always apply when it comes to funds and most investors would rather avoid high charges if possible.

In this research, Trustnet looked across the IA Global sector for active funds that had made top-quartile returns over the five years to the end of May along with having relatively cheap fees. To find the ‘cheap’ funds, we narrowed it down to those whose ongoing charges figures were at least 15 basis points below that for the average active fund in the peer group (0.93 per cent).

Although, it must be noted, while these funds may have a lower than average OCF, this is only one metric and does not account for transaction or performance fees.

Source: FE Analytics

At the top of the list is the £765m Baillie Gifford Global Stewardship fund, run by Gary Robinson, Iain McCombie, Matthew Brett, Mike Gush, Zaki Sabir and Josie Bentley.

With a top-quartile return of 223.77 per cent over five years, the fund also has an OCF of 0.53 per cent –0.40 per cent lower than the 0.93 per cent sector average.

Baillie Gifford Global Stewardship takes a sustainable approach to global equities and the team is comprised of six seasoned investment managers, all of which are specialists in their respective regions.

Positive screens are used during stock selection to address three key points: value to society, balance of stakeholders and a responsible culture.

FE Investments added: “While all holdings in the fund have been selected based on their potential to deliver sustainable long-term growth, the team recognises that there will be no such thing as a perfect company.

“The fund will then attempt to influence behaviour through engagement on all aspects of ESG - if engagement does not lead to meaningful outcomes the team will not hesitate to divest.”

Second on a five-year total return basis is the £1.8bn Baillie Gifford International fund, with an OCF of 0.59 per cent, which is 0.34 per cent less than the sector average. The fund hasn’t scrimped on returns either, achieving a total return of 156.83 per cent over five years.

Managed by FE fundinfo Alpha Manager Spencer Adair, Malcolm MacColl and Helen Xiong, the fund is managed in line with the Baillie Gifford Global Alpha strategy. This comprises four categories of company assessment: stalwart, rapid, cyclical and latent.

According to analysts at Rayner Spencer Mills Research, the result is a “diversified portfolio that captures a broad range of themes, growth drivers and ‘flavours’ of growth”.

They also added that the fund will tend to outperform in periods when quality and growth factors are more dominant, and less so in momentum or valuation-driven periods or when cyclical stocks are performing strongly. This can explain the fourth-quartile performance over three and six months.

Baillie Gifford has another two funds on the list. The group is known for its low fees and its performance over the long term has impressed thanks to its preference for quality-growth stocks.

Moving away from Baillie Gifford, the £2.4bn Brown Advisory Global Leaders fund stands out for its low OCF of 0.38 per cent. It’s also a top-quartile performer over five years making 132.83 per cent.

Run by Michael Dillon and Bertie Thomson, the fund is overweight technology stocks, holding Alphabet, Microsoft and Tencent within the portfolio.

Brown Advisory Global Leaders sector diversification relative to benchmark

Source: FE Analytics

It may be surprising to some to see a Vanguard name on a list of active funds, but as well as being a leader in the passive space, the firm runs a significant amount of active money.

The £264.5m Vanguard Global Equity fund has made it onto the list because of an approach that avoids bias to a single investment style.

The fund pairs two traditional, bottom-up complementary equity managers – one growth and one value – to deliver a core global equity exposure. Baillie Gifford covers growth while Wellington Management looks after value, with the overall portfolio split 50:50 between the two.

Vanguard Global Equity’s 0.48 per cent OCF is 0.45 per cent lower than the sector average and its long-term performance has been top-quartile – making 120.94 per cent over five years.

FE fundinfo Alpha Manager Alex Tedder’s £1bn Schroder Global Equity fund made the cut here, with an OCF of 0.52 per cent and a total return over five years of 117.53 per cent.

Performance of fund vs sector & benchmark over 5yrs

Source: FE Analytics

Like many in the list, the fund also has a large percentage in big-tech names, an area Tedder believes is still in a 2000-type tech bubble.

He said: “I think we’re still in it now, and we’re seeing a very substantial reset in big parts of the technology space, the renewable energy space, the biotech space, and I think it could definitely could go further.

“I think it will carry on and we will continue to see volatility for the next six to nine months as a minimum. In those six to nine months what you’ll see is increasing differentiation between winners and losers in the hyper-growth space.”