European stocks have soared in 2021 so far on the back of the global value rotation, but for investors looking to buy into the market, there is a difficult choice to make between a new hotshot and an established performer.

Returns have been encouraging in the year so far for those brave enough to buy Europe. Comparing the performance of the AIC’s regional sectors, IT Europe has been the fourth best so far this year, beaten only by its value focused cousin the IT UK All Companies sector and the UK and IT European Smaller Companies sectors.

Source: FE Analytics

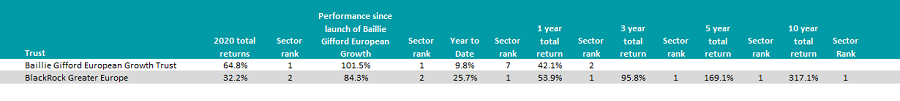

BlackRock Greater Europe Trust and Baillie Gifford European Growth Truste have been standouts, not just this year, but over several years. Both have a growth style but implement it in different ways, but which is better?

Managers of the Baillie Gifford European Growth Trust Moritz Sitte, Stephen Paice and Chris Davies follow the fund house’s well-known style of long-term investment in ‘exceptional’ growth companies.

This was a major shift away from the value focus the trust had under previous managers Edinburgh Partners.

Ewan Lovett-Taylor, head of investment companies research at Numis Securities, said that Baillie Gifford's take-over of the trust in 2019 meanwhile saw all but one company sold in the transition.

BlackRock Greater Europe Trust has a more differentiated approach, with FE fundinfo Alpha Manager Stefan Gries and co-manager Samuel Vecht including exposure to the emerging European market.

James Carthew, head of investment companies at QuotedData, said the two funds had two different styles, but that both managers had produced “quite similar results”.

When comparing the trusts’ performance it’s worth noting that direct comparisons can only be made from November 2019 when Baillie Gifford took over management of the trust.

Since then the Baillie Gifford European Growth Trust been the better performer of the two, fuelled by the pure growth bias which rocketed its performance in 2020. That year it was best performing fund in the IT Europe sector.

Performance of trusts vs sector since launch of Baillie Gifford European Growth

Source: FE Analytics

However, the BlackRock Greater Europe Trust, which has dominated the IT Europe sector over the long-term, coming through as top performer across all time frames within 10 years, should not be counted out.

Performance of trust over 10yrs

Source: FE Analytics

This long-term outperformance has put the fund on a 1.3% premium, making it the only IT Europe trust not on a discount. In contrast Baillie Gifford European Growth is on a 3.5% discount.

Emma Bird, research analyst at Winterflood Research, said that in the wider context of the IT Europe sector this discount actually showed the trust’s “particular value relative to the Europe peer group,” where the average discount is 6%. Bird added that in comparison to the BlackRock Greater Europe trust this discount provides some value and opportunity.

Anthony Leatham, head of investment trust research at Peel Hunt, also picked the Baillie Gifford portfolio.

For Leatham, the “high caliber team” have a foundation of strong performance and a trust filled with “exciting quality growth stocks”. These include semi-conductor company ASML Holding, fashion e-commerce site Zolando and sports wear brand Adidas.

These are examples of the type of growth stocks the managers seek out and the themes they focus on, such as digital platforms, consolidators, consumer franchises, healthcare innovators and pioneering industrials. All of which were massive beneficiaries of the Covid-19 pandemic, Leatham added.

These companies also fall under the “quality” bracket, a second key element to Baillie Gifford’s holdings.

Leatham said: “A holding in the Baillie Gifford European Growth portfolio must be able to at least double in the next five years,” as stipulated by the managers process.

The trust utilises gearing – which is currently at 6% - providing access to less liquid areas of the market, another positive, according to Leatham.

Bird agreed that, for the long term, she would expect the Baillie Gifford trust to outperform. She said that the current discount should move to a premium, and that the trust should be able to sustain it.

However, she added that the BlackRock option was “commendable”. She noted that the trust had delivered “strong performance” and had been the top performer in the sector for some time, but noted that Baillie Gifford European Growth was her preferred pick out of the two.