Several UK investment trusts are running well below their five-year-average discount presenting major buying opportunities, according to fund pickers.

The pandemic created a lot of volatility in markets with massive swings between growth and value investing during the initial crisis in 2020 and the recovery in 2021.

Investment trusts are more vulnerable to the whims of investors than their open-ended counterparts as withdrawals can cause the share price to drop, even if the underlying holdings keep their value. This creates a share price discount.

This phenomenon means if the underlying stocks fall, and investors sell out of the trust, shareholders that stick with it can be hit with a double whammy of losses.

However, the opposite is also true. If more people buy, then the shares could reach a premium to the value of the trust’s underlying holdings.

At times, trusts on a big discount can present good buying opportunities, while those that are on large premiums risk reverting back if the trust’s returns cannot keep pace with investor enthusiasm.

However, solely looking at a discount or premium can be misleading. A trust may always be highly valued or shunned by investors for a number of factors. As such, Trustnet asked QuotedData to look at the current discount and premiums of trusts in the IT UK Smaller Companies, IT UK All Companies and IT UK Equity Income versus their own five-year average.

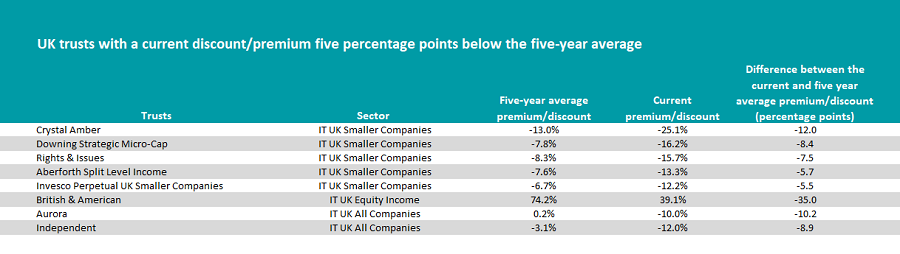

We then focused on those with a 5 percentage point difference between the current and five-year discount/premium mean. Overall there were seven UK trusts at least 5 percentage points below their five-year average, as the below table shows.

Source: QuotedData

The IT UK Smaller Companies sector had the most trusts diverging from their five-year average, in both directions. Small-caps are notoriously more volatile than mid and large-caps and tend to have flashes of investor sentiment that can move the premium or discount.

The trust on the biggest discount relative to its history was the Crystal Amber trust, which had a 12 percentage points disparity, as an activist investor has taken a 25% stake in the fund, threatening that it will be wound down.

Downing Strategic Micro-Cap was next. It had an 8.4 percentage point gap between its current and five-year average. In its latest results the board said it had been unable to keep the discount in check as it had been “inside” on a successful deal by the manager.

Also of note was the Aberforth Split Level Income trust. Analysts at Kepler Trust Intelligence said that that current 13.3% discount was an interesting opportunity for investors.

This discount is 5.7 percentage points lower than its five-year average and, provided it could maintain modest capital and income growth, the returns could be “extremely attractive”, making it a decent buy option, they said.

The biggest difference among all UK trusts was found in the British & American trust, which had a 35 percentage-point swing between the current and five-year average.

A member of the IT UK Equity income sector, shares are currently on a 39.1% premium down from the 74.2% average, though at £7.3m, the small fund’s shares can swing wildly on moderate trading volumes.

It was the only fund in the IT UK Equity income sector on the list, although BlackRock Income & Growth and Finsbury Growth & Income were just under the cap at 4.8 and 4.5 percentage points respectively.

Finsbury Growth & Income recently slipped down to a discount as the performance has suffered during the market’s rotation into value, a style not suited the FE fundinfo Alpha Manager Nick Train’s growth bias.

In the past year it has been the worst performer in the sector, returning just 14.8%. But long-term Train’s buy-and-hold approach has rewarded investors with the third best returns over 10 years (234.5%).

In the IT UK All Companies sector, two trusts were below their five-year average: Aurora and Independent. Aurora is on a 10% discount currently which is 10.2 percentage points wider than its five-year average (0.2%), while Independent is on a 12% discount, well below its 3.1% average discount rate.

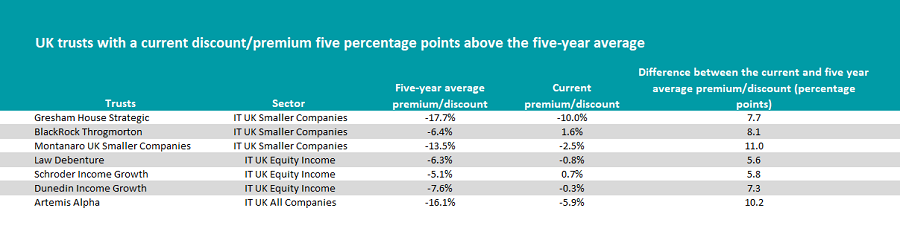

At the other end of the scale, the discount of Montanaro UK Smaller Companies trust narrowed the most from an average of 13.5% over five years to 2.5% today.

Source: QuotedData

The fund’s manager, Charles Montanaro, recently announced that he would be staying on as manager, which analysts at Numis Securities said investors should be reassured by given his strong track record.

Montanaro runs a quality growth tilt which has outperformed long-term, making the fifth best returns in the IT UK Smaller Companies sector over three years (70.4%).

BlackRock Throgmorton trust was another big name on the list from the sector, moving from a 6.4% historic discount to a 1.6% premium today.

Earlier in the year Kepler analysts said that this shift was partly down to the trust’s exceptional short and long-term performance. Indeed the trust made the second-best returns in the sector over 10 years (606.5%) and maintained a second-quartile ranking during the value rotation this year.

On the latter, they added that the trusts’ ability to maintain its premium even when the market had moved on from value was “reassuring”.

Gresham House Strategic was also on the list, though the trust is to be wound up following several months of dispute between the board and the now dismissed manager.

Numis said that although this was not the sector’s brightest moment it was right that that “sub-scale fund, with a concentrated shareholder register, winds-up”.

In the IT UK Equity Income sector three trusts were running 5 percentage points above their long-term average: Law Debenture, Schroder Income Growth and Dunedin Income Growth.

Dunedin Income Growth had the biggest increase, now on a 0.3% discount up from 7.6% as investors rewarded its strong performance over five years – up 75.5%, the second-highest in the sector.

Analysts at Kepler were bullish on the trust, noting it as a core option for UK equity income exposure earlier this year.

They added that the trust’s focus on environmental, social and governance (ESG) factors added a another appealing layer, which could help maintain the now narrower discount.

Finally, in the IT UK All Companies sector, Artemis Alpha was the only trust on the list. Its 5.9% discount, was 10.2 percentage points higher than the five-year average.

The trust’s board introduced a new share buyback programme last year, which has brought the discount in.

Analysts at Numis said that it had “materially assisted with discount control” and improved the trust’s liquidity, without impacting the portfolio management.