Global inflation could be a cause of concern for some investors seeking to hedge against it, but there are options for those wanting to capitalise on the surge.

This week UK inflation jumped 2% from July, the biggest month-on-month increase in annual inflation since records began in 1997. Inflation now stands at 3.2%, well ahead of the Bank of England’s 2% target.

The US has seen an even bigger increase, as the US Consumer Price Index (CPI) reached a 13-year high in July. US CPI rose 5.4% in July compared with the previous year, the US Bureau of Labor Statistics found.

Rising inflation is supported by a background of growing consumer demand post pandemic and supply-chain constraints, accelerating it further.

For investors looking to capitalise on this environment Paul Flood, manager of the BNY Mellon Multi-Asset Diversified Return fund, said investors “need to invest in areas where there is a direct tie to inflation,” either through inflation-linked pricing or assets that can continue to grow regardless.

Flood has a strong track record. After he took over management of the trust shortly after it launched in 2012, it has made 83.6%, beating both its sector and benchmark.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

One area Flood likes is music streaming. He said that people were not going to stop paying for their music subscriptions, regardless of the economic backdrop.

“Music streaming is tremendous value relative to buying a CD for £10 once a month,” Flood said.

The amount of people choosing to stream music is also growing in-line with wider adaptation of technology and the demographics are also broadening to the older generations.

“You can get a whole bunch of people that are not really music proficient but they’re quite happy to pay £10 a month for 17 year-old songs,” Flood said.

“And they won’t stop paying for their subscription, because if they do they have no music.”

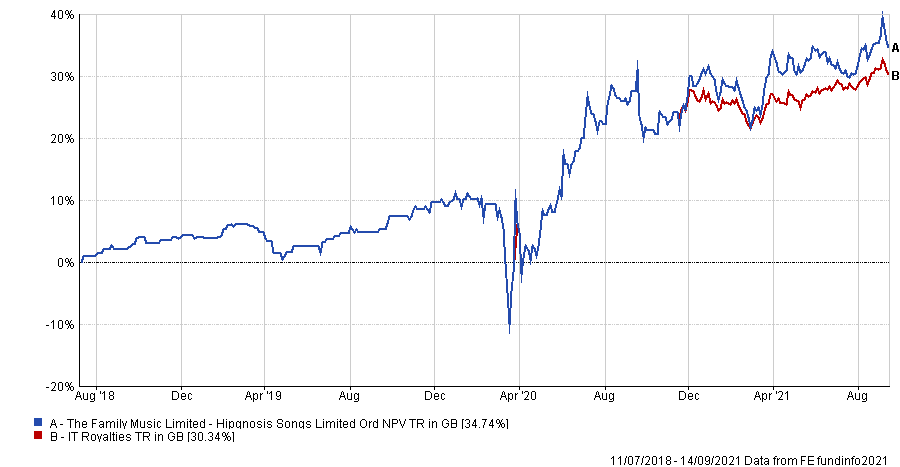

Hipgnosis Songs Limited, a more ‘alternative’ investment trust is Flood’s choice for this. It owns song royalties “so it’s benefitting quite well from the growth in music streaming.” It’s the third biggest holding in the BNY Mellon Multi-Asset Diversified Return fund.

Since it launched the trust returned 34.7%. It’s one of two trusts in the IT Royalties sector.

Performance of trust vs sector since launch

Source: FE Analytics

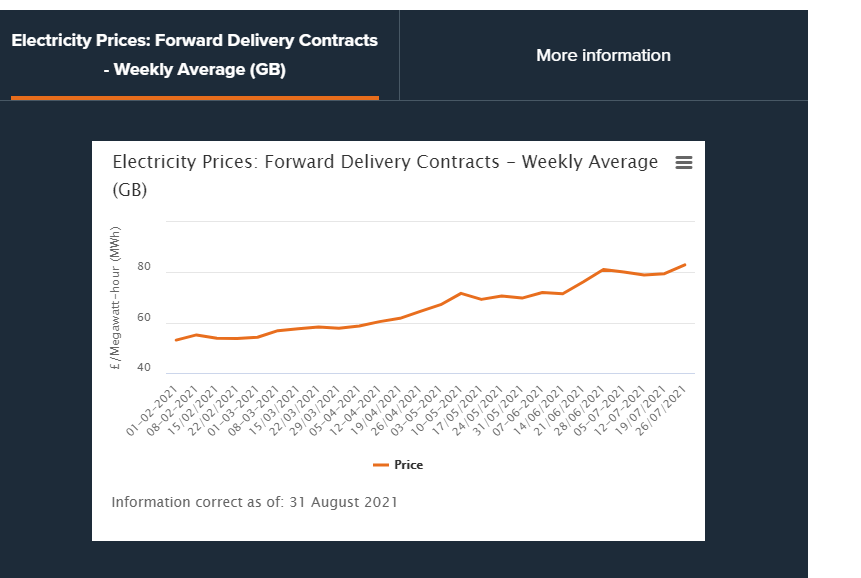

Another option to combat inflation is renewable energy suppliers, which have a direct link to the energy price.

The UK energy price had an “unusual” year in 2020 Flood said, because in a normal recession there usually isn’t a significant fall in demand, but during the pandemic a decrease in public transport usage and empty office space caused a decline. This led to a power price to fall.

Coming out of the pandemic and the reopening of day-to-day life has pushed energy prices up weekly year-to-date, shown by Ofgem, the gas and electricity market regulator.

Source: Ofgem

Flood thinks that this price rise can be sustained, and will benefit energy companies generally but renewables in particular.

Renewable energy has been getting a boost from governments over the past two years, with American president Joe Biden’s ‘Clean Energy Plan’ and Europe’s ‘Green Deal’ underscoring this.

This year’s COP 21 - an annual meet up of UN members to discuss climate change – is expected to bring about more intense and demanding climate change policies, with a particular focus on wider usage of renewable energy sources.

Renewable Infrastructure Group and Green Coat UK Wind are two UK companies Flood thinks will benefit from these tailwinds. Green Coat UK Wind has an added benefit of being more exposed to spot power prices.

The share prices of both companies have increased over the past five years, up 24.6% and 21.9% respectively.

Infrastructure is another option and Flood highlighted International Public Partnerships (INPP), a £2.7bn trust aimed at delivering inflation-linked returns via investment in 130 infrastructure projects.

These include gas distribution, waste water, offshore transmission projects, rail operations and health facilities among others.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

The long-term contracts of these projects are an attractive quality of the trust because they are locked in prices that are therefore protected from inflation.

This is also a way to access more ideal yields, Flood said, where you can find 5-7% yields “well above what we get in the bond market.” International Public Partnerships trust for example has an almost 5% dividend payout.

“An attractive nominal return is a benefit in a more inflationary backdrop,” Flood said.

“These funds are a good substitute for bonds because they don't have that much sensitivity to the to the economic backdrop. They have effective inflation-led revenues and high dividends, which is very supportive.”