For the majority of the past decade UK mid-caps have outperformed their large-cap cousins, but it’s not a straight forward story on whether investors should go FTSE 100 or FTSE 250, according to the experts.

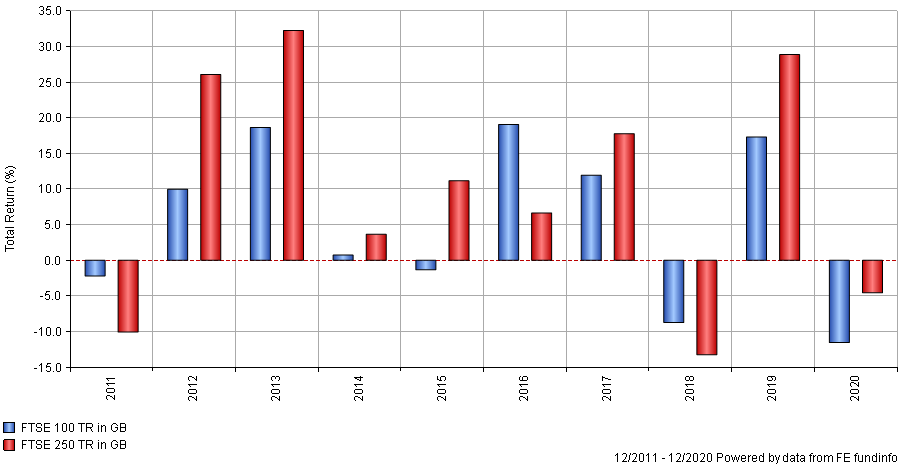

Looking at each of the past 10 calendar years, the FTSE 250 has beaten the FTSE 100 for the majority of the past decade. Out of 10 years the FTSE 250 has outperformed six times.

FTSE 100 vs FTSE 250 discrete performance over 10 years

Source: FE Analytics

But there has been periods where the latter has enjoyed some time in the sun. The last time last time the FTSE 100 outperformed the FTSE 250 was in 2018.

The global market of the past decade hasn’t been favourable to the make-up of the FTSE 100, which is biased towards cyclical names rather than growth, internet and technology stocks which have led during that time.

Names in the FTSE 100 tend to operate more globally and the index is host to some of the most-popular, dividend-paying stocks in the world, such as BP, Royal Dutch Shell or GlaxoSmithKline. This global reach means that it is usually the first port of call for overseas investors coming to the UK rather than the domestically focused FTSE 250.

But the lower cyclical bias of the FTSE 250 that is appealing, according to FE fundinfo Alpha Manager Richard Hallett, who runs the Marlborough Multi-Cap Growth fund, who said the mid-cap index was the clear favourite for the long-term.

Although the FTSE 100 holds some “great businesses” the index tends to be more weighted towards “mature companies operating in cyclical sectors” such as commodities or high street banks, he argued.

The biggest sector allocations of the FTSE 100 are financials and consumer staples, both around 19%, followed by consumer, financials and industrials.

These cyclical biases are beneficial when these assets rally, like markets have experienced during the recent recovery run as the economy reopened from lockdown, but this would serve as more of a short-term play, according to Hallett. Long-term these haven’t been the dominant assets, with global markets favouring growth companies.

Looking at the FTSE 100 performance versus the US or global markets – which have a growth bias – and it has only been during the short-term, recovery period that the UK has succeeded them as the market leader.

FTSE 100 vs MSCI ACWI and S&P 500 10 yrs

Source: FE Analytics

According to Hallett, the FTSE 250 is where there are more “powerful structural growth trends”.

He added that the FTSE 250 tends to be more representative of the domestic economic picture and also home to more “growth-oriented” companies, a style the FTSE 100 is not renowned for.

Commenting on the FTSE 250’s outperformance of the FTSE 100, Hallett thinks this trend is set to continue, increasing his backing of the index.

Historically the FTSE 250 has also outperformed the FTSE 100 and Hallett thinks this is set to continue, increasing his backing of the index.

Although the FTSE 250 has delivered “far superior long-term,” according to Seb Jory, TM Tellworth UK Select fund manager, but the battle between the indices is more “nuanced” than just examining this metric. It also comes down to current valuations, flows, and sentiment, he said.

At the moment mid-cap valuations are “eclipsing the 2000 tech bubble” as investors have extrapolated government fiscal policy as a positive for mid-sized businesses, but Jory warned that investors needed to exercise caution.

This “historic premium” currently on UK mid-caps should gradually close over time, Jory added, which he expected would happen via a re-rating of large-cap valuations. This could come via more receptive public investors or more from private equity and industry bidders which Jory said have been operating in the £1bn-10bn “sweet spot”.

Ken Wotton, co-manager of the LF Gresham House UK Multi Cap Income fund, also commentated on how expensive UK mid-caps had become, particularly before Covid-19. He said mid-caps were “touted as the engine of British growth”.

The disruption caused by the pandemic opened up “attractive entry points” to the mid and large-cap space, Wotton said. The manager picked up names such as Moneysupermarket.com, a mid-cap stock, and 3i, a FTSE 100 private equity and venture capital firm.

Overall, both Wotton and Jory leaned slightly more towards the FTSE 250, but said investors should invest across the company cap spectrum.

One manager who was more bullish on the FTSE 100 was Richard Buxton, manager of the Jupiter UK Alpha fund and head of strategy for Jupiter Asset Management.

Buxton said he has always encouraged investors to have some small and mid-cap holdings as good stock pickers should be able to identify fast-growing companies whose shares can “double and double again.”

This rapid growth in share price is harder to achieve in the more titanic sized companies, “although holders of Apple, Microsoft and Amazon may disagree,” Buxton said.

But, the FTSE 100 is remains him man focus. He said although the large-caps may be “slower growing” and “more mature” the share price disparity between the winners and losers every year was significant. This disparity makes it worth investing in the FTSE 100 and identifying those high performing names.

“If you can identify and back more winners than losers, you should still be able to generate good investment returns,” Buxton said.

Also, this can be achieved without any capacity or liquidity constraints, another bonus point for large-caps, he added.