Fund pickers are mixed on the upcoming fortunes of the Jupiter UK Mid Cap fund after a recent run of poor performance, has plummeted it to the bottom of the rankings this year.

Indeed, after a strong 2020 in which the fund registered the 10th best returns in the IA UK All Companies sector, it has failed to replicate that form in 2021, dropping to the fourth quartile among its peers.

This combination means that one year returns look poor, with the portfolio ranked 205th out of 252 funds.

Performance of fund vs sector and benchmark over 1yr

Source: FE Analytics

The main root of this underperformance has been that some of the fund’s ‘Covid winners’ have come off the boil since lockdowns ended.

However, the portfolio has been one of the best performers in the sector over the long-term, coming through as fourth best among its 200 peers over 10 years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

So is this a blip, or are there ongoing concerns? Laith Khalaf, head of investment analysis at AJ Bell, said that the fund had been hit by a handful of stocks, including fashion brands Boohoo and ASOS and e-commerce company The Hut Group.

The fund’s FE fundinfo Alpha Manager, Richard Watts confirmed that these names caused some of the main detractions from performance this year.

In Boohoo’s case he said that they had underestimated the impact of the global supply chain crisis on the business.

Watts said: “Whilst performance this year has been challenging it should be considered against a very strong performance in 2020 and the very strong long-term track record of the fund.”

He added that the fund has gone through periods of underperformance before, but that the most important thing is to maintain the process he has used for 20 years.

Watts added: “In my experience, difficult periods of performance can present opportunity. It’s important not to compound underperformance by making poor decisions and it’s very often the case that underperformance in share prices presents an opportunity to buy at more attractive levels.”

Fund pickers agreed that this short-term rut should not detract from the fund’s long-term performance or lead investors to question Watt’s management skills.

Khalaf said: “Occasional mishaps within a portfolio are commonplace though, and a one year investment horizon is too short to make any meaningful judgement around manager skill.”

“On that front Richard Watts and the Jupiter team have pedigree, which should provide reassurance to investors that the fund’s recent turn is simply a temporary dip in form.” The AJ Bell analyst made a ‘Buy’ recommendation.

Emma Wall, head of investment analysis at Hargreaves Lansdown, seconded the idea that this short-term underperformance should not deter investors from the fund, recommending that those already invested remain put.

The £3.5bn Jupiter UK Mid Cap fund has been run by Watts since its inception in 2008. At the time it was run under the Old Mutual brand, which became Merian Global Investors business, before being acquired by Jupiter Asset Management earlier this year.

The Jupiter UK Mid Cap fund and its manager “were one of the jewels in the crown of the acquisition,” Wall said.

The merger itself has thrown up some issues, however, according to Ben Yearsley, Fairview Consulting director. He said it was a “bit of a mess” noted that this was unlikely to have contributed to the fund’s poor returns.

“The fund has underperformed the index essentially since ‘Vaccine Monday’ last November – the fund is much more in the growth camp so that is unsurprising,” he said.

Yearsley pointed out that overt the past five years the fund has only had intermitted periods of sustained outperformance, which for a supposedly high-alpha fund “is not great”.

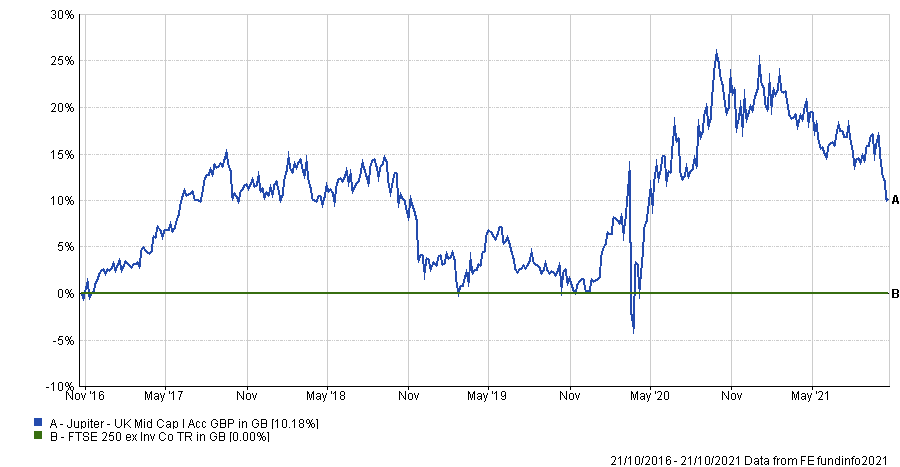

Specifically the fund has only outperformed the FTSE 250 significantly between October 2016 and August 2017 and March to September 2020. The rest of the time it has either performed in-line with, or fallen faster than, the index, shown in the graph below.

Performance of fund vs benchmark over 5yrs

Source: FE Analytics

“For a high alpha team that is not great as if the current trend continues all the additional performance could soon be lost,” Yearsley said.

The commentator also said that the launch of Chrysalis Investments Limited in 2018 could have taken up Watts attention.

“Being devil’s advocate, have they lost something since the launch of Chrysalis? Has that taken too much of their time and focus?,” Yearsley asked.

Chrysalis Investments is co-managed by Nick Williamson, who previously ran the Jupiter UK Smaller Companies fund but left after a round of planned promotions. He was added to the Chrysalis Investment trust earlier this year.

Yearsley said that, for now, he would continue to hold the fund “however it is definitely ‘on watch’ and I would probably sell after the next period of outperformance.”